main station reporter sees the world! Hello everyone, I am He Xinlei, our reporter in Japan.

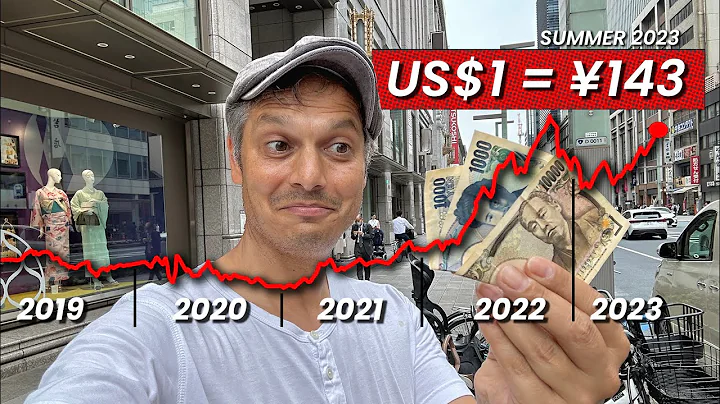

In recent times, with the further strengthening of the US dollar, the depreciation of the Japanese yen has shown an accelerating trend, becoming the focus of much attention in the foreign exchange market. The exchange rate of the Japanese yen against the US dollar continued to fall, reaching a new low in about 24 years since October 1998.

html In early June, a survey conducted by Japan's professional economic research institution on the Japan Economic Friendship Association showed that 73.7% of business operators believed that the depreciation of the yen had a "negative" impact on the Japanese economy. The reason is that the depreciation of the yen has pushed up the import price of resources and food, increasing the burden on businesses and consumers, and this is indeed the case.

html In early June, a survey conducted by Japan's professional economic research institution on the Japan Economic Friendship Association showed that 73.7% of business operators believed that the depreciation of the yen had a "negative" impact on the Japanese economy. The reason is that the depreciation of the yen has pushed up the import price of resources and food, increasing the burden on businesses and consumers, and this is indeed the case.

Yanagawa Kenji, who has been starting a business in Tokyo for three years, is currently running a fitness product startup project. When he started his business, he encountered the COVID-19 epidemic, which caused his team to encounter many difficulties in the early stages of the business. Starting this year, the fitness equipment mainly sold by Yanagawa Kenji will finally be launched on the market, but it has recently suffered from the rapid depreciation of the Japanese yen. As the yen depreciates, the cost of importing sports equipment from overseas increases, causing some Japanese supply companies to face operating pressure.

Yanagawa Kenji is introducing his entrepreneurial project to reporter He Xinlei

Yanagawa Kenji is starting a business in the fitness product industry. Its business model mainly relies on Japanese supply companies to find suitable supply factories in overseas markets, and then supply to brand manufacturers. Finally, It is up to brand manufacturers to bring products to the market. The recent rapid depreciation of the Japanese yen has led to a sharp increase in the purchase costs of Japanese supply companies, compressing operating profits, and thus affecting the supply chain.

Yanagawa Kenji had more than ten years of experience in international clothing trade before starting this business, and had also experienced the challenges brought about by the depreciation of the Japanese yen. In his view, the recent depreciation of the yen will bring considerable challenges to Japanese foreign trade companies that mainly rely on overseas factories for production, and may even affect the development of the entire industry.

The continued rapid depreciation of the yen has also brought the Bank of Japan's nine-year ultra-easy monetary policy to the attention of the outside world again.

What are the reasons for the recent rapid depreciation of the yen? How big will the impact be? With these questions, I interviewed Hideo Kumano, chief economist of Japan's Dai-ichi Life Economic Research Institute, who has been engaged in professional economic analysis for 20 years. In his view, the monetary policies of Japan and the United States are in conflict with each other, which has widened the spread of interest rates between Japan and the United States. This is the direct cause of the current depreciation of the yen. The rapid depreciation of the yen may prevent Japanese companies from responding quickly. In the short term, the risks for Japanese companies will increase.

Chief Economist of Japan's Dai-ichi Life Economic Research Institute - Hideo Kumano

Data previously released by the Japanese Ministry of Finance show that in fiscal year 2021, Japan's imports increased significantly by 33.3% year-on-year, among which energy bulk commodities such as crude oil and coal , almost all relies on imports. Kumano Hideo believes that the depreciation of the yen also has structural reasons for the economy to be highly dependent on imports. As international commodity prices continue to rise, Japan's import volume continues to rise. Under the new crown epidemic, rising prices have also put pressure on the lives of Japanese people.

Kumano Hideo predicts that due to the different financial policy directions of Japan and the United States, interest rates may further widen and the yen may continue to depreciate. For the Bank of Japan, managing risks is crucial.

Just last week, Bank of Japan Governor Kuroda Haruhiko warned that the recent rapid depreciation of the yen is "unfavorable" to the Japanese economy, and the Bank of Japan needs to closely monitor the exchange rate market trends. While paying attention to the foreign exchange market, the Bank of Japan also hopes that the stabilization of the new coronavirus epidemic in Japan will drive "retaliatory consumption." We will also continue to pay attention to whether 's loose monetary policy will continue to be implemented in the future.

Well, the above is the local observation of He Xinlei, the Taiwanese reporter in Japan!

The author of this issue of "Correspondents See the World" is Headquarters Correspondent in Japan He Xinlei

(from the Voice of China column "Correspondents See the World")

Producer丨Zhao Jiuxiao

Reporter丨He Xinlei

Editor丨Yang Boyu