Source: [Handan Daily - Handan News Network]

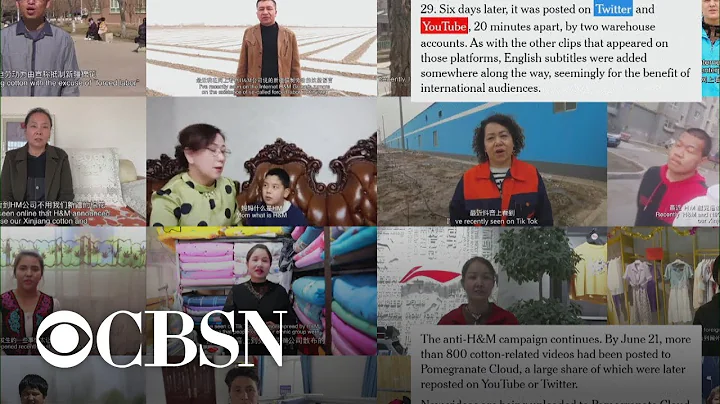

Recently, the Central Propaganda Department and the Ministry of Public Security jointly launched the "National Anti-Fraud in Action" centralized publicity month activity, aiming to strengthen publicity and education, mobilize the power of the masses, and create a nationwide anti-fraud and nationwide anti-fraud campaign. There is a strong anti-fraud atmosphere in society. To this end, Handan Evening News has jointly launched the "National Anti-Fraud in Action" series of reports with the Handan City Anti-Fraud Center to use the case as a lesson to popularize anti-fraud knowledge, enhance anti-fraud awareness, improve the ability to recognize fraud, and remind citizens and friends to protect themselves "money bag".

![Source: [Handan Daily - Handan News Network] Recently, the Central Propaganda Department and the Ministry of Public Security jointly launched the](https://cdn-dd.lujuba.top/img/loading.gif)

Reporter experienced “fraud”

Coincidentally, the day before this article was written, the reporter also experienced the classic routine of telecommunications network fraud.

html On the morning of May 15, the reporter was invited by someone unknown to enter a newly created corporate WeChat group called "Cao Sha Network Technology". In just five minutes, the group showed that there were hundreds of people. The administrator of thegroup later posted a message: "This group is a user task group invited by [Zhejiang Mira Media Co., Ltd.] to increase clicks for merchants. Just light up the little red heart when viewing videos... Calculated based on the task volume Remuneration." And it has repeatedly emphasized that it is legal and compliant and does not charge any fees.

Immediately afterwards, people in the group continued to send their payment codes to the group, along with screenshots of likes for merchant videos on various platforms. The administrator replied one by one that the transfer was completed, and these people also sent their payment records ranging from 5 yuan and 10 yuan to the group.

reporters who have been in contact with many people who have experienced fraud have noticed that the way in which the WeChat group publishes tasks is very similar to the deception experience described by the victims of the rebate scam: using small profits and small favors as bait, and then gradually attracting the victims. trap. In order to prevent anyone from being deceived, the reporter quickly posted two collected posts titled "False orders and likes hide traps, you can't be cheated until you read them" and "False order fraud, you have to tell me several times" to the group. Immediately, the reporter was removed from the group chat by the administrator. After being unable to collect more information, the reporter used the saved screenshots of the group chat to complain to WeChat about the administrator and the corporate account.

experienced this personally, and the reporter couldn't help but sigh, it turns out that fraud is all around you and me. From now on, the Handan Evening News will launch a series of reports on "National Anti-Fraud in Action" to help you understand the classic routines of the five most common cases of telecom network fraud, so that you can know how to be deceived and not be deceived, and keep your "money bag" tight.

Order brushing rebates

![Source: [Handan Daily - Handan News Network] Recently, the Central Propaganda Department and the Ministry of Public Security jointly launched the](https://cdn-dd.lujuba.top/img/loading.gif)

Reporters learned from the Municipal Anti-Fraud Center that order brushing rebates, fake investment and financial management, fake online loans, impersonating customer service, and impersonating public prosecutors are the five most common cases of telecom network fraud, and online order fraud cases accounted for 10% of the city's total in April Fraud cases accounted for 50.33% of the total, showing a high incidence rate. The fraudster first lures the victim to complete the task with a certain amount of small reward, and then requires the victim to pay a high fee in advance to continue the task or to "cash out" the proceeds.

scammers first publish advertisements in QQ groups, WeChat, Weibo, etc., luring victims into the bait under the banner of "high salary" and "easy"; then they post screenshots of other people's fraudulent orders and payments to deceive the victims' trust; then, The scammer will first give you a "sweetener" and you will get benefits by completing the designated tasks; finally, after the victim pays thousands of yuan, he will use excuses such as "the task is not completed" and "system failure" to induce the victim to top up and continue to cheat. Rebates for likes, temptations with small red envelopes, free items, deception on false prostitution platforms, and credit card repayments are all typical forms of rebate fraud.

Du Peng, a police officer at the Municipal Anti-Fraud Center, told reporters that many victims were actually skeptical about "false orders" at first, but after they tried to "test the waters" with a small investment, they found that they could actually make a profit, and gradually began to Increase investment. Some victims expect to recover the high principal they paid before, or hope that their previous "work" efforts will be rewarded, but they get deeper and deeper into the trap. Scammers take advantage of this mentality of victims and guide them to invest continuously and be deceived again and again.

Pretending to be a public prosecutor

Pretending to be a public prosecutor and other fraud cases usually take advantage of the victim's eagerness to clear himself of suspicion to defraud, deeply brainwashing the victim, causing them to suffer huge losses.

