Bailihao Investment Encyclopedia: What impact does the US core PCE data have on gold prices?

The US core PCE data is considered a good indicator of potential inflation trends, and potential inflation trends usually affect what kind of monetary policy the Federal Reserve implements, so it is favored by investors. of close attention. So, what impact does the US core PCE data have on gold prices? Please see details below.

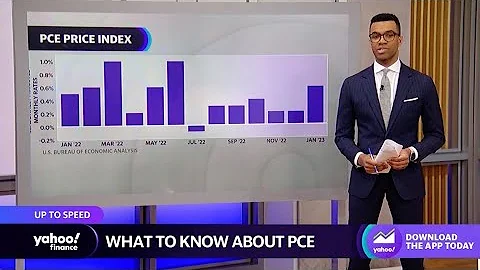

Generally speaking, if the PCE core data is higher than the previous value, it means that U.S. personal consumption expenditures are increasing, which will help drive U.S. economic growth and boost inflation. If the Fed's inflation target can be achieved, the Fed will be inclined to tighten monetary policy, which usually benefits the dollar and suppresses gold. On the contrary, if the core PCE data declines compared to the previous value, it will not be good for the US dollar and good for gold.

However, if the PCE core data remains unchanged, it means that there is no significant change in domestic personal consumption in the United States and will have little impact on gold prices. However, if the inflation target remains below 2% for a long time, the Federal Reserve will most likely implement relatively loose monetary policy for a period of time in order to increase inflation. At this time, although the data has not changed, the Fed's monetary policy will slightly lower the dollar, thus benefiting gold. On the other hand, if the core PCE remains above 2% for a long time, the Fed will continue to raise interest rates to control inflation, which will be beneficial to the US dollar and suppress gold.

In summary, when investors place orders, the relationship between PCE core data and gold prices can become a trading signal for investors to a certain extent. However, this is not the only basis for judgment. It is best for investors to make a single decision after analyzing all aspects of data.

Statement: This article is originally published by Bailihao Global! The above contents and opinions are for reference only and do not constitute any investment advice. Investors should operate at their own risk. For more precious metal crude oil market analysis content, please pay attention to Bailihao Global.