Compared with the rapid growth in previous years, the growth rate of Akuan Food's net profit attributable to the parent company in 2021 fell by 22.68%, and the comprehensive gross profit margin fell by 1.9 percentage points

" Investment Times" researcher Yin Yujia

Akuan focuses on Sichuan characteristics Red oil dough is a popular dark horse in the convenience food industry that was born in 2018 and has become popular in the market in recent years. The manufacturer behind it, Sichuan Baijia Kuan Food Industry Co., Ltd. (hereinafter referred to as Akuan Food), also issued a prospectus at the end of 2021, starting a journey to IPO, aiming to be the "first stock of new convenience foods".

"By exploring local traditional snacks and combining them with modern food processing technology to create hot-selling new convenience foods" is exactly the strategy behind Akuan Food's sudden rise.

In early June, Akuan Foods updated its prospectus based on feedback from initial public offering stock application documents. In this IPO, Akuan Food plans to raise a total of 665 million yuan, which will be used to build a health food industrial park (phase one) and a research and development center.

In the convenience food industry, there were many established companies such as Master Kong, Tongyi, Jinmailang, Baixiang Food, etc.; later, many new Internet celebrity brands such as Ramen Shuo and Shizuren entered the industry, and Guangxi Snail Noodles also monopolized A corner. And takeout is an invisible competitor of convenience food. Faced with the increasingly serious homogeneous competition in the Red Sea, Akuan Foods avoided the industry giants from the beginning, but took the differentiated competition route and went straight to the mid-to-high-end market.

However, its latest updated data shows that in 2021, the company achieved revenue of 1.214 billion yuan, a year-on-year increase of 9.4%, and net profit attributable to the parent company was 58.9669 million yuan, a year-on-year decrease of 22.68%.

A researcher from "Investment Times" wrote to Akuan Foods regarding the company's declining revenue and profit growth and industry changes. The company responded that everything is subject to the latest version of the prospectus.

Can Akuan Food, which aims at the mid- to high-end range of the convenience food industry, continue to break through? Can popular playstyles still be replicated?

The cost end continues to be under pressure

The prospectus shows that from 2018 to 2021, Akuan Food’s operating income was 422 million yuan, 631 million yuan, 1.110 billion yuan, and 1.214 billion yuan respectively, with year-on-year growth rates of 49.54% since 2019. %, 75.89% and 9.40%; net profits attributable to the parent company were 6.0848 million yuan, 23.6485 million yuan, 76.2649 million yuan, and 58.9669 million yuan respectively. Since 2019, year-on-year growth has been 288.65%, 222.49% and -22.68% respectively.

It is not difficult to find that compared with previous years, the company's revenue growth rate has dropped sharply in 2021, only 9.4%, and the net profit attributable to the parent company has declined for the first time, down 22.68% year-on-year.

Regarding this, Akuan Food did not explain the specific reasons in the prospectus, but it stated that if the company cannot improve its competitiveness by improving R&D strength, expanding marketing network, strengthening management, and timely expanding production capacity, it may face the company Market share declines, market space is squeezed, and product prices are impacted, which in turn leads to the risk of a decline in the company's operating income or net profit.

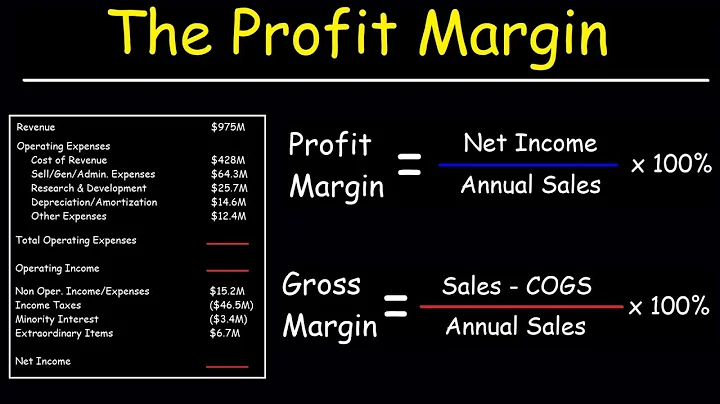

According to the prospectus, from 2019 to 2021, the gross profit margins of Akuan Food’s main business were 36.22%, 36.30%, and 34.50% respectively, showing a slight downward trend. Although the company's gross profit margin is relatively stable overall, the pressure brought by rising raw material prices cannot be underestimated.

As of the end of 2021, the company's prepayment balance increased by 102.26% compared with the end of 2020. This is mainly due to the continued expansion of business scale and in order to meet production needs and balance the risk of rising prices of some raw materials. The company increased prepayments for raw materials to some suppliers.

In addition, at the end of 2021, the company's raw material balance increased by 76.69% compared with the end of 2020, mainly due to the increase in raw material stocking required for the production of corresponding products. The company said that due to the impact of the epidemic and the international environment in 2021, the prices of raw materials such as oils, chili oleoresin required for production have risen sharply. In order to ensure production needs and cost control, the company has increased the stocking of corresponding raw materials.

