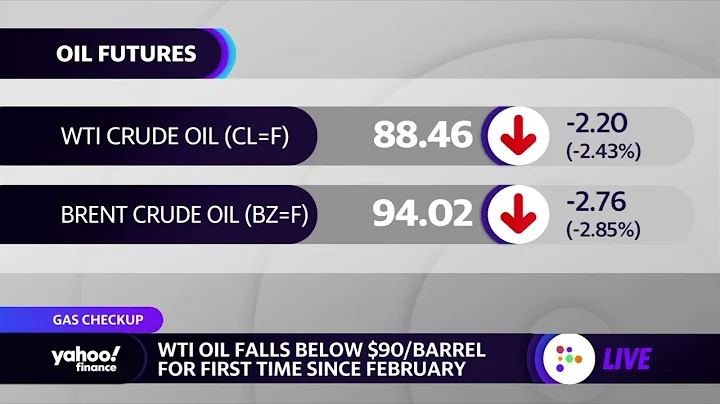

International oil prices continue to fall and fall below the US$100/barrel mark.

Under the influence of intensifying concerns about the global economic recession, international oil prices have fallen sharply recently, with WTI and Brent crude oil prices both falling below the US$100/barrel mark.

At the same time, domestic crude oil has also fallen by more than 15% in the past month. As of press time, the main crude oil contract quoted 651.8 yuan/barrel.

Intensified concerns about economic recession may be the main factor in this round of oil price collapse. After Goldman Sachs , Morgan Stanley and other international investment banks predicted that the global economy would fall into recession, recently IMF President Georgieva said that since the last economic forecast update, the global economy has The outlook is "significantly bleak" and the possibility of a global recession in 2023 cannot be ruled out.

Since April, some risks facing the global economy have become a reality, and the multiple crises facing the world have also intensified. The International Monetary Fund will lower its forecast for global economic growth of 3.6% in 2022 in the coming weeks. IMF economists are still finalizing new expectations. The IMF warned that the situation could get worse given the potential downside risks.

big benefits may be approaching! Many well-known investment banks are optimistic about the market outlook for oil prices

However, in the face of the continued decline in oil prices at home and abroad, many international investment banks are extremely optimistic about the market outlook. The reasons are mainly the following two points:

On the one hand, the EU is gradually implementing an embargo on Russian oil, and oil imports from Russia will be reduced by 90% before the end of the year; while the Organization of Petroleum Exporting Countries ( OPEC ) oil production in June will continue Behind targets, concerns are growing over the group's ability to mitigate the worst oil supply crisis in decades.

On the other hand, G7 leaders have discussed a proposal to impose a price cap on Russian oil, with some industry experts warning that such a move could lead to retaliatory Russian production cuts that could cost millions of barrels of oil. will disappear from the market.

Neal Dingmann, managing director of energy research at investment bank Truist, believes that crude oil supply will be subverted and oil prices will rise to higher levels than in previous months. He warned that if Russia cuts production and the supply gap cannot be filled, oil prices may rise by 50% before the end of the year.

JP Morgan analysts previously warned that if U.S. and European sanctions prompt Russia to implement retaliatory production cuts, global oil prices may reach $380 per barrel in the most extreme case.

Bjarne Schieldrop, chief commodity analyst at SEB , previously warned that if the G7 implements a so-called price ceiling, international oil prices may rise above US$200 per barrel.

In addition to being bullish, there are also institutions that are not optimistic about the future of oil prices. Citigroup had previously warned that if a severe recession hits, oil prices could fall to $65 a barrel by the end of this year and to $45 a barrel by the end of 2023.

![[MV] The Theme Music VIDEO of "Sisters Who Make Waves S3" is Online Now! 丨Hunan TV - DayDayNews](https://i.ytimg.com/vi/jz55lFSnFfY/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLCsCnIm6PXaTuHKNObsGyDVooYDEA)