PE valuation of CSI 300 and FED risk premium :

PE 12.28, percentile 30.17%, lower;

FED 5.37, percentile 81.17%, higher;

PE color: undervalued | relatively undervalued | is moderate | is overvalued | is overvalued

The FED difference is opposite to PE. The higher the FED value and percentile, the more investment value it has.

(Data source: Tiantian Fund APP, Liquaner APP)

The valuation of the CSI 300 has fallen back to the lower area , and it has entered the stage of better fixed investment. Since it has just entered the relatively undervalued area, I will observe it for a few more days. The current fixed investment varieties remain unchanged, and are still Galaxy Innovation Growth C and GF Nasdaq 100C.

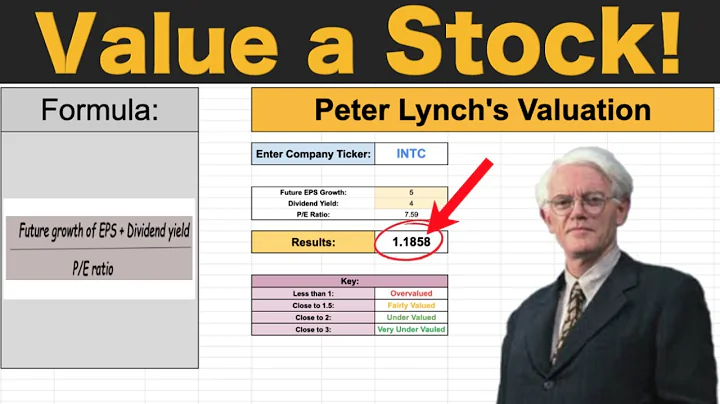

Starting today, we will introduce a reference indicator for fixed investment, the FED of the CSI 300. The calculation formula for this indicator is "1/PE of the CSI 300 - ten-year treasury bond yield". The larger the value, the greater the investment value. Specific instructions It is an indicator that most fund managers must use. This indicator is divided into difference and ratio. I am using difference here. I will look for a few articles and videos that introduce this indicator in detail for your reference.

I will use PE and FED as a reference to make fixed investments in the future, come on! [Come on]

code | name | yield | fixed investment |

undervalued area: spring plowing buy | |||

009163 | GF MedicalC | -13.05%↓ | pause |

004075 | Bocom PharmaceuticalsA | -5.48%↓ | 1|

519674 | Galaxy InnovationA | -0.05% ↓ | Stop |

014143 | Galaxy Innovation C | -2.00%↓ | Thursday 2 |

Moderate zone: flowers bloom and grow | |||

001508 | rich country new power | 0.75%↓ | pause |

006479 | Nasdaq100C | -1.11%↓ | Friday |

002079 | Qianhai scarceC | -11.52% ↓ | Pay |

| 005827 | Yifangda blue-chip | -14.43% ↓ TML11 pause | |

002621 | -15.89% ↓ |

| overvalued area: |

012414 | 3.90% ↓ |

CSI 300FED risk premium indicator

Galaxy Innovation Growth

GF Nasdaq 100