Hello everyone, today is Wednesday, November 24th.

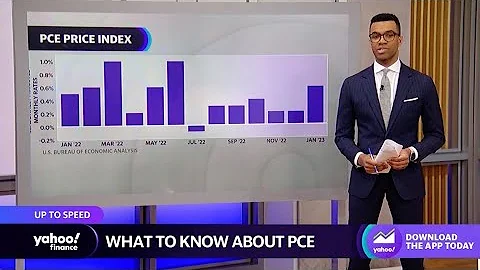

Due to the Thanksgiving holiday this week, the data has been advanced. The data originally scheduled for Thursday and Friday have all been released tonight, causing the fundamentals to be very crowded tonight. The most important thing is the core PCE data. Year-on-year and month-on-month data, this is the inflation data that the Federal Reserve is most concerned about. It is also one of the most concerned data in the market in addition to employment data. However, the current inflation data has a different impact on the market than before. So much the same!

Looking at inflation according to our previous inherent thinking, if inflation soars, gold will generally rise, because gold is the best choice to fight inflation, but this logic has not been used in the gold market for a long time. Why? Because for a long time, the market has been expecting tightening, and inflation has continued to soar. The market expected that the Federal Reserve would tighten monetary policy, which would be negative for gold. Therefore, for a long time, inflation rose, and gold fell instead of rising. At that time, many People have not been able to understand this for a long time. Every time the inflation data surged and gold fell, people would ask this question. But later, as the Federal Reserve implemented its debt reduction, it also expressed that it was not so anxious to raise interest rates and . Gold and inflation have returned to their original relationship, so last month's CPI data surged, and gold started to rise.

The text description is quite confusing. Let’s summarize the changes in the relationship between gold and inflation: 1. Gold and inflation rise and fall together, because gold fights against inflation. 2. Inflation rises, debt reduction expectations increase, and gold falls. 3. If debt reduction is implemented and there is no rush to raise interest rates, inflation will rise and gold will rise. So now it’s time to reach 4. After Powell’s successful re-election, the market is in a dilemma between 2 and 3. Should it follow inflation expectations or interest rate hike expectations ? Should gold fight against inflation or be subject to interest rate hike expectations? What about the impact? After the PCE data is released tonight, the market will give its own answer.

Although predicting the direction of gold's fluctuation tonight is no different from gambling, everyone has their own answer. I definitely have mine, so I will share my views and reasons with you, just as a reference!

Let’s first look at tonight’s PCE data. The year-on-year data for core PCE was 3.6%. The market expects it to return to 4.1%. This means that the market expects that US inflation will continue to surge. According to last month’s CPI data Judging from the above, the probability of a surge in PCE data tonight is relatively high. Then we must first lock in one variable and then predict another variable. If the PCE data surges again tonight as expected by the market, what will happen to gold? Going?

I personally think that gold will remain consistent with the trend when the last CPI data was released, that is, if inflation continues to soar, gold will rise. The Fed's debt reduction has just been implemented, and it emphasized that it will not be in a hurry to raise interest rates, so last time, When the CPI data soared, it did not lead to further strengthening of interest rate expectations, which was good for gold. In such a short period of time, the Fed Chairman was still a dovish Powell, and interest rate expectations will not return so soon, and Brainard is a super big man. The dove has been nominated as vice chairman. It is foreseeable that the Fed's monetary policy may be more conservative next year, and the market will not turn a blind eye to Brainard, a big dove.

And the most important point is that in next year’s U.S. congressional midterm elections, I analyzed in my previous article "Jia Shu: Powell or Brainard, Biden Dilemma" that Biden’s choice will be Representing different policy directions, Biden finally chose Powell. First of all, choosing Powell is a safe card. It will not consume too much energy and will not cause widespread opposition from the Republican Party. And now that Powell is chosen for re-election, Powell will I will not reciprocate the favor. I will continue to selectively ignore some economic indicators next year, continue to maintain the current loose monetary policy, and start advocating for an interest rate increase after the mid-term elections. I think this is very possible. My previous view is that , after the debt reduction is implemented, until the release of expectations for interest rate hikes next year, it will be relatively good for gold, and this wave of gold’s decline is mainly because Brainard is more dovish than Powell. In the end, Powell’s re-election made the market Expectations have been disappointed, but this does not mean that Powell is a hawk. Last time as a Fed governor, Powell was a staunch supporter of tightening, which eventually led to tapering panic. This is also one of the main reasons why Powell is currently timid, so I It is believed that the Federal Reserve is still a dovish Fed, and at least it will not make any too hawkish moves before next year's midterm elections unless inflation is really out of control.

So I think if inflation rises tonight, but it does not surge out of control, gold will most likely follow the logic of to hedge inflation and rebound. This is just a personal expectation. I suggest that if you don’t have a position in or , don’t go. There is too much data mixed with tonight's market, and the expectations are inconsistent. The key is that every expected logic makes sense. It is recommended to wait until tonight's data passes before proceeding!