[Dahe News·Dahe Financial Cube] (Reporter Jia Yongbiao) There is competition both inside and outside the game.

html On April 29, as Kunlun Wanwei officially disclosed its 2020 annual report, 24 of the 31 companies covered by the CITIC gaming industry have completed performance disclosure.Among them, Sanqi Interactive Entertainment, Perfect World ranked first in the echelon with a revenue level of more than 10 billion yuan, Kunlun Wanwei , and Gigabit demonstrated their profitability with a net profit level of more than 1 billion yuan. .

However, on the other side of the mirror, Aigaras was at the bottom with a huge loss of 1.2 billion yuan. *ST Zhongying and *ST Chenxin were in a worrying situation due to continuous losses.

As the game track continues to expand, powerful players such as Tencent, NetEase, and Bilibili continue to increase their investment. The Song of Ice and Fire in the gaming industry will also continue to be staged. Who is the last player to successfully "eat chicken" deep in the boat?

More than ten listed game companies have net profits of over 100 million yuan

Wind data shows that from the current disclosed profit level, Kunlun Wanwei ranks first with 4.99 billion yuan. , Perfect World, , and Gigabit ranked in the second tier with 1.5 billion yuan and 1.3 billion yuan respectively. A total of 18 game companies maintained positive profits.

![[Dahe News·Dahe Finance Cube] (Reporter Jia Yongbiao) There is competition both inside and outside the game. On April 29, as Kunlun Worldwide officially disclosed its 2020 annual report, 24 of the 31 companies covered by CITIC Gaming Industry have completed performance disclosure - DayDayNews](https://cdn-dd.lujuba.top/img/loading.gif)

Kunlun Wanwei annual report shows: In 2020, the company achieved a net profit of 4.993 billion yuan attributable to shareholders of listed companies, a significant year-on-year increase of 285.54%; deducting non-net profits of 2.067 billion yuan, a year-on-year increase of 63%; as of the end of the reporting period, the company's total assets 13.24 billion yuan, a year-on-year increase of 29.07%. The company's annual distribution plan is to distribute a cash dividend of 1.74 yuan for every 10 shares to all shareholders.

As the profit king in the game industry, one of the revenue sources of Kunlun Wanwei is composed of GameArk’s game prop revenue and Xianlai Interactive Entertainment’s joint game sharing revenue. In addition, the company's self-developed game "Legend of Sword and Fairy Mobile" and its agent games "Clash of Clans: Clash Royale" and "Boom Island" were all on the popular game list, contributing to the revenue of Kunlun A lot of power.

Perfect World released its 2020 annual report, with steady performance growth, achieving operating income of 10.225 billion yuan and net profit attributable to the parent company of 1.549 billion yuan, a year-on-year increase of 27.19% and 3.04% respectively; the game business achieved operating income of 9.262 billion yuan and a net profit of 2.285 billion yuan. billion, a year-on-year increase of 35.00% and 20.43% respectively. What are the main sources of

's revenue of over 10 billion yuan? Different from Kunlun Wanwei , Perfect World self-developed products account for more than 95%. In addition, with two super popular works "DOTA2" and "CS:GO (Counter-Strike: Global Offensive)", Perfect World has a place in the e-sports market. In addition, in the film and television business, Perfect World has participated in the creation and distribution of more than 100 excellent TV series and movies since 2008, and has won more than 200 professional awards.

In addition, mobile game representative Gigabit also performed very well, which is closely related to the company's continued increase in research and development. Its annual report shows: R&D expenses in 2018, 2019, and 2020 were 287 million yuan, 332 million yuan, and 431 million yuan respectively, accounting for 17.35%, 15.31%, and 15.70% of operating income respectively. This ratio exceeds that of many traditional fields. The enterprise's continuous high R&D investment also provides a solid guarantee for Gigabit innovation.

Many companies are famous, and Aiglass lost more than one billion yuan.

