On Thursday local time, The May data of the US personal consumption expenditures price index, or PCE, closely tracked by the Federal Reserve , was released. The data showed that US inflation pressure is still at a historical high in 40 years . This data, coupled with the recent continuous changes by the Federal Reserve The hawkish signal released continued to put pressure on the stock market, and the three major stock indexes in the New York stock market fell collectively. As of the close, the Dow Jones Industrial Average fell 0.82%, the S&P Index fell 0.88%, and the Nasdaq Index fell 1.33%. From a disk perspective, among the major sectors of the S&P 500 index 11, only the two sectors of industrial and defensive utilities rose slightly. At the same time, technology stocks fell broadly, with the Nasdaq leading the decliners.

The Nasdaq Composite Index suffered its largest quarterly decline since 2008 in the second quarter of this year. The S&P 500 Index's performance in the first half of this year was its worst in 52 years.

Thursday is the final day of this month, the second quarter of this year and the first half of the year. As the stock market closed, the three major U.S. stock indexes set a number of periodic decline records. Throughout June, the Dow Jones Industrial Average fell 6.7%, the S&P 500 Index fell 8.4%, and the Nasdaq Composite Index fell 8.7% due to the Federal Reserve's aggressive interest rate hike expectations. In the second quarter of this year, affected by factors such as interest rate hikes and slowing economic growth, the Dow Jones Industrial Average fell 11.3%, the S&P 500 Index fell 16.4%, and the Nasdaq Composite Index fell 22.4%. Among them, the Nasdaq suffered its largest quarterly decline since 2008. In the first half of this year, affected by multiple factors such as high inflation, supply bottlenecks, conflicts between Russia and Ukraine, and interest rate hikes by European and American central banks, the three major U.S. stock indexes suffered significant cumulative declines. The Dow Jones Industrial Average fell 15.3%, the S&P 500 Index fell 20.6%, and the Nasdaq Composite Index fell 29.5%. Among them, the S&P 500 index fell into a bear market twice this month. In the first half of this year, it recorded its worst performance in the same period since 1970, that is, in 52 years. . As more Federal Reserve officials express support for continuing to raise interest rates by 75 basis points in July, more Wall Street investment banks believe that U.S. stocks have not yet hit the bottom. Many investment banks predict that once the U.S. economy enters recession, the S&P 500 Index will continue to fall to the level of 3,100 points, which is a further 18% decline from the current level.

Popular Chinese concept stocks have continued to perform better than the U.S. stock market recently The broader market

On Thursday, popular Chinese concept stocks followed U.S. stocks lower, but the overall performance was better than the broader market. Throughout June, the Nasdaq Golden Dragon China Index rose by 16%, the largest monthly increase in three years. The index rose by more than 12% in the second quarter of this year, its best quarterly performance since the end of 2020.

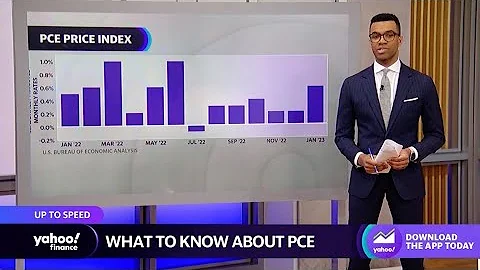

The U.S. personal consumption expenditures price index increased by 6.3% year-on-year in May. Personal spending slowed significantly

In terms of economic data, the U.S. PCE price index increased by 6.3% year-on-year in May, slightly lower than market expectations and the smallest increase since November 2020. , but still at historically high levels. The core PCE price index that excludes food and energy prices, the indicator that Fed policymakers pay most attention to, rose 4.7% year-on-year in May, also slightly lower than the 4.8% expected. Data seemed to show that U.S. inflation slowed in May, but a breakdown showed that the pace of U.S. personal spending slowed significantly, with spending growing slower than income for the first time since December, a sign that investors Quite worried.

On June 30, the three major European stock markets fell across the board.

In Europe, the Swedish central bank announced a 50 basis point interest rate hike on Thursday and said it would raise interest rates by 75 basis points if necessary. In addition, the European Central Bank also released a signal that it may radically raise interest rates to curb inflation. Europe's three major stock markets fell across the board on Thursday, with banking stocks leading the decline that day, with an average decline of 2.8%. As of the close, the British stock market fell 1.96%, the French stock market fell 1.80%, and the German stock market fell 1.69%.

Concerns about economic recession are widespread. Oil prices in New York fell sharply by 3.66% on June 30.

In the crude oil market, investors' concerns about the global economy falling into recession continued to put pressure on international oil prices. The latest data from the U.S. Energy Information Administration showed that U.S. commercial crude oil inventories dropped significantly last week due to the release of strategic petroleum reserves, but gasoline inventories increased significantly month-on-month, indicating that the supply of refined oil on the consumer side is relatively sufficient. Affected by this, New York oil prices fell sharply.As of the close, the price of light crude oil futures for August delivery on the New York Mercantile Exchange closed at US$105.76 per barrel, a decrease of 3.66%; the price of London Brent crude oil futures for August delivery closed at US$114.81 per barrel, The decrease was 1.25%.

Source: CCTV Finance

Original title: Falling into a bear market twice in one month! The S&P 500 Index had its worst performance over the same period in 52 years! Has U.S. stock market bottomed?