In everyone's impression, bank loan interest rates are generally relatively low. According to the current loan interest rate levels, bank's secured loan interest rates basically do not exceed 8%, and unsecured loan interest rates basically do not exceed 15%. .

Banks' lower loan interest rates provide low financing costs for the development of the real economy and the development of small and micro enterprises. This is one of the important driving forces for ensuring the normal development of the real economy.

However, in recent years, some small banks have been very keen to cooperate with some third-party online platforms to launch some consumer loans or retail loans . The comprehensive interest rates of these loans are not only much higher than the normal offline interest rates of banks, but even higher than those stipulated by the state. The red line for private loan sharking is even higher.

According to the Daily Economic News, a user applied for a loan through the Internet platform Xincheng Youpin. The lender was Longjiang Bank . There seemed to be nothing unusual during the loan process, but when repaying the loan, he discovered that, in addition to the interest, In addition, you also need to pay high service fees.

A loan user said that he borrowed 6,000 yuan for 9 months, and the interest rate agreed in the contract was 7.8%. There seems to be nothing unusual about this interest rate.

But in addition to the interest rate agreed in the contract, an additional service fee of 1,420.81 yuan must be repaid. This fee is also repaid in 9 months.

According to the repayment details, this customer needs to repay 1,150.63 yuan in the first installment plus service fees, and 808.52 yuan per month for the remaining 8 months. The total repayment required is 7,618.79 yuan, and the total interest and service fees paid are 1618.79 yuan, the nominal interest rate of is about 27%.

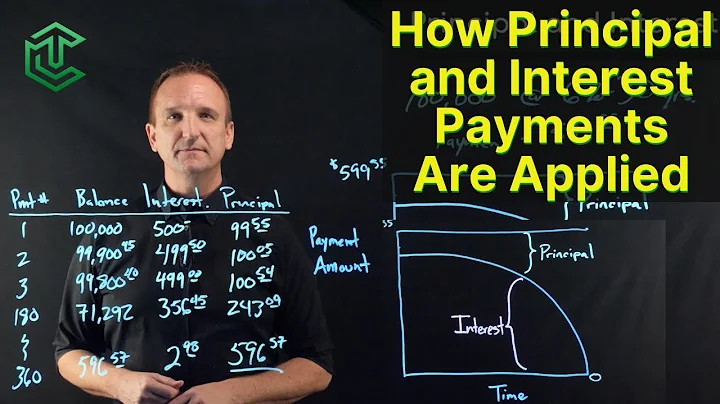

However, these repayments are based on monthly equal principal and interest payments. As time goes by, the principal becomes less and less, but the interest paid remains unchanged. If calculated according to the internal rate of return IRR, the actual monthly interest rate is as high as 5.28%, corresponding to an annualized interest rate of about 63.36%.

Faced with such high interest rates, when the media consulted Longjiang Bank, Longjiang Bank customer service surprisingly stated that the annual interest rate on the comprehensive repayment amount (i.e. service fee per period + principal and interest) was within 36%.

According to this customer service, it seems that within 36% is legal, but she may not know that according to relevant regulations of the Supreme Court, the red line for loan sharking in our country has already been changed.

In the past, the basis for judging usury was based on the two tiers and three districts. The amount within 24% is protected by the law; the part between 24% and 36% is free debt, and the court will neither support nor oppose it; if it exceeds 36%, it is not protected by the law.

However, since August 2020, my country’s loan sharking red line has been changed to 4 times the LPR in the same period.

According to the latest data released by the central bank , the current one-year LPR is 3.7%, and the 4 times LPR is 14.8%. This means that the latest loans issued, if the interest rate exceeds 14.8%, will not be protected by law and can Call it usury.

However, judging from customer feedback, the nominal interest rate of the loan that this customer borrowed from Longjiang Bank through the online platform reached 27%, and the actual interest rate may exceed 60%. No matter from which perspective, it has exceeded the Supreme Court’s The red line on loan sharking.

Regarding this kind of violation, the bank may think that the interest rate is only 7.8% when signing the loan contract, and the rest is the so-called service fee, in order to avoid the red line of usury. This approach is obviously deceiving the public.

Because during the actual trial of the case by the court, the so-called interest rate includes not only the interest rate agreed in the contract, but also various service fees, handling fees, etc.

So no matter from which perspective, the loans issued by Longjiang Bank in conjunction with other online platforms have actually exceeded the protection scope of the Supreme Court’s interest rates. From another perspective, the loans jointly issued by this bank and other platforms are actually usury.

This kind of high-interest lending behavior is not only illegal, but is actually not a good phenomenon for the bank's own operations.

First of all, the opacity of loan interest itself has violated relevant regulatory regulations.

According to Article 17 of Chapter 2 of the "Interim Measures for the Administration of Internet Loans of Commercial Banks" issued by the China Banking and Insurance Regulatory Commission , when commercial banks themselves or through cooperative institutions promote Internet loan products to target customers, they shall fully disclose the loans in a conspicuous position. Basic information such as the entity, loan conditions, actual annual interest rate, annualized comprehensive capital cost, principal and interest repayment arrangements, overdue collections, consultation and complaint channels, and liability for breach of contract are to protect the customer's right to know and make independent choices, and no default check boxes are allowed. , forced bundled sales and other methods deprive consumers of their right to express their wishes.

However, when some banks jointly issue loans with online platforms, the fees are not very transparent, and most of them are suspected of misleading customers.

Secondly, operating online loans across regions also constitutes a violation.

According to the relevant requirements of the "Notice on Further Regulating the Internet Loan Business of Commercial Banks " issued by the China Banking and Insurance Regulatory Commission, local corporate banks that carry out Internet loan business should serve local customers and are not allowed to carry out Internet loan business across registration jurisdictions.

Longjiang Bank is registered in Heilongjiang, but the loan customers they issue through the Internet come from all over the country, which obviously does not meet regulatory requirements.

So since online loans like Longjiang Bank are obviously illegal, why do they dare to issue loans at high interest rates? This may be related to their less than ideal performance.

According to Longjiang Bank’s annual report data, from 2019 to 2021, Longjiang Bank’s net profits (parent company caliber) were 1.503 billion yuan, 947 million yuan and 732 million yuan respectively, with year-on-year changes of -6.61% and -37 respectively. %, -22.49%. When

's performance is less than ideal, they may cooperate with other platforms to issue loans at high interest rates, trying to obtain more spreads to stop the continued decline in profits.

However, this approach is not advisable and may even fall into a vicious cycle. Behind this kind of high-interest lending is generally the poor qualifications of the customers, which can easily lead to an increase in the non-performing rate, and may even cause damage to the bank. Liquidity poses a threat; in order to solve the liquidity problem, these banks may supplement liquidity by soliciting deposits at high interest rates. However, once there is a problem with this approach in a certain link, it may cause great challenges to the bank's operations. Therefore, the risk of this approach is relatively high in the long run.