micronet news, IC Insights, a world-renowned semiconductor analysis organization, recently updated the global MPU report. The report shows that the top five MPU suppliers will expand their total sales share to 86% in 2021. The new rankings show long-time leader and Intel losing nearly half of total microprocessor sales.

Source: Internet

According to the latest data from IC Insights, despite the economic difficulties this year, total microprocessor sales are expected to maintain double-digit percentage growth in 2022 due to increases in average selling prices (ASPs), an increase of nearly 12%, reaching a record $114.8 billion. Second quarter semiconductor forecast. Total MPU sales increased 13% in 2021 and climbed 16% in 2020.

The epidemic has damaged the global economy, but it has also boosted demand for microprocessors. Domestic demand was once strong in application scenarios for PCs, smartphones and the Internet.

IC Insights' update for the second quarter of 2022 shows that total MPU shipments increased by only 3% this year, following increases of 6% and 5% in 2021 and 2020, respectively, pushing the number of units to nearly 2.5 million units, reaching a record high. IC Insights also said that MPU revenue is expected to be boosted by ASP growth of 8% in 2022, following ASP growth of 7% last year and 10% in 2020.

The chart below shows that compared with 2020, the rankings of the top five microprocessor suppliers have not changed in 2021. The total revenue value of MPUs they shipped last year increased by 15% to $88.3 billion.

In 2021, the combined market share of the five largest microprocessor suppliers reached 86.0% of last year's total global MPU sales of US$102.7 billion, compared with 85.0% in 2020 and 82.1% in 2016. The next five largest MPU vendors - ranked 6th through 10th by IC Insights (Nvidia, Samsung, Unisoc, HiSilicon, and NXP) - together account for 2021 4.3% of the annual total (or $4.4 billion), compared with 5.0% in 2020.

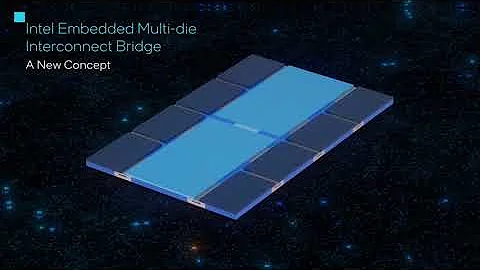

It is worth noting that IC Insights' MPU rankings are based on computer CPUs, embedded microprocessors, and mobile phone AP sales, but do not include AI/machine learning accelerators and independent graphics processing units (GPUs). Many application-specific system-on-chip (SoC) designs with integrated CPU core also do not count in the MPU rankings.

No. 1 Intel and No. 4 AMD provide processors built on the x86 microarchitecture for traditional PCs with Windows operating systems, Google -powered Chromebooks, some tablets, and the vast majority of servers used around the world. Intel and AMD also sell x86 designs for embedded MPU applications. Others in the top five MPU vendors sell mobile designs (mainly mobile phone APs) and embedded system-on-chip (SoC) microprocessors that include RISC architecture and other CPU design cores - these cores are licensed from ARM . The top four MPU suppliers are headquartered in the United States, and the fifth-ranked MediaTek is located in Taiwan, China.

While the combined market share of the top five vendors has steadily increased over the past decade, the revenue gap between longtime MPU leader Intel and the other four largest companies in the rankings continues to narrow. ICInsights estimates that Intel's microprocessor revenue will grow by only 3% to $52.3 billion in 2021, accounting for 50.9% of the total MPU market share last year, compared with 55.7% and 58.4% in 2020 and 2016, respectively. Rival x86 processor supplier AMD's MPU sales surged 56% to $9.2 billion in 2021, taking revenue away from Intel and pushing its microprocessor market share from 6.5% in 2020 to 3.3% in 2016 % improved to 8.9% last year. Over the past five years, the company has made a huge shift in CPUs for PCs and server computers.

(proofread/holly)