Gold demand in India will be strong in the second half of 2021 as the Indian economy recovers from the epidemic. Demand fell this spring as gold prices rose in rupee terms, but has rebounded in recent weeks.

html Retail gold demand remained strong year-on-year in the first three weeks of May amid strong sales and strong wedding demand. Sales were predictably flat in the last week of the month due to fewer auspicious wedding dates. Gold prices also rose in the last week of May, dampening retail sales.

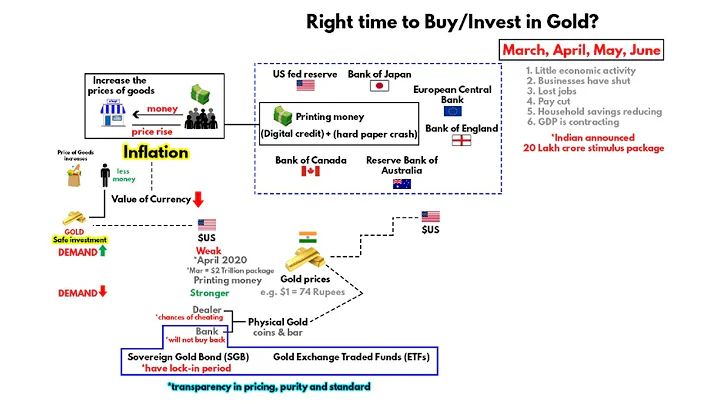

In terms of investment, the net inflow of India gold ETF this month was 0.4 tons. This goes against the global trend of a sharp decline in ETF gold holdings. According to World Gold Council , the main drivers of gold inflows into Indian ETFs are the macroeconomic backdrop of rising inflation and a depreciating rupee. This is the third consecutive month of net gold inflows into Indian ETFs.

Gold imports grew strongly in May, with 98 tons of gold flowing into the country. This compares with 27.1 tons in April 2021 and 11.4 tons in May. This is the highest imported tonnage since August 2021.

The Reserve Bank of India 5 added 3.7 tons of gold reserves. This is the highest monthly new addition since December 2021. Since resuming purchases in late 2017, the Reserve Bank of India has purchased more than 200 tons of gold. In August 2020, there were reports that the Reserve Bank of India was considering another significant increase in its gold reserves.

India is the world's second-largest gold consumer after China, but the gold market has been languishing in the past few years. The pandemic has crushed demand, especially for gold jewellery. But even before the coronavirus, record gold prices in rupee terms and government policies weighed on the gold market. There were signs of a turnaround late last year, and this has continued into the first quarter of 2021. The second wave of the epidemic hampered the recovery of India's gold market at the beginning of the second quarter, but it regained momentum later in the year with strong retail demand and a surge in gold imports.

Indians traditionally buy and hold gold. Overall, Indian households own about 25,000 tonnes of gold, a figure that is likely to be higher given the country's massive black market. The yellow metal is intertwined with the country's wedding ceremonies and cultural rituals. Indians also see gold as a store of wealth, especially in poor rural areas. Two-thirds of India's gold demand comes from these regions, where the vast majority of people live outside the official tax system.

Gold is not just a luxury item in India. Even poor people can buy gold in India. According to a 2018 survey by ICE, one in every two households in India purchased gold in the past five years. Overall, 87% of households in the country own some amount of the yellow metal. Even households at the lowest income level in India own some gold. According to the survey, more than 75% of the bottom 10% of households have managed to purchase gold.

During the pandemic, gold is the lifeline for many Indians.

The Indian government’s response to the first wave of the epidemic devastated the economy. As a result, many banks are reluctant to extend credit for fear of default. In this tight lending environment, many Indians have used their stash of gold to obtain loans. As India battles the second wave of the epidemic, many Indians are selling gold outright to make ends meet.

Gold tends to store value, ultimately gold is money. If they own gold, they know they will be able to get the goods and services they need - even in the event of an economic collapse. While Westerners may not accept the cultural and religious aspects of India's love for gold, the economic reasons for their love for gold are equally applicable in places like the United States.