The Japanese yen depreciation craze is coming!

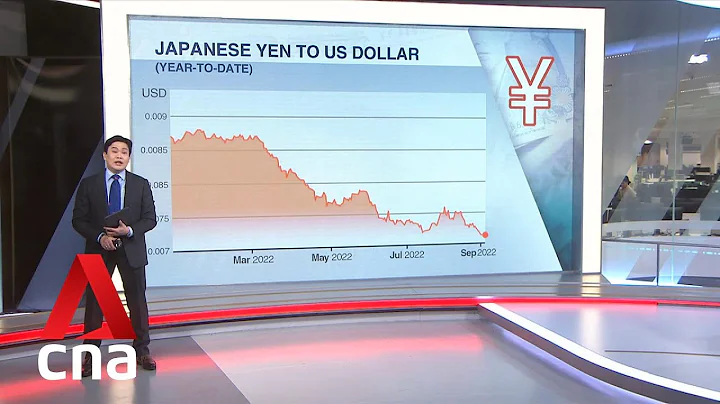

Recently, the exchange rate of the Japanese yen against the U.S. dollar once fell below 133 yen per U.S. dollar, once again hitting the lowest level in 20 years after the previous trading day.

Since March, the yen has depreciated by nearly 15%. If the time is calculated from 2021, the yen will depreciate by more than 25%.

Isn’t the depreciation of the yen always considered to be “healthier” and can boost the economy? Now that the yen has plummeted, what is the situation in Japan?

Let me give you an example and you will understand. Japanese clothing brand Uniqlo has been competing with other companies on low-cost basic products such as socks and underwear for the past ten years, but what about now? Prices are about to go up. The price of its autumn and winter series of woolen products and down jackets will increase by 1,000 yen.

JPMorgan Chase said that if the US dollar against the yen exceeds 135, the yen in the hands of ordinary people will further "shrink", who will still hold the yen? Japan will then fall into a currency crisis.

So the question is, the yen is devaluing like crazy. Why doesn’t the Bank of Japan take action and the United States doesn’t save it?

In fact, Japan has been following the establishment of Abenomics established ten years ago, including a 2% inflation target, active reduction of the yen exchange rate, and loose monetary policy . And what is the United States doing at this time? It has tightened monetary policy, raised interest rates twice in a row, and is likely to continue to raise interest rates to harvest global wealth. The interest rate gap between Japan and the United States continues to expand. Investors are selling the yen and buying the U.S. dollar. The yen is under pressure to depreciate. But you have to know that such a huge depreciation is very rare in the world. The Japanese and US finance ministers met on the exchange rate issue but were unclear about the Japanese exchange rate issue. So, why did the United States condone such a large depreciation of the yen? Woolen cloth?

What is the situation in the United States now? After two consecutive interest rate hikes, the inflation rate is still as high as 8.3%, and there are still problems such as poor logistics and shortage of goods. The depreciation of the yen at this time means that the goods imported by the United States from Japan are discounted. Earlier we said that if the yen depreciates by 25% from 2021, this means that the price of goods imported by the United States from Japan will be A 25% drop will be directly transmitted to inflation in the United States to lower the level of inflation.

In other words, in the eyes of the United States, the younger brother is sacrificed and can withstand thunder at critical moments.