6 morning comment on June 30, The market has retreated, which is a very good time to buy high-quality stocks. The market in July is still promising.

The market fell heavily yesterday, with turnover exceeding 1.3 trillion. The Shanghai Stock Exchange fell 1.4%, while GEM fell 2.53%. Only 770 stocks rose, while more than 4,000 stocks fell.

also mentioned a few days ago that if the market reaches 3,400 points, the closer it gets to the annual line, it is a good strategy for stocks that have risen too much to take short-term profits. But if you have a medium- to long-term investment perspective and the stock price in your hand does not rise too much, you don’t need to pay too much attention to it. What

now has is just switching between shareholding sectors, adjustments to stocks and , and switching between high and low shareholdings. Since

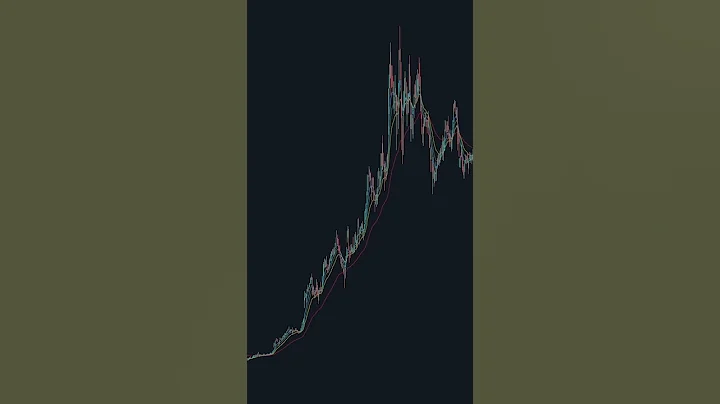

rebounded from 2863 points, my bullish view has not changed. The market is still optimistic about the midline in the later period.

The stock that led the decline yesterday was the automobile sector. This sector has been the leader in rising prices in the past two months. The main line sector, the automobile sector, has risen by more than 60% from 1,000 points to more than 1,600 points. Many stocks have risen by more than 1,000 points. Big, like Changan Automobile has grown from more than 6 yuan to more than 21 yuan, accumulating huge profits. These types of stocks are all funded by large funds. Once the buying funds dry up, there may be a stampede. This was the case with yesterday's sharp decline in automobile stocks. Therefore, we do not want to buy stocks with excessive short-term gains. To intervene easily.

In fact, the adjustment of the automobile sector should be a boon to other sectors. At this time, mainstream funds will switch between high and low positions and operate in other sectors that they think are valuable.

Although the market fell yesterday, I think it is still a normal and healthy adjustment. Although some stocks fell a lot, the market only fell back to near the 5-day line. The overall trend is still upward. Yesterday's correction was also expected. Because the area around 3450 points is currently the strongest pressure level in the market. There are a lot of unwinding and locking orders at this place. It is near the annual line. It is also a bull-bear dividing line . This position is a battle between the long and short parties. The most critical point should not be achieved overnight or broken through all at once.

China's stock market has always been a policy market and a capital market. Judging from the current market, policies have always supported the stock market and economic development. In addition, from a financial perspective, funds have been abundant in the past few months. In order to stimulate the economy, the upper management has released a large amount of water every month, and the following July is the most abundant time of the year. Therefore, I have been saying that I am optimistic about the meat-eating market in July. July this year is the best month for us to make money.

Yesterday the central bank proposed to strengthen the implementation of sound monetary policy. This is very similar to 2020. Starting from March and April after the epidemic in 2020, the central bank has been releasing more than 10% of water, creating a wave of monetary policy in 2020. The stock market is in the mid-level market, and this year’s market is somewhat similar. As long as the central bank keeps releasing more than 10% of water every month, the stock market will not go bearish and will get out of the plummeting market.

China Securities Journal, Toutiao announced today that the reform of A-share comprehensive registration system is expected to be implemented steadily in the second half of the year. A comprehensive registration system will definitely be launched this year. The comprehensive registration system has brought IPOs to the stock market, and refinancing has been maintained on a regular basis, and the number of stocks listed has increased. However, at the same time, the delisting system of and are strictly implemented. More stocks have been delisted this year than in previous years, and many enforcement efforts have been significantly strengthened. In the face of capital withdrawals, many long-term funds are also encouraged to enter the market, and policies are provided to support increased liquidity. .

In short, I think the comprehensive registration system is conducive to the development of the stock market, but for those stocks with poor performance and no growth stocks, it is a very big negative. In the future, the speculation on junk stocks and -themed stocks and will not be as popular as before. In this wave of market conditions, I think if you have those junk stocks that were over-hyped in the past, it is a good strategy to reduce the weight on rallies. . The stock selection strategy of

after that will focus on the growth and performance of stocks, as well as whether they have core assets. If you grab those low-priced stocks that are suitable for value investment, you will definitely get rich returns later.

For those stocks whose recent gains have been too large and whose performance cannot support the current stock price, there will be stock price adjustments later. Interim reports will begin to be disclosed one after another in July. Now when adjusting positions and exchanging shares, we must pay attention to the growth of the stock. and performance.

From the sector selection above, I am heavily optimistic about the coal sector, green electricity and new energy sector . This is also the main sector I am doing this year, and it has brought me huge profits. I think the market is not over yet. . Now I also hold shares in this type of sector.

And other stocks such as the construction sector, securities sector, aerospace and military industry sector, and semiconductor sector can be used as investment target sectors.

There are also many value investment stocks in the CSI 300. Those that have fallen too much in the early stage are at low levels. If you buy them and put them later, you should get good returns.

The current short-term support for the market is the 5-day line, and the 10-day line support. It is still around 3330 at 3350 points. Those who are short-term can get low interest rates. If the market is strong, there may be a retracement in the next few days. Under normal circumstances, the market should not break through 3,300 points. Yesterday I saw a lot of people saying that the market might go back down to about 3150 points. That possibility is not too great. If that happens, the market trend will go bad.

In short, the market is optimistic. No matter whether it is a correction or a direct upward trend, the overall trend should be upward. Now there are positions and positions. When selecting stocks, choose those with logic, growth potential and value. Invest in stocks. Many stocks with good growth potential will have a big market trend later. If there is a big market trend, many stocks will increase by five to ten times. The trend of the market and individual stocks will not go bad and they will not leave the market.