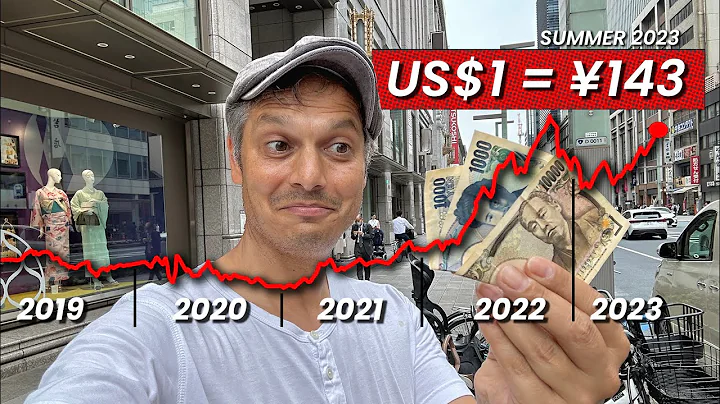

Under the surge of US dollar index , many currencies have depreciated against the US dollar, including the RMB. However, compared with the Japanese yen, the depreciation of the yuan is nothing. Because the Japanese yen has depreciated by more than 15% against the US dollar in just a few months, becoming the weakest currency among major currencies. So, why did the Japanese yen depreciate sharply?

Why the Japanese yen will depreciate sharply

One reason is the sharp appreciation of the US dollar. Because the inflation in the United States is too serious, the Federal Reserve has to suddenly tighten monetary policy.

In the past, large amounts of money were printed to buy U.S. Treasury bonds and other asset-backed securities, but now they dare not do so, because if they continue like this, U.S. inflation may soar to unimaginable levels, and the economy will directly collapse. Not only that, the Federal Reserve also significantly raised interest rates, attracting a large amount of foreign capital to flow to the United States. This reduces the supply of U.S. dollars and increases demand, making it difficult for the U.S. dollar to appreciate or not.

Of course, the appreciation of the US dollar is only relative to the currencies of other countries. Within the United States, due to its high inflation, the US dollar is actually depreciating rapidly. For the United States, the Japanese yen is obviously the currency of other countries. If the US dollar has appreciated significantly, it is not surprising that the Japanese yen has depreciated against the US dollar.

Another reason is that Japan has not followed the United States in tightening monetary policy. If the Federal Reserve reduces the size of its bond purchases and raises interest rates, and the Bank of Japan follows suit, even if the Japanese yen depreciates, it should not depreciate so much.

But in fact, instead of following the Fed in tightening monetary policy, the Bank of Japan is further easing monetary policy because the Bank of Japan is also increasing the scale of its purchases of Japanese government bonds. Japan can become one of the countries with the highest debt ratio in the world, and the Bank of Japan can be said to have taken the greatest credit.

Perhaps it is not that Japan does not want to follow the steps of the United States in tightening monetary policy, because they are also troubled by the sharp depreciation of the currency, but the conditions do not allow it. After all, Japan's economy is not very good. Once monetary policy is tightened, it will definitely fall into recession.

Since we want to continue to purchase large amounts of government bonds, we must continue to issue large amounts of currency. Everyone knows that if too much currency is issued, it will most likely depreciate, especially when the U.S. dollar is strong. So if the yen doesn’t depreciate, who will?

There is another reason, which may be because the competitiveness of Japanese products in the international arena has declined. Generally speaking, if a country's currency depreciates, it is more conducive to exporting its own goods, because in the eyes of foreigners, its goods become cheaper.

For example, in the past, 1 U.S. dollar could only be exchanged for 100 yen, that is, you could buy 100 yen Japanese products with 1 U.S. dollar. Now, 1 U.S. dollar can be exchanged for 130 yen, and you can buy 130 yen products.

However, despite the sharp depreciation of the yen against the US dollar, Japan's trade deficit has not been reversed, but has expanded. This may indicate that the sharp depreciation of the yen has failed to achieve strong growth in exports of Japanese goods. Is there a better explanation other than a decline in the international competitiveness of its goods?

The lack of motivation for commodity exports means that other countries do not need to exchange too many yen to buy Japanese goods. Weak demand for yen may also cause the depreciation of the yen.

In short, under the combined influence of many factors, the depreciation of the yen is almost inevitable.