Loss is like an invisible ghost in the world of financial speculation. For every trader, the two results of trading are profit and loss.

It always makes people happy when they make profits, but how to solve it properly The problem of loss often determines whether a trader's trading result will make money or lose money.

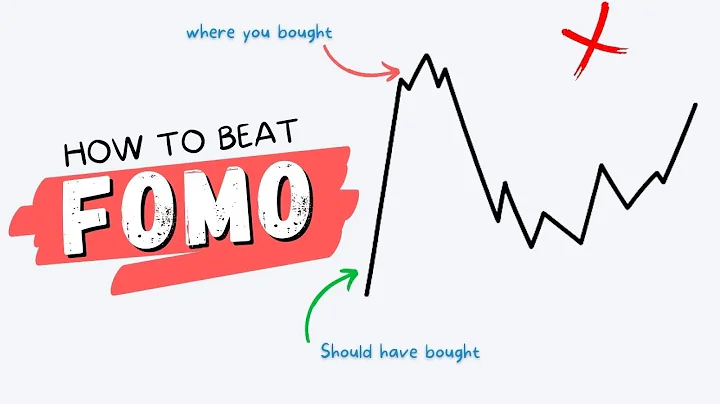

This is a very common phenomenon. When a book loss occurs, many traders will choose to carry on without losing money.

This order is not necessarily wrong for a certain transaction, because it can indeed be recovered in many cases. Even turning from a loss to a profit, but trading within a certain period of time, is the main reason why ordinary traders lose money.

The greatest charm of the speculative market is that it is a place, a place of high-profile heroes

,

Of course it is not just when you win beautifully, when you lose

the

is vigorous enough to be used as a lesson by future generations.

No matter you call yourself a genius or you are ashamed of yourself, there will always be losses and wins, but some people can't survive the few big losses. In the end, Victory and defeat are not determined by a few insignificant operations,

so never push yourself into a desperate situation. Leaving the result to luck is basically doomed to a final failure.

Keep in mind the "wait patiently" and "go with the flow"

5 standards:

First, making money is the last word;

Second, it has always shown sustainable replicability in the long-term test of various environments;

Third, the key factor for success is in oneself, not some uncontrollable external factor;

Fourth, one can maintain a healthy, comfortable and free lifestyle and not compromise the quality of life for making money;

Fifth, any Under any circumstances, the small probability of being pushed over and restarted can be avoided.

Forest Law

1. Wait patiently for the opportunity to appear.

2, specializing in attacking the weak. "Stock trading is like the law of the forest in the animal world. It specializes in attacking the weak. This approach can often achieve perfect results."

3. You must be ruthless when attacking, and you must do it with all your strength.

4. If things go as expected, saving your life is the first consideration.

5. Everyone has weaknesses. Similarly, any economic system also has weaknesses. Weaknesses are often the most indestructible point.

So if you want to use the trend investment method, you must ensure two prerequisites; first, the up and down trend must be clear; second, the trend must be determined as early as possible.

This requires investors to make scientific and accurate judgments based on some signs of the stock market, but often many investors cannot find the trend at all and can only rely on speculation, so retail investors often lose money in the stock market.

Therefore, many investors have chosen diversified investment, portfolio investment, and other methods to avoid investment risks, etc. This means that when we study stop loss , cannot just focus on a certain product, but more Think carefully about how to rationally transform and layout an active, stable and conservative investment portfolio.

After identifying the market trend, what principles should be followed when selecting trend line points?

There are three points:

(1) Connect important low points or connect important high points;

(2) Pass through important low points or The more high-point touch points, the better the effect;

(3) provided that it does not violate the first two standards, the closer the point is to the present, the better the effect.

Upward trend line

Downtrend line

The more contacts that pass through important low points or high points, the better the effect: It is very knowledgeable to take the points to connect the trend lines. If the points are not taken well, the front will be missed, and the back will be ridiculous. Thousands of miles. Therefore, the trend line is not static and must change according to the changes in the market. However, there is a general principle for selecting points, that is, the more points that pass through important lows or highs, the more standard it will be.As shown in the figure:

the upward trend line 2 passes through only two consecutive important low points, 1 and 2. The important low points that the upward trend line passes through are 2, 3, and 4 points, so the effect of the upward trend line one is better.

Because human beings' cognition of the world follows the law of forgetting, the farther things are, the less impact they will have on the present, and the closer things will be, the greater the impact will be on the present. The closer the point is to the present, the greater the impact will be on the present. big.

W bottom ( double bottom ) buying principle:

1) You can buy when the stock price breaks through the neckline with heavy volume. You can also buy when the stock price of

(2) pulls back to the neckline of again.

(3) After buying, investors can set the stop loss at the neckline and stop the loss when it falls below the neckline. In the process of forming two bottoms in

(4), the greater the cumulative turnover rate, the better the trading volume is coordinated, and the greater the room for future growth, which is the performance of the main fund-raising.

Stock trading experience:

No matter how perfect and feasible your strategy is, you cannot make a profit in every transaction. Sometimes your technique is good, but the end result is still failure.

Professionals focus on making sure every part of trading (waiting, timing, buying, money management, selling, etc.) is done correctly and the profits will come naturally.

Traders should remind themselves before every trade that any success or failure does not matter in the grand scheme of things. Whether you make a profit depends on when you buy the stock.

buying is the foundation and selling is the result. Knowing when to do what will make you a great trader.

Every trader will eventually realize that the best trades are those that result in immediate profits. The right purchase is like a good child that won't cause you any trouble and will do what it's supposed to do at the right time.

He obeys all your commands. Once you understand these trends, you can follow the price. Never catch a falling dagger. Wait until it hits the ground and stops shaking before picking it up.

This is the lesson I learned. Don't buy stocks that are falling. My trading history tells me that it is foolish to buy stocks that have fallen sharply.

Okay, today’s content is shared with you. coding is very hard. If you agree with the point of view, you can like Little Rocket to support it. Thank you.

![[Source: Hebei News Network] Hebei News Network (Correspondent Wang Kaikai) On June 30, a centralized signing ceremony for projects in the second quarter of 2022 was held in Gaocheng District, Shijiazhuang City. 20 projects with a total investment of 7.666 billion yuan were signe - DayDayNews](https://cdn.daydaynews.cc/wp-content/themes/begin/img/loading.gif)