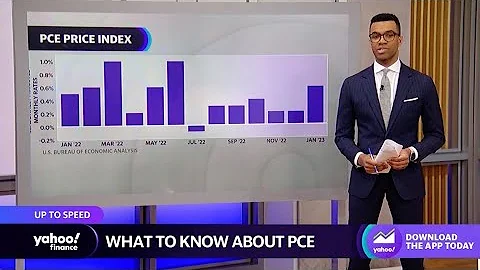

The indicator that Fed policymakers are most concerned about, the core PCE price index excluding food and energy prices, increased by 4.9% year-on-year, 4.9% expected, and the previous value was 5.2%. From a month-on-month perspective, the core PCE price index increased by 0.2% month-on-month in April, which was the smallest increase in this indicator since last summer.

Although the growth rate of the PCE price index in April slowed down compared with the previous value, it was still the fastest inflation growth since 1982.

htmlThe slowdown in inflation in April was mainly driven by falling gasoline and other energy prices. Natural gas prices soared in February and March following the Russia-Ukraine crisis, but they have risen again in recent weeks, which could push the inflation gauge back up in May. Food prices have also risen rapidly in recent months.

According to media reports, Omair Sharif, founder of research firm Inflation Insights, said:

I suspect that the Fed may ignore this slowdown.

He noted that the core PCE price index also slowed last fall, but picked up again at the end of the year, catching the Fed off guard.

Many forecasters believe that headline inflation peaked in March and will begin to gradually cool in April, but the recent rebound in energy prices may complicate this situation. And even if inflation continues to decline, prices are still rising well above the Fed's 2% target.

Tim Quinlan, senior economist at Wells Fargo said: "Inflation has been high and rising over the past year, and we are now in a 'slow decline from the highs' phase."

He also said, The public is unlikely to view a slight slowdown in inflation as a cause for celebration. "To them, price growth year after year is not important, which is why a bad lunch now costs $12." . Income data released by

at the same time showed that personal income in the United States increased by 0.4% month-on-month in April, which was expected to be 0.5%, and the previous value was 0.5%; personal consumption expenditures (PCE) in the United States in April increased by 0.9% month-on-month, and the expected value was 0.8%, and the previous value was revised Value 1.4%. As expected, spending surged while revenue showed only modest growth.

This is the seventh consecutive month of revenue growth. In terms of subcategories, private sector worker wages increased 12.7% year-on-year, down from 14.0% in March, while government worker wages increased 5.6% year-on-year, down from 5.7% in March.

This ultimately caused the U.S. savings rate to plummet to 4.4%, the lowest level since September 2008.

However, whether inflation will actually start cooling soon remains an open question. Trends suggest that core inflation may continue to slow in the coming months. Retailers reported rising inventories of televisions, furniture and other home goods as consumers shifted their spending more toward service-related items such as travel and restaurant purchases.

Retailers may have to rely on discounts to clear inventory in the coming months. As some supply chain issues are resolved and automakers manage to hire more workers, they have been ramping up production. Both trends help lower commodity prices.

Meanwhile, rising wages for many workers, especially in restaurants, hotels and warehouses, will continue to push up service prices, which in turn will offset at least some of the cooling inflation from cheap goods.

Most economists expect inflation, as measured by the Fed's preferred inflation measure, to remain around 4% or higher through the end of the year. If prices rise to this level, it may mean that the Federal Reserve will continue to raise interest rates and reduce the inflation rate to the 2% target level.

Federal Reserve Chairman Jerome Powell has previously pledged to continue raising the Fed's key short-term interest rate until inflation "declines in a clear and convincing way."

After raising interest rates twice this year, the Federal Reserve stated in the meeting minutes released on Wednesday that the monetary stance needs to quickly shift to a more neutral stance, and restrictive policies beyond neutral levels may become appropriate. Fed policymakers believe it is necessary to raise interest rates by 50 basis points at the last two meetings in June and July this year.

This article comes from Wall Street News, welcome to download the APP to view more