Due to the extremely important importance of IP in the game industry, the differentiation between strong and weak is relatively obvious.

html On April 29, trading in Aigaras stock was suspended. After the resumption of trading, the Shenzhen Stock Exchange issued a delisting risk warning and superimposed other risk warnings on the company's stock trading. The stock abbreviation was changed from "Aigaras" to "*ST Aiga". After the delisting risk warning is implemented and other risk warnings are superimposed, the daily increase or decrease in the company's stock trading is limited to 5%.'s annual report data shows that the company's operating income in 2020 dropped 67% last year to 1.8 billion yuan, and the annual net loss was 1.2 billion yuan, a 51% decrease from the same period last year. The company's self-developed products include "Soul of Heroes", "Soul of the Fighting Soul", "Empty City Strategy", etc., and its agent products include "Hunter", "A Sword of Love", "Dragon Nest", etc.

's substantial performance losses are attributed to two major reasons: first, the main income in 2020 comes from old game products developed by itself and game products released by agents, and the game launch situation did not meet expectations; second, the market environment Changes, industry policies have become stricter, the head effect has become more obvious, competition has become more intense and game products are scarce.

In the era of fierce competition among multiple oligarchs in the gaming industry, Aigaras's tragic record is not an exception. A reporter from Dahe Daily and Dahe Finance Cube noticed that Zhongying Internet released its 2020 performance report and stated that it achieved revenue of 265 million yuan, a year-on-year decrease of 42.56%; a net loss of 318 million yuan, compared with a net loss of 1.348 billion yuan in the same period in 2019. After the annual report was released, Zhongying Internet was issued a delisting risk warning because its audited net assets were negative at the end of 2020. The annual report released by

*ST Chenxin shows that the company achieved operating income of 105 million yuan in 2020, a year-on-year increase of 57.95%; the net loss attributable to shareholders of the listed company was 52.0184 million yuan, and the net loss in the same period last year was 1.007 billion yuan (adjusted) ; The net loss attributable to shareholders of the listed company, excluding non-recurring gains and losses, was 70.6963 million yuan; the basic loss per share was 0.0364 yuan.

Regarding this loss, *ST Chenxin said: During the reporting period, the original game entered a period of decline and related game products were offline, resulting in a significant decrease in game revenue. However, compared with other game companies, *ST Chenxin has expanded its business in related fields around the "Malt E-Sports" brand, focusing on the development of e-Sports education business, and has reached strategic cooperation with leading e-Sports clubs in the industry to jointly focus on the "nurturing plan" ” to popularize e-sports knowledge among young parents.

Powerful players such as Tencent and Bilibili continue to compete for territory

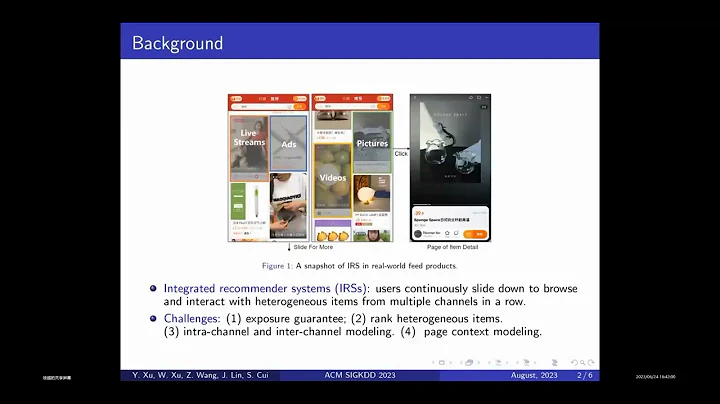

In fact, it is not comprehensive enough to analyze the entire gaming industry only with reference to the list of 31 companies covered by CITIC Gaming Industry. Powerful players represented by Tencent, NetEase, and Bilibili continue to compete for territory and are reaping the dividends brought by the rapid expansion of the industry.

The 2020 annual performance report disclosed by Tencent Holdings Co., Ltd. shows that Tencent Holdings 's total revenue in 2020 was 482.064 billion yuan, and the annual profit was 160.125 billion yuan, an increase of 67% from last year. The annual net profit exceeded RMB 100 billion for the first time. At the same time, annual report data shows that Tencent’s online game revenue reached RMB 156.1 billion, accounting for 32% of total revenue. This data undoubtedly kills many A-share listed game companies.

