Speaking of travel, perhaps the biggest thing everyone has noticed in the past two years is that there are more and more green-plate cars on the road. New energy and its hybrid car , as the biggest dark horse in the automotive industry, have burst onto the market and have won the favor of most car lovers.

However, there are many voices of doubt about its development. The biggest reason is the battery problem. As we all know, most of the electric vehicles use batteries made of lithium raw materials. However, lithium is a non-renewable metal resource in the world. As of 2020, the total global surface lithium ore reserves are still very limited, only 128 million tons.

According to the current consumption rate, approximately all lithium ore resources are expected to be used up before 2050.

The growth of lithium battery cars is in fierce conflict with the insufficient supply of lithium batteries

In 2019, the sales of 2.2 million electric vehicles accounted for only 2.5% of global car sales;

In 2020, due to the impact of the epidemic, the entire automobile market shrank, but electric vehicles Sales bucked the trend, rising to 3 million units, accounting for 4.1% of total car sales;

By 2021, electric vehicle sales will double to 6.6 million units, accounting for nearly 9% of the global auto market, while All net growth in sales of these vehicles came from electric vehicles.

Over the past decade, China has played a leading role in the growth of global electric vehicles. Electric vehicles' share of the overall market jumped from 7.2% in January to around 20% in December. The Chinese government’s goal is for electric vehicles to reach a 20% market share in 2025, and the performance in 2021 shows that we are likely to achieve this goal ahead of schedule.

Global market share distribution of electric vehicles in the past ten years

But after entering 2022, a problem suddenly blocks our goal.

html In January, Xpeng Motors first apologized to all car owners who ordered the P5 sedan due to insufficient battery supply, which caused a significant delay in the delivery of the P5 sedan. Immediately afterwards, Tesla also informed buyers that they would have to wait up to four months before the vehicle was delivered. Other Chinese car companies have also significantly extended their delivery times. Almost every day on Autohome you can see car owners lamenting that they cannot wait for their cars.On May 13, 2022, at the 8th Global Future Automobile Summit, as the world’s largest electric vehicle manufacturer, boss Musk publicly stated that the goals it set a few months ago can now only be regarded as Tesla’s ideals. , rather than a promise.

"We may stumble and fail to achieve this goal."

For a time, these high-speed growth car companies that investors flocked to seemed to have become pessimistic.

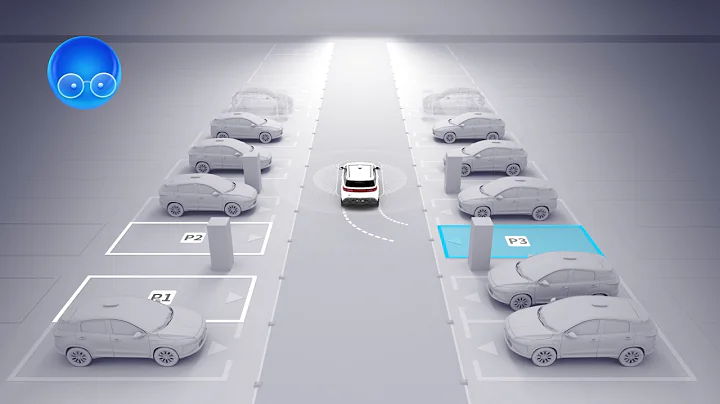

China's largest electric vehicle battery manufacturer CATL has launched a battery exchange service called EVOGO

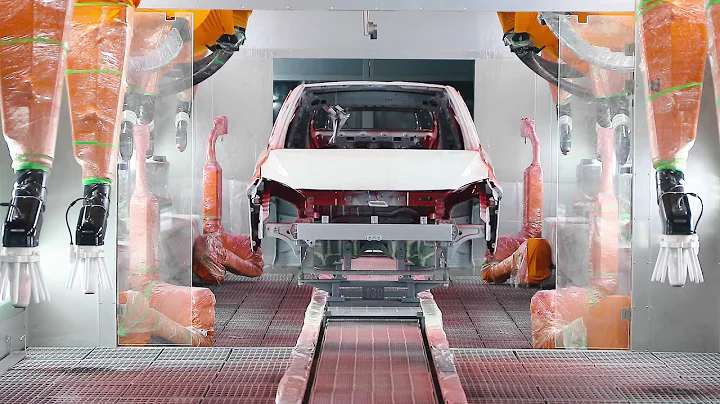

New energy vehicle supply chain is worrying

Corresponding to years of rapid development and an increasingly mature market, new energy vehicles are increasingly Highlighted supply chain issues. Especially the shortage of battery supplies. In fact, the raw material prices of the entire electric vehicle industry have not declined evenly in recent years due to the increase in orders, but have been rising. In 2022, the price of lithium carbonate increased by 150% year-on-year, the price of graphite increased by 15%, and the price of nickel increased by 25%. The sudden rise in prices of

reflects the huge gap in the supply of raw materials , especially battery raw materials.

Lithium is the key mineral in lithium-ion batteries for electric vehicles

The most common battery types in modern electric vehicles are lithium-ion and lithium-polymer batteries. Lithium-ion (and the physically similar lithium-polymer) batteries were originally developed for laptop computers and electronics, and are essentially larger, modified cell phone batteries.

