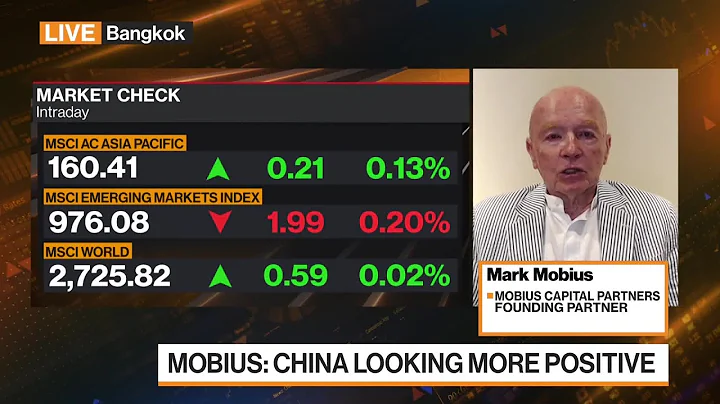

Under the Russia-Ukraine war, the global stock market was affected. Mark Mobius, known as the "Godfather of Emerging Market Investments," recently said in a TV interview that as geopolitical risks continue to rise, there will be huge opportunities to invest in the Chinese stock market. In the future, the Russian economy will increase trade cooperation with China, and Chinese stock markets, gold and other emerging market stocks will be relatively stable investments.

Mobius said that China’s stock market has performed poorly in the past year due to regulatory, real estate and other factors. However, as China has begun to grow steadily, I believe that the Chinese stock market will benefit significantly in the future. He believes that the weakness of the Chinese stock market will not last long and that the market has great opportunities.

Mobius also mentioned in the interview that although many people want to buy bottom Russian stocks recently, it is not advisable in the short term, at least not wise within a year. European and American countries continue to increase sanctions on Russia, and no bank is willing to become a custodian of Russian securities, which means investors may not be able to get their money back.

Mark Mobius

Picture source: Internet

was selected into the "Top Ten Top Fund Managers in the World "

In fact, Mark Mobius has always been optimistic about the Chinese stock market. He told the media in early January, China's stock market will rebound in 2022, and he prefers software, hardware, education and consumer stocks.

Information shows that Mobius once served as executive president of Franklin Templeton Fund Company, the world's largest listed fund company, and was in charge of more than US$50 billion in assets. Along with Buffett, Peter Lynch, and Soros, he is listed among the "Top Ten Global Fund Managers" selected by the "New York Times". One of the 50 most influential people in the world, he has been engaged in emerging market investment and research for more than 40 years and is known as the "Godfather of Emerging Market Investment."

Mobius was born in Hempstead, New York, in 1936, of German and Puerto Rican descent. After receiving his bachelor's and master's degrees in communication studies from Boston University, he received his PhD in economics from the Massachusetts Institute of Technology in 1964. He also studied at University of Wisconsin , University of New Mexico and Kyoto University in Japan.

After graduation, Mobius, who liked Japanese culture, decided to settle in Japan and work full-time at the Japan International Association to study consumer psychology and behavior of Western brands in Japan. In 1969, Mobius established its own consulting company in Hong Kong to provide Asian consumer survey services to Western companies. In 1973, he completed the book "Trading with China" and became an Asia guide in the eyes of Westerners.

In 1980, Mobius sold the consulting company and worked for Weidago International Securities Company, where he began to study the stock markets of Hong Kong, Southeast Asia and Taiwan. During this period, he wrote a large number of Asian securities analysis and investment reports. As a result, Mobius was spotted by Sir John Templeton, the father of global investment. In 1987, he joined the Templeton team and established the first listed emerging market fund. At the time, the company had only six markets to invest in, mainly in Asia and Mexico, and it has since grown rapidly. Later, in addition to the Hong Kong office, they also opened 14 offices around the world, covering Asia, Africa, Eastern Europe and Latin America, and the company's assets increased to US$60 billion.

In 2019, Mobius left Franklin Templeton Fund Group to form a new team dedicated to ESG plus C-category fund investments.

Visits an average of more than 20 countries and 1,200 companies every year

The investment legend of Mobius was built step by step with both feet. His investment scope reaches as many as 70 countries, and he visits more than 20 countries and 1,200 companies every year on average. Over the past 40 years, he has spent almost 200 days every year looking for investment opportunities around the world.

Mobius said that if you only read the report without conducting personal research, you will never find that a certain company has a major problem.

"Personal visits" account for a large part of Mobius' investment. In his view, whether it is a country, a city, a company, or a factory, without the ambition to continue to grow, there is no premise worthy of investment.

Every time he visits the company, Mobius will ask a question: "What will be the future of this company? What is your strategy for this company in the next five years?"

Mobius said that companies worth investing in come from for operators worthy of investment. A good operator is always very clear about his business strategy and has a specific and clear vision of the company's future appearance. If a company doesn't even know its goals and doesn't even dare to imagine what the future will look like, then they probably don't have the courage and enthusiasm to pursue growth, let alone a strategy.

Recently, Mobius said in an interview with "Red Weekly" that in 2021, he went to Egypt , Oman , and also went to Turkey and several other surrounding countries. The trip to Asia has never been possible because most Asian countries have closed their doors due to the COVID-19 epidemic.

