text/Tong Xizhong

"Since 2021, in Liaoning, a financial risk-hit area, 63 'top leaders' of small and medium-sized banks have been detained and criminally enforced." In mid-May, this news was disclosed by the China Banking and Insurance Regulatory Commission. attracted the attention of the financial circle.

According to the list of legal persons of banking financial institutions announced by the China Banking and Insurance Regulatory Commission in late March this year, as of the end of December 2021, there are at least 100 banks in Liaoning. Among them, there are 14 city commercial banks, rural commercial banks, 60 rural banks, and 1 private bank. In addition, there are 32 Liaoning Provincial Rural Credit Cooperatives United Cooperatives and branches, and the Rural Credit Cooperatives are banking financial institutions.

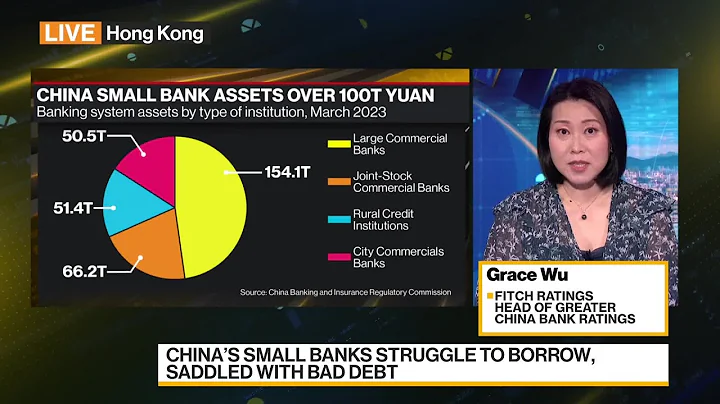

Among city commercial banks, the assets of Shengjing Bank, Jinzhou Bank, and Dalian Bank are approximately 1.02 trillion, 830 billion, and 450 billion respectively. The remaining city commercial banks have total assets of one to two hundred billion. Ranging from tens of billions. The assets of rural commercial banks are smaller. According to the 2008 statistical caliber of the central bank, all banks with assets less than 2 trillion are small and medium-sized banks.

At present, the China Banking and Insurance Regulatory Commission and Liaoning local authorities are actively handling financial risks and strengthening supervision of financial institutions. In addition to the investigation of 63 "top leaders" of small and medium-sized banks in Liaoning, since the 19th National Congress of the Communist Party of China, a total of 630 cases have been filed within the China Banking and Insurance Regulatory Commission system, 83 people have been detained, and 73 people have been transferred to judicial organs.

Behind the financial anti-corruption in Liaoning

The financial anti-corruption crisis in small and medium-sized banks in Liaoning has a profound background.

In April 2020, the China Banking and Insurance Regulatory Commission mentioned at a press conference that due to the limited management capabilities and operating strength of small and medium-sized banks, especially the certain particularities of their customer groups, they were relatively affected by the epidemic at that time. obvious.

At that time, the China Banking and Insurance Regulatory Commission stated that it would make every effort to deepen the reform of small and medium-sized banks and mitigate risks. You will gradually see that the reform and restructuring of small and medium-sized banks will be relatively intensive, especially in the market-oriented restructuring. There will be more measures.

In July of the same year, the "2020 China Banking Industry Development Report" released by China Banking Association pointed out that small and medium-sized banks have been significantly affected by the epidemic, and reform and restructuring efforts will be further increased in the future.

This is actually the case. The wave of mergers and reorganizations launched by small and medium-sized banks in 2020 will continue in 2021. Taking Liaoning Province as an example, at the end of January last year, the Liaoning Provincial Government published an article stating that it had effectively promoted the "overall reform of city commercial banks in the province" and established a new provincial-level city commercial bank, merging 12 related banks in Liaoning Province. city Commercial Bank.

In the wave of mergers of small and medium-sized banks, financial risks cannot be ignored. In April last year, the central bank released the "Central Bank Financial Institution Rating Results for the Fourth Quarter of 2020", which showed that rural cooperative institutions (including rural commercial banks, rural cooperative banks, and rural credit cooperatives) and rural banks have the highest risk, and the number of high-risk institutions There are 285 and 127 institutions respectively, accounting for 8% and 10% of the assets of this type of institutions respectively.