At the same time, as one of the key raw materials in the instant noodle industry, the price of palm oil has been fluctuating and rising from the beginning of 2021 to June 2022, with an increase of up to double.This is also the direct reason why the company has stepped up stocking of raw materials and increased advance payments.

Akuan Food stated in the prospectus that if the purchase unit price of direct materials increases or decreases by 10%, the company's main business gross profit will decrease or increase by 14.76%, 19.02% and 20.60%. The main business gross profit will increase or decrease the direct material purchase unit price. The sensitivity coefficients are -1.48, -1.90 and -2.06 respectively. It can be seen that the increase in raw material prices is the reason for the company's year-on-year decline in gross profit margin in 2021. Although the company's 2022 data has not been updated yet, rising raw material prices may inevitably put pressure on the company's cost side.

Channel Disaster

Akuan Food’s main products include instant noodles, instant vermicelli, instant rice noodles, self-heating food and other 4 major categories. There are more than 200 single products, among which there are two major brands: "Akuan" and "Baijia Chenji" It has a high reputation in the market, but the company's overall market share is relatively limited. "Red oil dough" is the company's flagship product. As the sales scale of the company's red oil dough series products continues to increase, the company has taken advantage of the situation and launched a variety of red oil dough products in different series and specifications.

’s hit strategy is gradually becoming effective, so what is the company’s revenue situation? In fact, the instant noodle category where Hongyou Noodles belongs is the company's main source of revenue. The prospectus shows that from 2018 to 2021, the revenue of Akuan Nianpi instant noodles category was 166 million, 276 million, 572 million and 758 million yuan respectively, accounting for 40.60%, 45.12%, 53.03% and 64.53% of the total revenue respectively. %.

"Investment Times" researchers noticed that from the sales side, from 2018 to 2021, the company's sales expenses were 106 million yuan, 140 million yuan, 144 million yuan and 164 million yuan respectively, accounting for the company's revenue respectively. 25.31%, 22.12%, 13.02% and 13.52%. It can be seen that although sales expenses have been rising, the proportion of sales expenses in total revenue will decrease starting from 2020. This includes the impact of the "stay-at-home economy" brought about by the COVID-19 epidemic in 2020. Although revenue has increased significantly, sales expenses have not subsequently increased significantly.

On the other hand, judging from the composition of the company's main business revenue by sales model, in 2021, the distribution model accounted for 56.08% of the total revenue, and the direct sales model accounted for 43.92% of the revenue. Under the direct sales model, from 2019 to 2021, the company's self-operated e-commerce revenue was 111 million yuan, 228 million yuan, and 268 million yuan respectively, accounting for 18.15%, 21.18%, and 22.81% of the revenue respectively. It is not difficult to see that the self-operated revenue of Akuan Food e-commerce is generally relatively stable and has no tendency to expand. As a new brand that has become popular on the Internet, it does not rely on a single online self-operation model.

In fact, the gross profit margins of online channels and offline channels of distribution models are also quite different. From 2019 to 2021, the company's gross profit margins for offline channels were 37.18%, 32.70% and 31.95% respectively, and those for online channels were 26.77%, 20.95% and 21.22% respectively. Although the online channel has few circulation links, e-commerce platform service fees, express fees, promotion fees and other related expenses are borne by the online dealers themselves. The company usually directly gives them a certain percentage of discounts for orders, resulting in a gross profit margin of this channel. The interest rate is actually lower than offline channels.

However, under the general environmental trend, online income is still an indispensable and important sales channel for Akuan Food. The prospectus shows that in the three years from 2019 to 2021, the company’s online channel sales revenue were 3.08 yuan, 661 million yuan, and 743 million yuan respectively, accounting for 50.46%, 61.34%, and 63.30% of the company’s main business revenue respectively. , the overall trend is increasing year by year.

The expansion of online distribution channels has actually helped the company bear a large amount of "sales expenses", although the cost is that the gross profit margin of online channels is generally much lower than that of offline channels.

In addition, there are still some aspects worthy of attention, such as the per capita consumption of the company’s self-operated e-commerce stores. In 2021, the company's total order amount was 186 million yuan, a year-on-year decrease of 23.46% from 243 million yuan in 2020; the number of active users was 4.3521 million, a year-on-year decrease of 19.04% from 5.3756 million in 2020; the per capita consumption amount was higher than the previous year. There was also a slight decline for the year, reaching 42.69 yuan, and this data was 45.15 yuan in 2020.In this regard, the company stated that due to the promulgation of the " Personal Information Protection Law ", in order to protect the rights and interests of consumers' personal information, third-party e-commerce platforms have not included some retained encrypted data.

Akuan Food’s main business income composition by sales model from 2019 to 2021

Data source: Prospectus