Fraudsters obtained the victim's name, ID number, contact number and even bank card number through illegal channels in advance, pretended to be public security personnel, and fabricated "fraudulent insurance fraud" by forging false arrest warrants and property freezing documents issued by the public security tribunal and judicial network. "Illegal entry", "illegal overseas consumption", "money laundering" and other various crimes, and threaten the victim with a harsh "interrogation" attitude; then, the victim will be asked to keep secrets from others and find a place isolated from the outside world. , to prevent others from seeing through the scam. Victims who are eager to "prove their innocence" may not have time to react before they have already followed the fraudster's instructions and transferred the money to the designated "safety account".

Du Peng told reporters that there are no so-called "safe accounts" in the public security, procuratorate, and other departments. Anyone who requests a bank transfer or remittance of their deposits through phone calls or text messages, or who claims to review the funds, should not be believed. In addition, the public security organs, as law enforcement agencies, will never use telephone methods to investigate and deal with so-called suspected crimes, and other departments such as the public security organs and law enforcement agencies will not transfer calls to each other. "For such fraud cases, the public should 'don't listen, don't believe, and don't transfer money' to prevent being deceived."

pretending to be customer service

![Source: [Handan Daily - Handan News Network] Recently, the Central Propaganda Department and the Ministry of Public Security jointly launched the](https://cdn-dd.lujuba.top/img/loading.gif)

"Taobao customer service" and "express claim settlement", these may all be frauds posing as customer service. In such cases, fraudsters will illegally steal the purchaser's online shopping information and express delivery order information in advance to carry out precise fraud on consumers or platform merchants.

reporters learned from the Municipal Anti-Fraud Center that fraudsters will pretend to be the customer service staff of Taobao, Tmall and other e-commerce platforms or logistics express customer service, falsely claiming that there is a problem with the goods purchased by the victim. On the grounds of refund, claim settlement, etc., the victim is induced to privately add "claim settlement customer service" WeChat or QQ, or fill in bank card number, mobile phone number, verification code and other information on the fake refund and claim settlement webpage, thereby changing the information in the bank card. Money transferred. In addition, there are also cases where victims are induced to pay handling fees to commit fraud on the grounds that they have mistakenly upgraded the victim to a VIP member and will incur additional deductions if they do not cancel the above-mentioned services.

Du Peng reminds citizens who often shop online, "When receiving a suspected after-sales call, you must verify the identity of the other party and confirm whether there is a return or refund through the customer service of the official platform."

False investment and financial management

There are many such cases Using methods such as "online dating", "part-time recruitment" and "recommendation from investment mentors" to lure victims to fake investment and financial management website APPs to commit fraud. Most of the people who are defrauded are single men and women with certain income and assets, or people who are keen on investment, financial management and stock trading.

First of all, fraudsters look for people who are easily deceived by publishing investment and financial management information on dating platforms, web pages, and apps. After defrauding the victim's trust, the fraudster will pretend to be an investment mentor or financial management consultant, or falsely claim to have special resources that can obtain high financial returns, lure the victim to join an investment group chat, and listen to live classes by investment experts to further further Inducing victims to invest on the fake investment website or APP provided by them. A small initial investment to test the waters can result in rebates, but when the victim increases his investment, he discovers that he cannot withdraw cash, or even loses all of his money, and is blocked by the fraudsters, and the fake website or APP can no longer be logged in.

The police remind you to be cautious in investment and financial management, and formal platforms are more reliable.

Fake online loans

Online loans, because of their convenience and speed, meet the urgent needs of some people for money. However, when some people applied for online loans, they found that they had not received the loan and their savings were gone.

In such cases, fraudsters use phone calls, text messages, etc. to publish advertising information for loans, credit card limit increases, etc., looking for victims who are in urgent need of funds, and then offer "no collateral", "no credit requirements", "no interest and low interest" to quickly lend money "Free cash withdrawals" and other offers are used as bait to trick victims into downloading fake financial apps to apply for loans. The victim was then asked to transfer money to the designated account on the grounds of collecting handling fees, deposits, capital verification, paying taxes, etc. After the victim transferred the money, the fraudster continued to ask the victim to transfer money on the grounds that he did not meet the loan conditions and could not lend, until the victim discovered that he had been deceived.

What's worse, fraudsters obtained the victim's bank account and password information through the above methods, and directly transferred money for consumption to achieve fraud. The Municipal Anti-Fraud Center reminds that any online loan platform that claims no mortgage, no qualification requirements, low interest rates and fast lending is extremely risky.

The above-mentioned five types of high-frequency telecommunications network frauds have various forms and "skillful" methods, which makes people have to guard against them. To prevent telecom network fraud, "five major anti-fraud tools" are indispensable: National Anti-Fraud Center APP, 96110 Early Warning and Dissuasion Hotline, 12381 Fraud-related Early Warning and Dissuade SMS System, National Mobile Phone Card "One Card Check" Service, and Cloud QuickPass APP" "One-click card check" to build an all-round anti-fraud "firewall" for the public. In addition, if our city’s citizens want to consult relevant anti-fraud information or may be experiencing fraud, they can also call the city’s anti-fraud center at 0310-4067110 or 3110110.

hereby reminds the general public to learn more anti-fraud knowledge, understand fraud routines, and enhance their awareness of fraud prevention. The whole nation is fighting against fraud, you and I are together.

Handan Baorong Media Intern Reporter Rong Zhiqing Text/Shadow

This article comes from [Handan Daily-Handan News Network] and represents only the author's opinion. The National Party Media Information Public Platform provides information release and dissemination services.

ID:jrtt