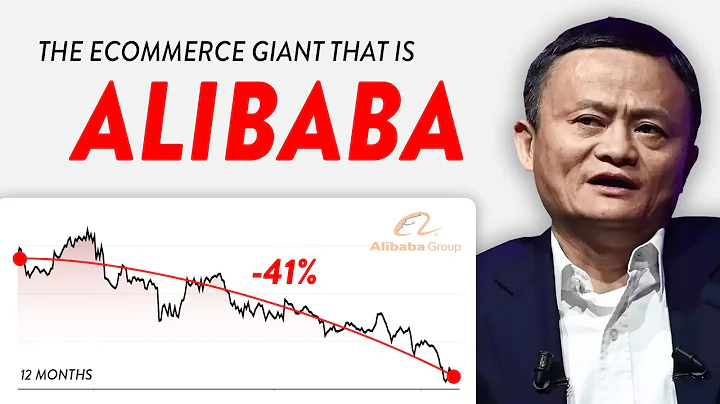

has some discussions on Alibaba’s e-commerce business. In the next few years, the e-commerce business will be surrounded by wolves. What chance does Alibaba have of winning?

Before the National Day, the biggest events in the Internet industry were of course Alibaba 's Investor Day and Yunqi Conference. Thousands of investors flew in from all over the world, and many friends and businessmen also participated. There is already a lot of publicly disclosed data in this regard and there is no need to go into details.

In the past period of time, we talked about facts and gossip about the WeChat ecosystem, Kuaishou, and Toutiao, including Taobao.

However, we have not yet conducted a comparative and systematic discussion on Alibaba’s e-commerce, especially the “Taobao” retail e-commerce. Today I will make up for this shortcoming - about Taobao, Tmall , Juhuasuan, Taobao Live, etc., I will tell you everything that the Phantom Thieves know.

1. Taoxi e-commerce’s trump card: free traffic, activity rhythm, and contract fulfillment capabilities

Strictly speaking, “Taoxi” has never monopolized the domestic retail e-commerce market, and has not even touched the edge of monopoly.

first had eBay , then Dangdang, Jingdong , and now there is Pinduoduo . There are many people who want to be e-commerce platforms. WeChat mini programs are doing it, Kuaishou is doing it, and Douyin is also doing it.

So, how did Taobao (Taobao/Tmall) occupy and maintain the leading position in retail e-commerce, and even widened the gap?

There are two ways to answer the above questions, as well as any similar questions: The first is a fake and hooligan answer, which often attributes it to "corporate genes" and "values", talks about "endgame" and "flywheel", and even mentions "Big data" and "technology in the middle" sound very talented, but upon closer inspection, they are useless; the second type is a down-to-earth answer. Find reasons from the front line, data, and cases, and don't rush to summarize. Any theory that is universally applicable comes from practice and goes to practice.

The Phantom Thieves are most annoyed by the "endgame theory" and "gene theory". They hate looking at PPTs the most. They love drinking tea and chatting with front-line employees and suppliers the most.

Let’s talk about the Phantom Thieves’ views.

1. Taobao e-commerce has a fair distribution of free traffic, and the volume is not small and the efficiency is not low.

Taking mobile Taobao as an example, the "sort by sales" in the "search" function is fairly distributed; the homepage information flow is also It will be distributed fairly based on your following stores, historical purchases and search records.

Alibaba is the largest advertising platform in China, but it has more integrity, which is very useful to merchants.

Whether you are a small shop owner on Taobao or a big brand on Tmall, you are convinced that if you run a Taobao online store well and your sales, reputation, and number of followers increase, you will be able to get free traffic. If

is smart enough and familiar with the platform algorithm, he can still get the advantage of the platform - of course, this opportunity is becoming less and less.

2. The Taobao platform is very proficient in organizing activities and promotions.

Needless to say, Double Eleven, Double Twelve, and 618. Each important category has its own shopping festival, and each user category has targeted activities. , not to mention that Taobao’s e-commerce agency operating company is also very strong.

As a brand owner, if you carry out activities on Taobao/Tmall, you can theoretically just follow the platform's promotion rhythm without any thought. Strictly speaking, we have only scratched the surface of and Pinduoduo so far, while WeChat is a completely decentralized operation.

Therefore, for those who have no experience in e-commerce operations, relying entirely on WeChat mini-program online stores is a recipe for self-destruction.

3. No matter what you sell, you need the ability to perform contracts.

The so-called contract fulfillment refers to logistics in a narrow sense. In a broad sense, it includes supply chain, logistics, data analysis, customer service and even customized orders. This is the real "closed loop".

Historically, , JD.com, and have boasted the most about their contract fulfillment capabilities as a self-operated platform; since 2016, Alibaba has continued to do more, strengthening its logistics, data, and O2O service capabilities, and desperately penetrating into the upstream supply chain, building a Block extremely thick barriers.

