pre-market news: U.S. stocks fell sharply, A shares policy favorable policies frequently appeared! It is not impossible to challenge the annual line, but be aware of the risks!

The trend of A-shares yesterday was quite good. Not only did the Shanghai Composite Index hit a new rebound high, it returned to 3,400 points after three months, and it was only one step away from the annual line! Moreover, stocks performed brilliantly. Not only did they rise more and fall less, there were more than 100 stocks that reached their daily limit and 0 dropped their limit . The market atmosphere was quite good.

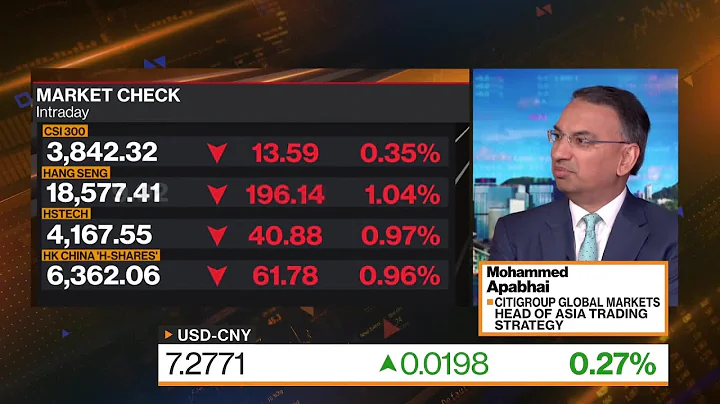

However, bad news came from the U.S. stocks that closed in the early morning. Affected by the downturn in economic data and rising expectations of interest rate hikes, the Nasdaq index representing technology stocks fell nearly 3%, and the three major indexes fell across the board. The decline has changed the good situation of continuous rebound in recent days. It is expected that a new round of adjustment in US stocks will begin again.

So can the Shanghai Stock Exchange challenge the annual line today? Will U.S. stocks have a negative impact on the continued rebound of A shares? Let’s review some of the big news before the market opens!

news 1, ETF was included in the Internet and officially launched on July 4th

Shanghai Stock Exchange , Shenzhen Stock Exchange and Hong Kong Stock Exchange simultaneously released the first batch of underlying ETF lists, including Shanghai Stock Connect ETFs, a total of 53, and Shenzhen Stock Connect ETFs, a total of 30 , there are 4 Hong Kong Stock Connect ETFs. Among them, the Shanghai-Hong Kong Stock Connect ETF covers core broad-based products such as SSE 50ETF, Shanghai 180ETF, CSI 300ETF, as well as biomedicine , semiconductors, new energy and other representative industry theme products. Shenzhen-Hong Kong Stock Connect ETF covers core broad-based products such as GEM ETF and CSI 300 ETF, as well as representative industry theme products such as biotechnology ETF, chip ETF, carbon neutral ETF and other products.

Interpretation: It is expected that these ETF products will receive major attention from northbound funds! Angkor also suggested that friends can appropriately shift part of their attention from the sidelines to the sidelines. After all, the flexibility of ETFs is quite good.

News 2: Further optimization of epidemic prevention and control measures

The National Health Commission issued a notice on the issuance of the new coronavirus pneumonia prevention and control plan (ninth edition): the isolation and control time of close contacts and entry personnel will be changed from "14 days of centralized quarantine" "Medical observation + 7 days of home health monitoring" was adjusted to "7 days of centralized isolation medical observation + 3 days of home health monitoring".

Interpretation: As the domestic epidemic situation improves and various prevention and control measures are effectively implemented, the optimization of prevention and control measures has also been further improved. This has also brought new opportunities to the reversal sector after the epidemic situation improved. The airport, aviation, tourism and other sectors performed well and can continue to be paid attention to.

News 3: Continue to implement various policies and promote economic operations to return to the normal track as soon as possible

Fully implement new development concepts , efficiently coordinate epidemic prevention and control and economic and social development, promote accelerated economic recovery and development, protect market entities, and stabilize the basics of employment market, and effectively protect people’s livelihood.

Interpretation: Recently, various measures to stabilize growth have emerged one after another, but after these policies and measures are introduced, it is more important to implement them, so as to promote the rapid recovery of the economy! It is expected that various data in the next second quarter will provide feedback on the effectiveness of these measures. We can pay close attention to some recent economic data, and more directly, the semi-annual reports of listed companies.

News 4: The liquidity easing continues, and the central bank will send another 100 billion

The central bank announced on June 28 that in order to maintain stable liquidity at the end of the first half of the year, it launched a 110 billion yuan reverse repurchase operation through interest rate bidding, and the winning interest rate is 2.1%. Since 10 billion yuan of reverse repurchase expired on that day, a net investment of 100 billion yuan was realized in the open market.

Interpretation: Only by easing credit can we stabilize growth. The current continued loosening of liquidity will last until the second half of the year. The main tone will not change. There is not much room for interest rates to fall, but liquidity will continue to be injected into the market through various methods to support The development of small and micro enterprises and the real economy.

News 5: Cultivate and expand the bioeconomy pillar industries

A few days ago, the "14th Five-Year Plan for Bioeconomy Development Plan" was officially issued.As my country's first five-year bioeconomy plan, the "Plan" proposes to accelerate the development of biotechnology and bioindustry, making the bioeconomy a strong driving force for high-quality development of , and clearly needs to cultivate and expand medical and health, biological agriculture, , bioenergy, and Pillar industries such as bio-environmental protection and bio-informatics.