From a regional perspective, provinces such as Liaoning, Gansu, Inner Mongolia, Henan, Shanxi, Heilongjiang, Jilin, Shandong, and Guangxi have a larger number of high-risk institutions.

At the end of March this year, the central bank released the "Central Bank Financial Institution Rating Results for the Fourth Quarter of 2021", which showed that rural cooperative medical institutions and rural banks still have the highest risk, but the number of high-risk institutions has dropped significantly, reaching 186 and 103.

The central bank did not announce the specific provinces this time, but only stated that "the existing high-risk institutions are mainly concentrated in four provinces." Due to the large base number in the fourth quarter of 2020, the industry believes that the number of high-risk institutions in Liaoning will still not be small in the central bank's ratings in the fourth quarter of 2021.

In addition, as of the end of October 2021, among the 20 special bond issuance areas of small and medium-sized banks across the country, Liaoning ranks first in terms of issuance scale, second only to Henan. The scale of special bond issuance is related to the credit status of small and medium-sized banks in various places.

This is also supported.In April this year, data disclosed by China Bond Information Network showed that Liaoning Provincial Department of Finance planned to issue 13.5 billion yuan of special bonds for the development of small and medium-sized banks on April 14, Dandong Bank , Yingkou Bank , Fuxin Bank , Chaoyang Bank , Huludao Bank "blood transfusion".

The above-mentioned banks are already among the small and medium-sized banks in Liaoning with relatively large assets, and the other banks with smaller assets are having a more difficult time.

At the beginning of this year, the Liaoning Provincial Government announced the "Liaoning Province's "14th Five-Year Plan" Financial Industry Development Plan", which proposed that the non-performing loan rate of Liaoning's financial industry in 2020 will be 5.11%, and it will return to a reasonable range in 2025. The non-performing loan ratio is regarded as a core indicator of bank credit risk. The warning line for non-performing loan ratios of commercial banks is 2%.

Many important officials in the financial field have been investigated

In the face of financial risks, Liu Qifan, Secretary of the Liaoning Provincial Commission for Discipline Inspection, once said in a prefectural and city survey that "we will promote the punishment of financial corruption and the prevention and control of financial risks in an integrated manner."

As the financial anti-corruption deepens, many important officials in the financial field in Liaoning Province have been investigated. According to the official website of the Liaoning Provincial Commission for Discipline Inspection and Supervision, from 2021 to the present, Wang Zhongyin, Secretary of the Party Committee and Chairman of the Liaoning Provincial Rural Credit Cooperatives United Union, Li Lin, former Secretary of the Party Committee and Director of the Liaoning Supervision Bureau of the China Banking Regulatory Commission, Du Benwei, former Secretary of the Party Committee of Dongbei University of Finance and Economics, Liaoning Liu Bo, Secretary of the Party Committee and Chairman of the Financial Holding Group Co., Ltd., has been investigated one after another.

The above-mentioned personnel play an important role in Liaoning’s financial field. The "Double Opening" report stated that Wang Zhongyin profited from financial activities such as private lending, interfered and intervened in the loan business of lower-level banks, benefited others in bank loan processing and other matters, and abused his power to cause heavy losses to the interests of the country and the people.

Li Lin has worked in Liaoning’s financial field for a long time, especially as deputy director and director of the Liaoning Supervision Bureau of the China Banking Regulatory Commission. Before Du Benwei was dismissed, he was the Party Secretary of Dongbei University of Finance and Economics. He had also previously served as Chairman of the Liaoning Provincial Rural Credit Cooperatives Union, Mayor and Municipal Party Committee Secretary of Huludao City.

Liu Bo served as the director of the Financial Office of the Liaoning Provincial Government, the vice chairman of the Provincial Rural Credit Cooperatives Federation, the director of the Provincial Local Financial Supervision and Administration Bureau, the party committee secretary and chairman of Liaoning Financial Holding Group, and has considerable influence in the financial field of Liaoning Province. .

