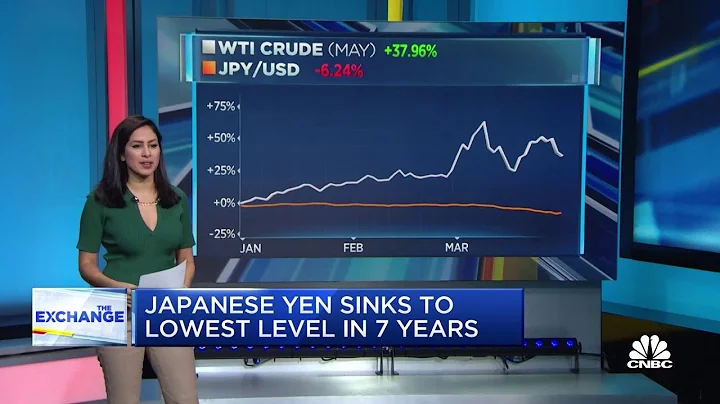

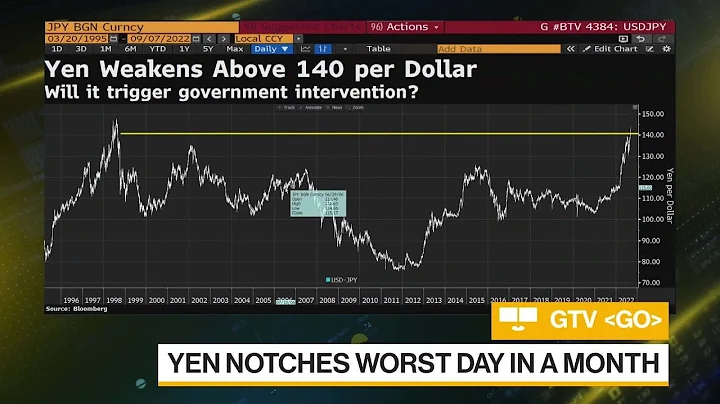

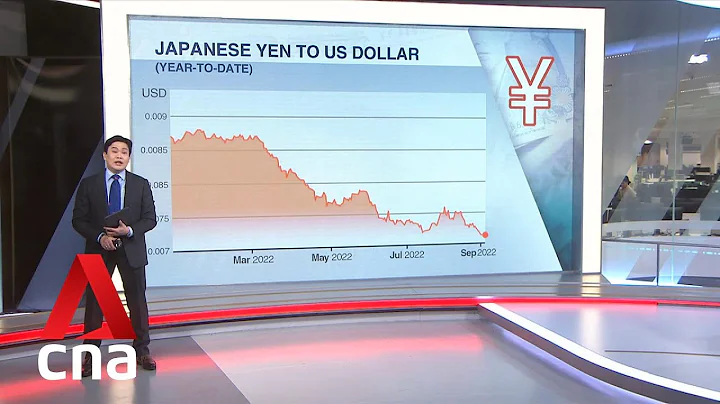

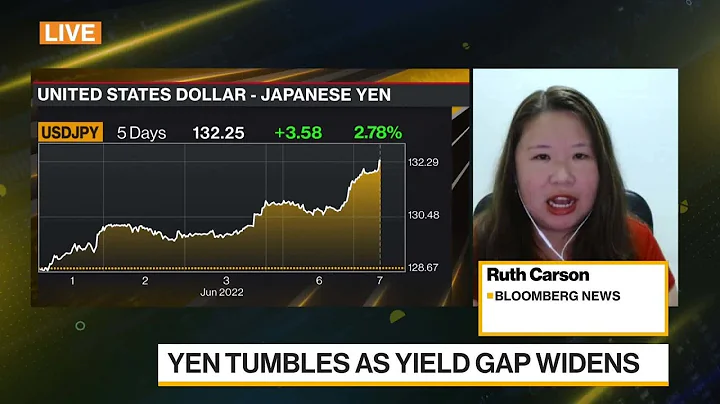

Since this year, the yen has been falling continuously. Not long ago, the yen exchange rate once fell to 135.22 yen for 1 U.S. dollar, setting a record low in the past two decades. According to the speculations of some experts and scholars, with the continuous depreciation of the yen, Japan's current GDP1 GDP2 is probably around three trillion US dollars.

As early as the beginning of this year, some Japanese scholars predicted that South Korea's GDP would catch up with Japan within five years. However, who would have thought that this day would come so quickly. In less than half a year, South Korea's GDP GDP per capita has already caught up with Japan, and this happened not because of the rapid growth of South Korea's economy, but because of the continuous regression of Japan's economy.

Many friends may think that the continuous depreciation of the yen is conducive to the export of Japanese goods and can stimulate the development of Japan's manufacturing industry. This is actually a good thing for Japan. After all, Japan is a big exporting country. The depreciation of the yen is beneficial to the export of Japanese goods and brings great convenience to Japan's economic development.

This sentence does not seem to have any problems, but if we look at Japan's export data in the past two years, it is not difficult to find that although the yen has depreciated sharply this year, Japan's exports have not How much to increase. On the contrary, Japan's import volume has increased sharply, and it costs more to import raw materials and goods.

The main reason for this situation is that Japan is not only a big exporting country, but also a big importing country due to the lack of resources due to its geographical location. The continuous depreciation of the Japanese yen has actually caused Japan's trade deficit. continues to grow.

In recent years, the competitiveness of Japanese products in overseas markets has continued to decline. For example, if it was more than ten or twenty years ago, if we wanted to buy home appliances, many people would have chosen Japanese products as their first choice. Why? Woolen cloth? Because in comparison, Japanese products are of better quality and more cost-effective.

However, if this problem is put to the present, I believe that the first choice of most people is to buy domestic products, because the quality of our products has been continuously improved over the years, and the product prices have also been continuously reduced, and the price/performance ratio is very high.

On the other hand, looking at Japanese products, with the shattering of the myth of Japanese manufacturing, people no longer believe that Japanese products are of better quality. In addition, the price of Japanese products is often much more expensive than domestic products, which results in the export of Japanese products. , competitiveness overseas continues to decline. Therefore, many industries in Japan are currently facing very embarrassing dilemmas.

We all know that Japan is not a resource-rich country, and many raw materials need to be imported from overseas. The continuous depreciation of the yen has put great pressure on Japan's manufacturing industry, and many companies have complained about this.

If the Bank of Japan continues to maintain loose monetary policy and allows the yen to continue to depreciate, I am afraid it will make Japan's economy worse. By then, Japan's economic recovery will be far away.