Interpretation: Biotechnology is Angkor's old profession, and he has always believed that biotechnology will change human beings themselves. Biotechnology is closely related to agriculture, environmental protection, medicine, etc. There is great potential for developing bio-economy.

News 6: New energy investment is strong and green development momentum is surging.

The first batch of projects in the large-scale wind power photovoltaic base is under construction, and the second batch of projects has been accelerated.

Since the beginning of this year, under the overall situation of promoting "double carbon" work, striving to stabilize growth and ensuring energy security, my country's investment in renewable energy, especially new energy, has been strong, and green development momentum is surging. During the "14th Five-Year Plan" period, my country's renewable energy has entered a new stage of high-quality development, opening up huge incremental space. Industry insiders predict that the scale of investment related to renewable energy systems will reach trillions from 2021 to 2030.

Interpretation: Although the recent decline of new energy sector from the beginning of the year has been huge to the recent rebound, many sectors and related funds have recovered the decline at the beginning of the year, but this does not mean that the development of new energy has come to an end.

Although the growth rate has been huge, the development of new energy has not only proved to be a promising track in the past few years, but will continue to prove it in the coming years and even decades.

Therefore, there are risks in the short term and adjustments are possible, but if adjustments come, it may be another good opportunity to build a position.

News 7, Penghua Fund Yan Siqian: The new energy field has broad prospects, and the current development is still in the first stage.

Yan Siqian pointed out that there may still be games in the upstream opportunities. After all, it involves judgments on prices, which are currently volatile. On the one hand, there is still room for growth. Take the price of lithium as an example. In the first quarter of this year, it rose from 200,000 to 500,000. It is difficult to double it now, but it will still be relatively scarce, so there are still opportunities in the upstream;

in the downstream Intelligent development is very fast. Last year, many new technologies were launched, including Huawei's unmanned intelligent driving, domestic lidar, integrated die-casting, Tesla's new technology, etc., and they all progressed very quickly.

Midstream is still a long-term allocation. If the prices of upstream raw materials fall in the next year or so, midstream such as batteries will achieve both volume and profit growth. Therefore, the investment cycle of in midstream will be longer than that in upstream.

Interpretation: Similar to Cui Chenlong’s point of view, Yan Siqian also believes that the development of new energy has just begun. Angkor also strongly agrees with the above point of view, but Angkor would also like to remind everyone that although the new energy track is promising in the long term, there are also great fluctuations in the development process. Everyone must be mentally prepared for this. The strategy of bottom position + fixed investment is It is relatively safe, of course, it is necessary to stop profits in a timely manner!

News 8: European and American stock markets have diverged trends. The three major U.S. stock indexes have fallen sharply, while European stocks have risen!

The S&P 500 index closed down 78.56 points, or 2.01%, to 3821.55 points. The Dow closed down 491.27 points, or 1.56%, to 30946.99 points. The Nasdaq closed down 343.01 points, or 2.98%, to 11181.54 points.

Britain's FTSE rose 0.90%, Germany's DAX rose 0.35%, and France's CAC rose 0.64%.

Interpretation: After the U.S. stock market rebounded last week, it was once again troubled by declining economic data and concerns about rising interest rates. There are obvious signs of economic recession, and adjustments are expected to continue in the future.This is not good news for A-shares, but it is not a big problem. After all, most of the current effects on A-shares are only the high opening or low opening of and . A-shares will still move at their own pace!

A-share outlook

Angkor has several opinions for your reference:

1, short-term adjustment may occur

The Shanghai Stock Exchange stood at 3400 yesterday. After completely winning the half-year line in the past few days, it is approaching the annual line again. The current annual line is around 3438 , today is expected to challenge, but the line is not so easy to win. It is expected that there will be obvious shocks, even big shocks, before the annual line.

2, the midline continues to be optimistic.

is different from the pessimistic economic data in the United States. With wide credit and stable growth, China's economic environment is gradually improving, which can support the midline of A-shares to continue to rise. If it can stand firm on the annual line, then the market will also A complete return to the bull market is good news for investors, and it is also a good time to implement a comprehensive registration system.

3. Pay attention to the rhythm of sector rotation.

Since the 2863 point of the Shanghai Stock Exchange, the Shanghai Stock Exchange has rebounded by more than 500 points. Some sectors have increased by more than 60%, or even 100%. These sectors need to be careful about possible adjustment risks. This sector Including complete vehicles, new energy vehicles, photovoltaics, etc.

There are also some sectors that have not increased much, and there is a certain amount of room for supplementary growth. These sectors include semiconductors, medicine, breeding, real estate, infrastructure, etc., which can be paid attention to.

We can also switch between high and low!

4. The rebound has been strong, and adjustments may come at any time.

The Shanghai Stock Exchange had two gaps last Friday and this Monday. According to the practice of the Shanghai Stock Exchange, it will always be filled up. It just depends on how long or short the time is. To sum up, Look, although 3385 has stood, it is not yet stable. Coupled with the suppression of the annual line above, the market may have a significant correction in the near future. At this time, we still need to be risk-aware, and it is necessary to properly control the position !

and above for reference!

#stock market analysis#