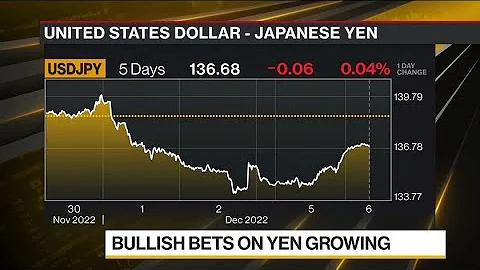

In April this year, the yen depreciated 6% against the U.S. dollar, pushing the U.S. dollar above 131 yen for the first time in two decades. Entering May and June, the depreciation trend of the yen still failed to stop. Japan's strong demand for U.S. dollars caused the exchange rate of the U.S. dollar against the Japanese yen to rise for 13 consecutive trading days. The yen's exchange rate against the U.S. dollar has reached its lowest value in more than 30 years, as measured by OECD purchasing power parity. The main purpose of the Japanese government to allow the yen to depreciate is to stimulate exports.

Figure 1: Trend of Japan’s export value in the past five years

After the depreciation of the yen, Japan’s exports have indeed increased significantly, with recent year-on-year growth exceeding 10%. In May 2022, Japan's exports increased by 15.8% year-on-year to 7,252.1 billion yen, the largest increase in three months, and the increase in April was 12.5%. This is the 15th consecutive month of growth in shipments. Compared with market expectations of a 16.4% increase, machinery shipments increased by 13.3%, and semiconductor machinery shipments increased by 30.1%; semiconductor exports increased by 21.1%, and motor stocks were affected by Impact rose 11.1%. In addition, sales of other products also increased by 19.5%. Exports of industrial products increased by 35% year-on-year, mainly due to the 60.2% increase in steel exports; exports of plastic materials increased by 15.7%, and chemical products increased by 15.5%.

Figure 2: Year-on-year growth in Japan’s exports in the previous 12 months (%)

In contrast, transportation equipment exports fell by 5.3%, which was related to a 7.9% decrease in automobile exports and an 11.4% decrease in automobile exports. Its export sales have increased in many places, such as the United States (13.6%), Hong Kong (22.6%), Taiwan (20.1%), South Korea (41.6%), Singapore (29.9%), Thailand (20.2%), Malaysia (28.3%), Australia (19.6%). In contrast, exports to China and Germany fell by 0.2% each.

Although the depreciation of the yen can stimulate exports, it is not without side effects. While Japan's exports are surging, Japan is also facing a huge trade deficit . In May this year, Japan experienced its largest single-month trade deficit in more than eight years. High commodity prices and the depreciation of the yen increased imports, casting a shadow on the country's economic prospects. As the trade deficit continues to widen and the yen depreciates, the cost of fuel and raw materials that domestic manufacturers rely on for production is also soaring.

Data released by the Japanese Ministry of Finance on Thursday showed that as of May, Japan's imports increased by 48.9% year-on-year, higher than the market forecast of 43.6% growth in a Reuters survey. This exceeded the 15.8% year-on-year export growth in the same month, resulting in a trade deficit of 2.385 trillion yen ($17.8 billion), the largest single-month trade deficit since January 2014. As of May, Japan's trade deficit has been for 10 consecutive months and is higher than the 2.023 trillion yen gap estimated by Reuters survey.

Looking by region, Japan's shipments of machinery and transportation equipment to China declined, causing its exports to China to fall by 0.2% as of May this year. Japan's exports to the United States, the world's largest economy, rose 13.6% due to growth in machinery and fossil fuel exports. Data showed higher shipments of oil from the United Arab Emirates and coal and liquefied natural gas from Australia, strongly pushing up Japanese imports.

Although Japan's economy is expected to grow at an annualized rate of 4.1% this quarter as the COVID-19 epidemic recedes, the yen's fall could hurt consumer confidence as fuel and food costs rise. A private survey released this week showed that nearly half of Japanese companies believe that the weak yen is detrimental to their business, suggesting that the depreciation of the yen is damaging corporate confidence.

In any case, the sharp depreciation of the Japanese yen has had a huge impact on the entire Asian economy. The editor of Zhiguan Wenzai will continue to pay attention to how it will develop in the future.