Tencent said that this growth was mainly driven by the revenue growth of smartphone games in domestic and overseas markets, especially "Peace Elite", "Honor of Kings" and "PlayerUnknown's Battlegrounds Mobile", as well as the full-year impact of the Supercell merger. Revenue from PC client games declined slightly.

Currently, NetEase is one of the domestic players that can compete head-on with Tencent Games. This is evident from its financial report. The financial report released by NetEase shows that NetEase’s net income in Q4 was 19.8 billion yuan (US$3 billion), a year-on-year increase of 25.6%. Among them, the net income of online game services was 13.4 billion yuan (2.1 billion US dollars), a year-on-year increase of 15.5%. , exceeding 10 billion for 11 consecutive quarters, achieving stable growth. In 2020, NetEase's online game services net revenue was 54.6 billion yuan, compared with 46.4 billion yuan in 2019.

On the other hand, Bilibili, which just completed its secondary listing on the Hong Kong stock market not long ago, has also been making frequent moves for some time. On April 1, Bilibili announced a strategic investment of approximately HK$960 million in Xindong Company. The two parties will cooperate on Xindong’s games and the well-known game sharing community TapTap. According to news on April 29, Station B has made another big move and plans to participate in China Mobile Games’ share placement. After the placement is completed, Station B will hold 7.15% of the company's shares and become the second largest shareholder.

A reporter from Dahe News and Dahe Finance Cube noticed that from the perspective of station B’s revenue structure in 2020, games, value-added services, advertising, and e-commerce are the four core sectors. In 2020, the proportion of game business in total revenue dropped to 40%; the proportion of value-added service revenue increased to about one-third; advertising revenue accounted for 15.4%; e-commerce and other revenue accounted for 12.6%. It is not difficult to find that after going public, Bilibili has successively targeted the gaming field. It not only sees the profitability of the gaming industry, but also intends to build its own moat by digging deep into IP.

Industry supervision tightens, game version numbers are still key

html On April 27, the National Press and Publication Administration website showed that domestic game version numbers have been issued in April this year, and a total of 86 domestic games have been approved. Among the games that received license approval this time, Tencent’s “Return to the Empire” and NetEase’s “Greenery Faith” received licenses. As for other A-share listed companies, Perfect World 's "Magic Tower", Giant Network's "Dragon and the End of the World", Zhejiang Digital Culture's "Chess Master", Youzu Network's "Young Heroes", Zhongqing Bao's "The Wandering Ark" and many other companies received licenses."Game development and production are only the foundation. Whether you can successfully obtain the version number and launch it is the most critical step. This is similar to the production and distribution of movies. If some game companies cannot schedule the game launch well, their performance will be ruined." There may be significant fluctuations." A game industry insider said that after the game is successfully interviewed, post-maintenance is also very critical.

Looking at the above-mentioned listed companies in the game industry that disclosed annual reports, it is not difficult to find that online games themselves have a life cycle, and almost all games need to go through a growth period, an explosion period, and a decline period. If a company fails to update and maintain existing games, version upgrades and continue marketing in a timely manner, or player preferences change, games that are already online may quickly enter a period of decline, and the performance of game developers may also fluctuate dramatically.

's "2020 China Game Industry Report" shows that in 2020, the actual sales revenue of China's independently developed games in overseas markets was US$15.45 billion, a year-on-year increase of 33.25%, a year-on-year increase of 12.3 percentage points, and the revenue growth rate hit a new high in the past four years.

The game industry continues to expand, and relevant regulatory policies are also tightening. In addition to version number review, relevant industry regulations and industry standards are also constantly improving. On April 27, the Internet Society of China approved the release of the "Online Game Industry Corporate Social Responsibility Management System" group standard. As the industry's first social responsibility management system standard, the standard restrains enterprises from the perspective of social responsibility and has certain demonstrative significance. .

"Benefiting from the booming stay-at-home economy, the ecology of the game industry has improved significantly, and many game companies are also seeking to go overseas to open up new business markets. When global game manufacturers compete on the same stage, it is worth looking forward to who will be the real king." The above-mentioned person say.

Editor: Liu Anqi | Reviewer: Li Zhen | Director: Wan Junwei