Vietnam "Vietnam+" reported on June 25 that after the epidemic, the lives of most people in Vietnam have returned to normal. The trend of cashless payments grew strongly during the epidemic, but it has not “cooled down” as the epidemic has disappeared, and is actually becoming a payment habit for many people.

Cashless payment has become a habit

After the epidemic, many people’s payment habits have completely changed. According to a research report released by VISA in early June, Vietnamese consumers have quickly accepted a range of digital payment methods and changed their payment habits.

Specifically, 65% of respondents said they have less cash in their wallets, and 32% said they would stop using cash after the epidemic. Cashless payment is developing rapidly. Currently, nearly 76% of consumers use e-wallets, and the proportion of credit card users is even higher, reaching 82%.

According to a report by VISA, during the epidemic, two-thirds of consumers in Vietnam shopped online, and half of consumers tried shopping through social network platforms for the first time. Nine out of 10 consumers use home delivery services, and nearly all are using these services more frequently than before the pandemic.

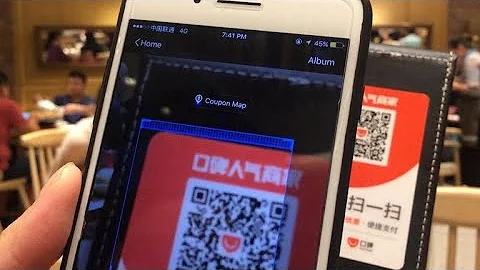

Affected by the epidemic, more than 80% of consumers use credit cards, QR code payments and e-wallets at least once a week; 50% of consumers start to use credit cards more frequently; 64% of consumers use mobile phones and 63% Consumers are increasing their use of contactless payments through e-wallets. Convenience and speed are consumers’ preference for digital payment methods, followed by physical health and transaction security.

Deng Xuerong, president of VISA Vietnam and Laos, said that the impact of the epidemic cannot be ignored, whether in the short or long term. Enterprises must promote reform and innovation mechanisms and accept digital payments to adapt to the development of new trends.

Mr. Nguyen Minh Sam, Vice President of Saigon Commercial Joint Stock Bank (Sacombank), said that after the epidemic, cashless payment still attracts attention and is growing in all aspects and regions.

It is worth noting that due to the implementation of the electronic identity verification information system (eKYC), many people can open accounts remotely during the epidemic.

According to statistics from the State Bank of Vietnam , there are about 3.4 million accounts opened online through eKYC, and 1.3 million new bank cards were opened. Currently, the proportion of adults with a bank account is close to 66%, with an average growth rate of 11.44% between 2015 and 2021.

By April 2022, cashless payment transaction volume has increased by 69.7%, and transaction value has increased by 27.5%; Internet transaction volume and transaction value have increased by 48.39% and 32.76% respectively, and payment through mobile phones has increased by 97.65% and 86.68%, respectively. Payments through QR codes increased by 56.52% and 111.62% respectively; activated e-wallets increased by 10.37% compared with the end of 2021.

It is worth noting that the Vietnamese government has allowed the trial use of telecommunications accounts to pay for small goods and services (mobile money).

Only 4 months after the mobile money trial, 1.1 million new accounts have been opened, more than 60% of which are located in rural, mountainous, remote areas, border and island areas. In the future, the State Bank of Vietnam will cooperate with the Ministry of Information and Media and the Ministry of Public Security to promote the development of mobile money and provide strong support for the construction of digital government, digital economy and digital society.

Economic and Commercial Section of the Consulate General in Ho Chi Minh City