As mentioned above, the Liaoning Provincial Government once issued special bonds to "transfuse blood" for small and medium-sized banks. In fact, in terms of procedures, the "blood transfusion" must be completed through the Liaoning Provincial Financial Holding Group. Since December 2020, Liu Bo has served as the "top leader" of Liaoning Financial Holdings Group until he was dismissed in early March this year.

Judging from public reports, many people in small and medium-sized banks have also been investigated one after another, involving Benxi Bank, Fuxin Rural Commercial Bank, Tieling Bank and many other small and medium-sized banks, as well as many branches of Liaoning Rural Credit Cooperatives Union.

For example, Li Ji, the former president of Pingshan Branch of Benxi Bank, Niu Jiliang, the former president of Fuxin Rural Commercial Bank, Zhang Tao, the president of Mingshan Branch of Benxi Commercial Bank, Deng Xiaoyu, the former president of Kaiyuan Branch of Tieling Bank, and Sanglin Credit Co., Ltd. of Taian County Rural Credit Cooperative Former director of the company Wang Debao, former loan officer Li Yongde, etc.

html Why were 363 "top leaders" of small and medium-sized banks investigated?

In mid-May, the China Banking and Insurance Regulatory Commission also mentioned some of the reasons when disclosing information to the media. The China Banking and Insurance Regulatory Commission stated that "a group of corrupt elements who colluded with government and businessmen, conveyed benefits, and illegally embezzled were brought to justice, and some of them were financial management department staff who 'watched and stole'."

professor of Peking University School of Economics Cao Heping told China News Weekly that in the financial field, regulatory agencies are equivalent to the third "eye" on whether the system is operating normally. When the interests of regulatory agency officials and financial institutions are not independent, , the third eye of supervision will be "blinded". Regulatory authorities themselves must be honest and effectively supervise banks.

He believes that technical variables are also an important factor in the large number of "top leaders" of small and medium-sized banks being dismissed.With the development of digital economy , the traceability of information is getting stronger and stronger, and economic crimes are becoming more and more traceable.

According to the official report, these people are mostly involved in credit. The aforementioned Wang Zhongyin once issued a loan of 1.043 billion in violation of regulations. Another example is Feng Qingli, the former general manager of the International Business Department of Anshan Bank, Song Jialei, the former president of Benxi Bank, and Hu Fuli, the former director of Fushun Shuncheng Rural Credit Cooperative Association, all involved in credit violations.

Judging from the people who have been dismissed, there are certain characteristics of clusters of crimes. Taking the Rural Credit Cooperative as an example, Wang Zhongyin, Liu Bo, Du Benwei and others all worked in the Liaoning Provincial Rural Credit Cooperative Union. According to media statistics, after Wang Zhongyin was dismissed, Liaoning’s At least seven senior executives in the rural credit system have been sacked.

A bank practitioner told China News Weekly that in fact, small and medium-sized banks also have their own weaknesses. Compared with large banks, small and medium-sized banks have shorter loan processes and larger operating space. The power of the "top leaders" within the bank cannot be restricted, and so-called internal supervision is limited. It will become a mere formality.

In May of this year, the China Banking Regulatory Commission also mentioned the weaknesses of small and medium-sized banks in an interview with the media. The China Banking Regulatory Commission stated that it is common for shareholders of small and medium-sized rural banks to be "small, fragmented and weak", and some institutions still have problems such as insider control, outsider manipulation, and illegal related transactions.

The above-mentioned bank practitioners mentioned that in actual operations, small and medium-sized banks are greatly affected by local governments. If local governments put pressure on small and medium-sized banks, riskier loans will also be made.

Dong Ximiao, chief researcher of Zhongguancun Internet Finance Research Institute and part-time researcher of Fudan University Financial Research Institute, also mentioned to China News Weekly that in some places, although local governments do not hold shares in small and medium-sized banks or have a low shareholding ratio, they will interfere Corporate governance of small and medium-sized banks.

Regarding financial governance, Dong Ximiao suggested that when local party committees and governments recommend candidates for senior executives of small and medium-sized banks, they should put their professional experience and professional qualities first, and should not push government officials who lack financial experience to small and medium-sized banks. Regulatory authorities should make good use of qualification verification and other systems to strictly control the candidates of senior executives of small and medium-sized banks, especially the "top leaders".