Jingdong 's logistics capabilities may be stronger than Taobao's, but that's not necessarily the case with other aspects; what's more, the shelves of Jingdong and Pinduoduo are far less complete than Taobao's.

Buyers know that Taobao has strong contract performance capabilities, and sellers also know that. Of course, everyone is willing to put the transaction process on Taobao/Tmall.

2. "The aging of e-commerce" is almost as important as the "sinking of e-commerce"

In recent years, not only and Pinduoduo have suddenly emerged, but the annual/monthly active users of Taobao, Jingdong, have also surged, and WeChat small The number of e-commerce users of the program is also rising (although there is no accurate data).

What's going on?

The general conclusion of investors and media is that e-commerce will sink, develop “business outside the Fifth Ring Road”, and even have to sink all the way to villages and towns.

However, from another perspective, "the aging of e-commerce" may be the true meaning.

Think about it, was it Ojisang or Obasan who forwarded you the Pinduoduo link first? Have many of your uncles and grandfathers started learning to use Taobao recently?

"Aging" is probably the main reason, but most of the elderly live outside the fifth ring road and in low-tier cities, which is reflected in the "sinking of e-commerce."

Take Taobao as an example. In 2013, there were only 1.7 million annual active users over the age of 50, creating 7 billion GMV. In 2017, the number of users over the age of 50 expanded to 30 million, and the GMV soared to 150 billion. By 2019, it is estimated that the above two figures will at least double.

Moreover, elderly users are particularly competitive. As early as 2017, the per capita consumption on Taobao reached 5,000 yuan, and the average per capita purchase was 44 items. They are very high-quality buyers (although I estimate that the return rate will be high).

"Internet for the elderly" is now the latest entrepreneurial trend. The earlier ones include Meipian, and the later ones include Little Rice Cake and Jelly Beans. They all started by operating WeChat group traffic for middle-aged and elderly people (similar to and Pinduoduo ).

To be honest, e-commerce for the elderly has just started: those who sell protein powder, those who sell Chinese medicinal materials, those who sell customized clothes, and those who sell liquor, all of them are making a lot of money. But so far, “IQ tax logic” still accounts for the majority.

The leader of the Phantom Thieves has only heard of income tax, value-added tax, and consumption tax before. Later, he heard that there is an IQ tax. This IQ tax is really murderous. One day in the future, elderly e-commerce companies will gradually get rid of the IQ tax logic and enter normal logic. At that time, many hot products will appear and bring a lot of GMV to the Taobao platform.

3. What is the traffic distribution logic of Taobao e-commerce?

We all know that for third-party sellers, especially brands, Taobao/Tmall is the most efficient platform and the most accurate platform to reach users. The ROI of purchasing traffic (advertising, through trains) is generally higher than Jingdong , higher than Tencent Guangdian Tong. How does

do this?

Ordinary people talk about big data and technology platforms. Come on, Alibaba’s technology center has only started construction in the past few years, and the concept of big data has been popularized since 2012. Could it be that before this, Taobao e-commerce companies relied on good luck?

The real reason is very simple:

- Taoxi has strong operational capabilities and a deep understanding of "commodity", which in English is know-how. When you are in doubt, ask the waiter. The waiter on Taobao is likely to know the user better than the user, the brand better than the brand, and the response speed is faster. You can't help but feel dissatisfied.

- Taobao has the most and most comprehensive SKUs, which provides sufficient conditions for "accurate push" - you open a small program online store with a total of dozens of SKUs, and you still push a few? Do you recommend that everyone buy a can of Coke?

- Alibaba is very strict against false and cheating traffic. It will react whenever abnormal traffic occurs to ensure the user experience of search and other functions.

In short, the Internet is a "people" business, and e-commerce platforms are even more "people" businesses. Don't always think about "big data" and "technical middle-end" to solve problems - now open all Taobao's data to me , I can’t subvert Taobao.

In recent years, Alibaba has emphasized that "thousands of people have thousands of faces", but this is just a beautiful vision.

Taobao has nearly 700 million buyers and at least 40 million sellers. There are infinite kinds of corresponding relationships on both sides, and it is impossible to be accurate on an "individual" basis.

In practice, Taobao has divided 700 million buyers into groups of tens of thousands and hundreds of thousands, and goods and stores have also been divided into groups of tens of thousands and hundreds of thousands, matching each other in vertical groups. This is also very technically difficult, but it is possible.

As a platform, Alibaba’s appeal is very simple, which is to maximize UV (single user value): UV = unit price * conversion rate. Through algorithms and know-how, users are stratified more accurately. We can approximately think that the unit price of each user group is basically stable.

Then, the biggest variable is the conversion rate, which is the probability of you achieving a real transaction after the Taoxi algorithm is exposed to you.

