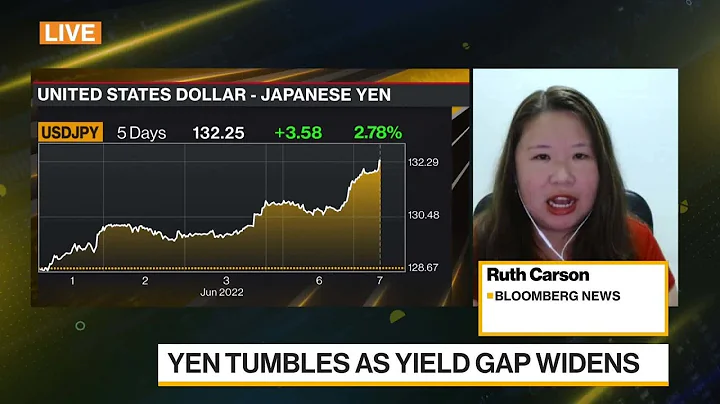

The Japanese yen continues to depreciate against the US dollar and has just hit a 20-year low, once falling to 133 yen per US dollar. At the same time, in the face of public concerns, the Bank of Japan still adheres to its "super dovish" policy.

Since the beginning of this year, the Japanese yen exchange rate has been in free fall. On June 8, local time, Bloomberg’s indicator measuring the yen relative to G10 currencies fell to a seven-year low.

Rising prices have caused public dissatisfaction

Affected by rising international commodity prices and the weakening of the yen, Japan's corporate price index has risen year-on-year for 14 consecutive months. Data released by the Bank of Japan showed that Japan's corporate price index rose 10.0% year-on-year to 113.5 in April, setting a record high.

Amid inflation, the purchasing power of the Japanese people is declining. On June 7, local time, a report released by the Japanese government showed that Japan’s inflation-adjusted wages fell for the first time in four months in April, further indicating that cost-push inflation is eroding consumers’ purchasing power.

Currently, Japanese companies and households are increasingly dissatisfied with the negative impact of the continued weakening of the yen. A survey by the Bank of Japan in April showed that about 82.1% of respondents believed that rising prices were "very troublesome" and only 2.9% believed that rising prices were beneficial.

Faced with the falling yen, Japanese Finance Minister Shun Suzuki said a day ago that the Japanese government is monitoring the foreign exchange situation with "a sense of urgency." Sudden, disorderly exchange rate movements can have a negative impact, and it is hoped that foreign exchange markets will reflect economic fundamentals.

Central bank governors take the lead in opposing easing

At present, the Bank of Japan is still the only central bank in developed countries that has not tightened monetary policy.

On June 7, local time, the Reserve Bank of Australia just announced a rate hike that exceeded expectations, and the European Central Bank may hold a "hawkish" meeting on Thursday. In such a tightening wave, the Bank of Japan, which still adheres to the "super dovish" stance, appears to be unique.

FXTM Chief Chinese Analyst Yang Ao said in an interview with a reporter from the International Finance News that although the Russia-Ukraine geopolitical crisis has not yet subsided, the main reason why the Japanese yen, as a traditional safe haven currency, continues to plummet is actually Japan. The central bank's loose monetary policy clearly deviates from the tightening direction of major central banks around the world. The market expects that this situation may be maintained for a long time, causing both Japanese bonds and yen assets to be sold sharply.

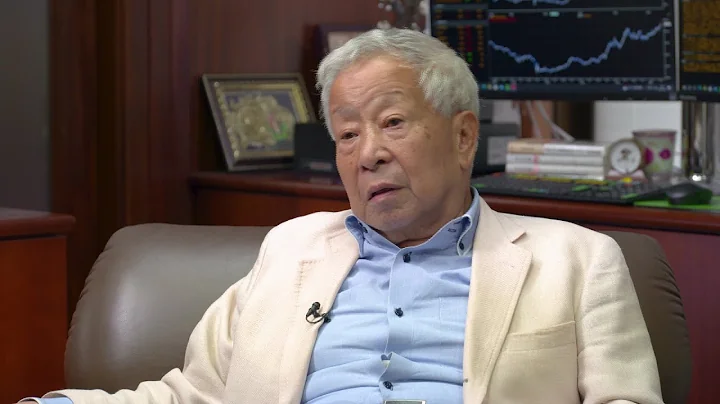

Bank of Japan Governor Haruhiko Kuroda is the main driver of the current loose monetary policy. On June 6, local time, he once again stated that he would maintain loose monetary policy. On the grounds that the Japanese economy was recovering from the impact of the new crown epidemic, he emphasized that "it is not at all an implementation of monetary policy." conditions of austerity”.

Haruhiko Kuroda said that in order to promote a sustained and stable rise in prices, the Bank of Japan will "unswervingly adhere to monetary easing."

He did not express nervousness about the depreciation of the yen. Instead, he pointed out that "if the yen does not change violently, but steadily depreciates, then it is more likely to have a positive effect on the entire economy."

According to Kyodo News, the April Consumer Price Index (excluding fresh food) announced by Japan’s Ministry of Internal Affairs and Communications on May 20 increased by 2.1% year-on-year.

This is the first time in more than seven years that the increase has exceeded 2%. On the surface, the central bank's goal has been achieved. However, Kuroda believes that the data of is not accompanied by sufficient salary increases and lacks sustainability.

"Kuroda Haruhiko's comments were a catalyst for accelerating the yen sell-off." Jun Kato, chief market analyst at Tokyo Shinkin Asset, said, "As the market actively digests expectations that the European Central Bank will raise interest rates, while the Australian dollar remains on an upward trend, its clear tightening The position left the Japanese yen excluded and became the only loser."

reporter Li Xizi

editor Wang Zhexi

editor-in-chief Sun Xiao

.