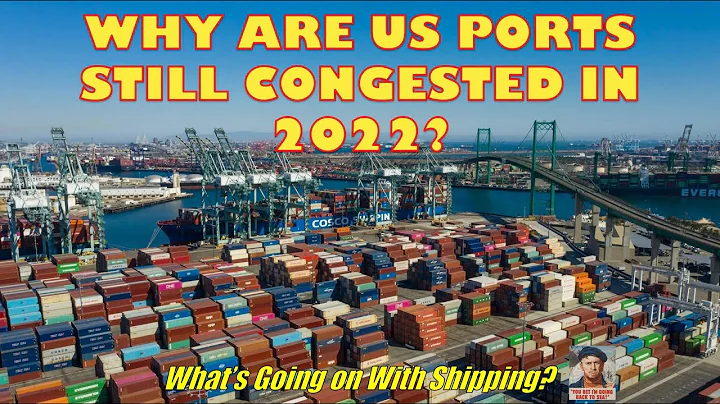

The problem of port congestion in the United States continues to worsen. Currently, there are as many as 44 container ships queuing up on the West Coast of the United States waiting for berthing positions, breaking the historical record in early February, and the average waiting time has further lengthened.

According to Bloomberg reports, the global shipping supply chain continues to be chaotic. As the U.S. shopping season is approaching, as of August 27, 44 container ships have been stranded in the Port of Los Angeles and Long Beach Port in California, exceeding the 40 ships in early February. At the historical record level, the average waiting time for at the Port of Los Angeles has also increased from 6.2 days in mid-August to 7.6 days.

At the same time, the port congestion has also affected inland transportation in the United States, causing many container goods to be unable to efficiently enter logistics centers and warehouses. Part of the reason for this situation is labor shortage, and there are also factors that companies are rushing to stock up on goods before the year-end holidays. August and September are critical months for goods to be exported from China before the Golden Week in October.

The arrival of the peak shopping season in the United States has also made the industry more worried about port congestion and that goods shipped from Asia will not arrive in time. Mike Witynski, CEO of US retailer Dollar Tree, said that because a crew member was diagnosed, his ship was refused entry into the port in China and had to travel to Indonesia to replace the entire crew. This back and forth also delayed the voyage. 2 months.

Although the Ningbo Zhoushan Port, the world's third busiest , has resumed operations, it is expected that the backlog of goods will still take several weeks to digest. Consulting firm GardaWorld pointed out that the continued shortage of containers, the shutdown of factories in Vietnam, and even the aftermath of the previous Suez Canal blockage incident, these problems continue to ferment in today's supply bottlenecks.

statistics show that the current average global container ship on-time rate is only 40%, and the global port congestion has caused an invisible reduction of 20% in available shipping capacity. If there is no way to alleviate it, the gap between supply and demand will increase, and the shortage of containers and cabins will not be solved. Solved, freight prices will remain high.

In the latest week, the freight rate per FEU from the Far East to the US West Line was close to US$6,000, and the US East Line was US$11,000. This is a new sky-high price for exporters. High freight rates will affect gross profit margins. As long as many exporters are not in a hurry to deliver goods, they are waiting for freight rates to fall back before shipping in large quantities.

Considering the recurrence of the global epidemic, it is difficult to predict when the port congestion will be resolved. Some industry insiders pointed out that port congestion and ship shortage will become the norm in the market. Exporters should respond early and adjust shipments. It is expected that the prosperity of the global container shipping market will continue until next year. mid-year.

Experts analyzed that the US port congestion problem is very responsible and will be difficult to solve in the short term. The main reason is that due to the epidemic, the terminals have been short of work for a long time and their operating efficiency has declined. In addition, in recent years, the trend of large-scale ships has made the terminal infrastructure unable to keep up. Ships are getting larger and processing operations are not fast enough, causing chaos in the supply chain in the U.S. inland market.