4. The sustainable development roadmap of Taobao e-commerce

In the past few quarters, the operating data of Alibaba’s core e-commerce (mainly Taobao) can be said to be explosive: GMV, revenue, profit, and number of users have all exceeded expectations. Originally, Taobao was already very large, but Big Stupid Elephant was still able to move forward at a speed higher than the industry average.

Everyone is not only concerned about "how this is done", but also more concerned about "whether and how this can be sustained."

The Phantom Thieves' point of view is very simple, that is, in the next four quarters, Taobao e-commerce can still do whatever it wants - how high the growth rate and profit margin can be depends mainly on whether it wants to do it.

As for the longer-term future, everyone is just trying to figure it out, so there is no need to predict it now.

It is undeniable that the traffic dividends of "e-commerce sinking" and "aging" have been eaten up by more than half. In the future, the main logic is to increase the unit price and repurchase rate.

Taoxi, Jingdong , Pinduoduo , it is likely that they have all touched or are close to touching the ceiling of long-term traffic. In the case of tight traffic, Taoxi's logic is to encourage the internal Matthew effect and grasp the large and let go of the small.

We all know that Taobao/Tmall has a 7-level store system. The higher the transaction volume, the higher the store level and the more traffic it receives. Since the beginning of this year, Taobao traffic has obviously tilted towards Tmall merchants with level 6 and above, especially big brands and KA merchants with level 7, making the strong always strong.

Now go and open a new Taobao store below level 5... just go to sleep.

Taoxi’s traffic support logic has always been to support brand flagship stores as much as possible. The recent detailed ranking of

is: store type Tmall store, Tmall flagship store , Tmall specialty store, Tmall specialty store, corporate Taobao store, personal Taobao store. The higher the front, the more traffic resources.

Of course, this is not absolute. The personal Taobao Crown store of Internet celebrities must still have a lot of traffic.

At the product level, Taobao is a "polarization" strategy:

- On the one hand, it supports low-priced hot products because it can drive traffic and create topics;

- On the one hand, it supports first- and second-tier brands because it can attract customers at unit prices and create publicity.

The most painful thing is those "middle-of-the-road products", which are high and low.

5. Taobao E-commerce’s “traffic grassland” strategy

Some people say that Alibaba is a “traffic black hole”, with traffic only entering but not exiting, and it is very cautious about uncontrollable third-party traffic (Baidu, WeChat, etc.).

This is true, but only part of the truth.

Alibaba is now talking about the "flow grassland" strategy: grasslands rather than forests, capillaries rather than aortas. In other words, Alibaba hopes to import traffic from many channels, but these channels must be "grassland" and cannot grow a big tree; they must be secondary sources and cannot become primary sources.

Using the wisdom of the ancients, it means that "the princes are built more but their strength is less".

Everyone knows that Baidu is a platform that Alibaba has no influence on, so Baidu is prohibited from directly searching for Taobao products; Alibaba is more afraid of the WeChat platform, but cannot give up completely. What to do with

?

obtains traffic through " Taobao ". The so-called Taobao guest is a CPS-priced Taobao off-site advertising promotion model.As long as you get the product code from the official Taobao area, send it out through your personal website, social media, WeChat group, etc., and if others click on it (or jump through the Taobao password), you can go directly to the Taobao store, and the money you earn is yours. of.

In 2016-17, at the most exaggerated time, there were millions of "Taobao customers" WeChat groups, all engaged in the business of raking in traffic. Later, they were beaten to pieces by WeChat's iron fist. Now, for the WeChat platform, Taobao customers mainly use personal public accounts and personal chats to bring goods.

Since 2018, the latest Taobao traffic “capillaries” are Kuaishou and Douyin. The former is simple and crude, punching a master to death; the latter is very stylish and reaches white-collar female users.

At present, Kuaishou and Douyin’s contribution to Taobao’s traffic and GMV is still relatively low (we estimate that it will only be 3-4% if they are exhausted), and they will not become the “main artery” even if they rush for another year or two.

However, both Kuaishou and Douyin are coveting the lucrative e-commerce platform business, and they also have small-scale self-owned e-commerce platforms. The problem is that the thickest barriers of Taobao e-commerce - huge SKU pool, strong fulfillment capabilities, understanding of products, data and algorithms, etc. - are difficult to copy or break in the short term.

That’s why I said that in the next four quarters, Taobao e-commerce companies can do whatever they want.

That’s about it for now. Next, let’s discuss some gossip about the headlines.

Related reading

Discussing the WeChat ecology again: mini programs, live broadcasts, WeChat payment data and gossip

Some latest data and facts about the WeChat ecology

Author: Pei Pei; Public account: Internet and Entertainment Phantom Thieves (ID: TMTphantom)

Source: https://mp.weixin.qq.com/s/cGpFT9mF5xodmU53yZbThg

This article is authorized by @ Internet and Entertainment Phantom Thieves to be published in Everyone is a product manager. Reprinting without permission is prohibited.

The title picture is from the genuine picture gallery Tuchong Creative Authorize