He said that he has been traveling non-stop for many years. If there was no impact caused by the new crown epidemic, he would continue to live and visit many countries. He is eager to return to Asia, to Indonesia, Singapore, Malaysia, Thailand, Vietnam, and of course, China, Philippines, Taiwan, and South Korea. All countries are important to him. important.

Mobius also said that last year, among more than 2,000 emerging market funds around the world, their company's fund performance was excellent, which was mainly due to their investments in Taiwan, China and India.

Observe the infrastructure construction of each country

Regarding the investment judgment of a country, Mobius opened up his investment sense from the moment he stepped into the country.

Mobius said that the government’s ambition can be seen from the infrastructure construction, and the attitude of every member of the country towards the future can be seen from the quality and mentality of the people. Therefore, observe carefully anytime and anywhere.

Mobius also said, for example, that when he walks into the airport, in addition to the airport's equipment, he will pay special attention to the situation of the customs, whether the customs personnel have frequent quarrels with foreigners, and whether the customs' English is good enough. , are the focus of his observation. To a certain extent, it reflects the country's openness to the outside world, whether it can accept new things, and whether it is friendly to investment funds from overseas. After walking out of the airport, he will start to feel whether the asphalt road is smooth, whether the design of the highway is complete and smooth, and whether the traffic conditions are good.

Regarding the investment opportunities brought by infrastructure construction, Mobius believes that "privatization" is one of the key points. The privatization of national enterprises is the key to the government's decision to grow. For example, the stock he has held the longest is Telecom Mexico, which he invested in before privatization in 1990 and has been held for more than 30 years.

"Overturn" experience

Traveling across five continents and three oceans, Mobius measured the world with his footsteps and created his own investment legend. Of course, there are times when legends "overturn". During his personal visits, Mobius also had the experience of being deceived.

Around 1995, Mobius invested in Asia Pulp and Paper Company. During the interview, the company constantly emphasized that it had a sustainable business philosophy. However, the company later broke out in financial problems, borrowing heavily in the name of the company and investing in other families. In career.

Because Mobius discovered it too late, even if Mobius immediately liquidated its holdings, the stock price had plummeted, resulting in a certain degree of fund losses.

had another "turnover" experience when he invested in a family business of , in Brazil. After several personal visits, he confidently believed that all the company's finances were transparent and the business was running well. But later it was discovered that the general shareholders did not share in the company's surplus at all, and all the profits were eventually carried by the five ghosts and fell into the pockets of the family shareholders.

Mobius said that this investment had a great psychological impact. Fortunately, they had learned to diversify their investments at that time, and the losses were still within control.

After being deceived several times, Mobius decided not to trust anyone easily and to revise his judgment criteria based on experience. Later, during his personal visit, he focused on observing the expressions of the company's employees and whether they could maintain a happy and satisfied mood despite being busy. In addition, the equipment and layout of the general manager's office can show the operator's ability to control the environment.

Investment Rules

The above is Mobius’ personal experience and investment anecdotes. Let’s take a look at his investment rules and some suggestions.

Advice to China’s current generation of investors

In an interview with Red Weekly, Mobius also gave advice to China’s current generation of investors:

First, do your own research and conduct in-depth investigations into what you want to do. In the field of investment, don’t trust other people’s advice one-sidedly.

Second, keep a long-term view. Don't think about investing in a company for just one week, one month, or just one year. Look at at least the next five years.

Third, be patient and don’t think about getting rich overnight, otherwise you may end up speculating, and speculation often means failure.

In Mobius's view, there are many types of Chinese investors, some are just gambling and speculating, while others are thoughtful about the market and have done a lot of research. Overall, he believes that Chinese investors are getting more and more detailed information and are able to make more accurate investment decisions. Chinese investors have gradually learned that investing requires a long-term perspective and should not be limited to current speculation. Of course, this kind of short-term speculation occurs not only in China, but also in economic markets around the world. In the end, you will find that speculators are short-sighted, while good investors focus on the long term.

15 investment rules

Rule 1: When everyone wants to enter the market, it is the time to exit; when everyone is eager to exit, it is the time to enter the market.

Rule 2: Your best protection is diversification.

Rule 3: If you want to participate in the profitable growth of the fastest growing economies in the world, you must invest in emerging countries.

Rule 4: The quality of the management team is the highest standard for stock selection and investment.

Rule 5: Use FELT to choose stocks or stock market investments.

Rule 6: The so-called "crisis" is the reason why people start to wake up.

Rule 7: Falling markets will eventually recover. If you are patient, there is no need to panic.

Rule 8: Sometimes you have to perform worse than the market to beat the market in the future.

Rule 9: Use the net asset value (NAV) to determine whether it is worth investing.

Rule 10: First understand a country’s stock exchange, otherwise do not invest blindly.

Rule 11: The overall picture of a country is often at odds with the future growth of individual companies.

Rule 12: When choosing investment targets, investment methods such as technical analysis alone will often misjudge the situation and must be supplemented by actual field investigations.

Rule 13: If the world's stock markets experience a sharp decline due to short-term factors in a country, the investment recommendation should be immediately changed from holding to buying.

Rule 14: Political uncertainty is a common sign of entering a market. Uncertainty will depress stock prices, but if you believe your basic analysis, uncertainty will cause you to buy large blue chip stocks that may have been overpriced. good opportunity.

Rule 15: Once uncertainty becomes certainty and anyone can predict the consequences of an event, the previous risk premium will disappear immediately like smoke.

Qihe Research Center comprehensively compiled from the Internet