Before the rise of electric vehicles, lithium-ion battery manufacturers, such as South Korea's LG, mainly supplied smartphones and notebook products. However, after the rise of electric vehicles, the batteries used are much larger than ordinary electronic products. The raw materials required to make a Tesla modal Y battery can make 800 iPhone12.

In addition, over the years, orders for electric vehicles have continued to grow at an extremely high rate of almost 50% per year. Although the market size of lithium-ion batteries has grown from 55 gigawatt hours in 2015 to 225 GWh in 2020, it is still far from Far unable to keep up with the order volume of electric vehicles, there has been a global slowdown in electric vehicle manufacturing.

According to the estimates of International Automobile Federation , by 2030, the world will need to add at least 2224GWh - about 10 times the current scale of battery production to meet the manufacturing of 32 million electric vehicles. This number is also The currently generally predicted global electric vehicle market size in 2030 .

Lithium-ion battery in Jaguar I-Pace

At present, the main way for countries to deal with this challenge is to significantly expand battery production capacity. However, the rapid expansion of battery factories has brought new challenges, namely the shortage of production capacity of raw materials lithium ore, cobalt ore, nickel ore and graphite. If all 121 battery factories are put into operation, will require 1.9 million tons of lithium per year, but the current global production capacity is only 390,000 tons of lithium. The situation for nickel, cobalt and graphite is similar to that of lithium.

There are not enough factories to build, but what should I do if there are not enough raw materials? You can't go digging on the moon, right? Could it be that the development route of new energy vehicles will be stuck on the problem of insufficient raw materials?

China’s automobile battery raw materials are 70% dependent on foreign countries. Why? The situation of

is not optimistic for our country. As early as a few years ago, when new energy vehicles first appeared on the market, some people expressed relevant concerns.

For our country, although the development of new energy vehicles is "good and fast", under its brilliance, there is a problem that is more serious than the shortage of raw materials: Our raw materials are not even dug by ourselves, but are highly dependent on Imported from abroad, the proportion of imports is as high as 70%.

However, in fact, when our government laid out the new energy automobile industry eight years ago, it had already considered its upstream supply chain issues. Measures were taken in advance to ensure that our country is currently in an absolute leadership position in mineral mining and processing.

Let’s talk about lithium ore first. The world's lithium reserves are mainly distributed in four regions, Australia, South America, Africa, and China. China itself is one of the five countries with the most lithium resources. The other four are Australia (52%), Chile (22%), Congo (6%), Brazil and Zimbabwe (4 %), China accounts for 13%.

Unlike oil, China's own lithium ore reserves can meet its own needs and does not require additional imports. The reason why we were highly dependent on foreign countries before was simply that our mining technology was not yet mature.

However, the lessons learned from iron ore prices in previous years are still at hand. As the world's largest iron ore customer, it is jointly harvested by the world's three largest mining companies all day long.

Therefore, lithium mines cannot repeat the same mistakes. From the beginning, our country did not intend to stop at meeting its own needs, but to completely grasp the pricing power of global new energy materials. It is our turn to harvest others!

China's steel industry once suffered from the fact that because it had no pricing power, the three major mining companies repeatedly raised prices.

Since 2015, with the strategic support of the Belt and Road Initiative and the Asian Infrastructure Investment Bank, Chinese companies have been aggressively acquiring Australia, Congo and South Africa. Shares in American mining companies. Tianqi Lithium alone currently owns 51% of Australia’s total lithium reserves. In 2018, Tianqi Lithium became the second largest shareholder of Sociedad Química y Minera, Chile’s largest lithium producer.

Another Chinese company Ganfeng Lithium has signed a long-term agreement with Australia's largest lithium miner Greenbush. In the next ten years, all lithium ore mined can only be sold to Ganfeng Lithium for processing. , Greenbush is the world’s largest high-grade lithium mine.

In Africa, Zimbabwe and Congo are the main producers of lithium ores. Due to the backwardness of local mining technology, it is impossible to complete the construction of the mine independently.Chinese-funded enterprises directly buy the entire mine. From the construction of the mine to mining, operation, and management, everything is completed by the Chinese-funded enterprise. All management personnel are sent from home and abroad, and all the mined ores are handed over to the Chinese-funded enterprise. Processed and sold. Currently, 60% of Congo’s lithium mines are controlled by Chinese-funded companies.

Crushed ore from Greenbush Lithium Mine in Australia

This time, there will no longer be a scene where BHP Billiton, Rio Tinto , Vale join forces to raise prices for Chinese steel companies. If lithium mining companies in Australia and South America want to raise prices for Chinese companies, they must first ask the Chinese directors on your board of directors if they will agree.

Let’s talk about cobalt ore. China's cobalt reserves are only 1% of the world's and it mainly relies on imports. Especially imports from Congo, the source of more than two-thirds of global cobalt production. However, although it is said to be an import, the essence is still importing from Chinese companies to Chinese companies. Because China already owns eight of Congo’s 14 largest cobalt mines, accounting for more than half of the country’s output. Most of the remaining half of

can only be sold to Chinese companies after being mined. Because we dominate the processing of local raw material cobalt. China already controls more than 80% of its cobalt refining industry. The United States once owned Congo's largest cobalt mine, but it also sold it to China's molybdenum mine in 2016.

Most of the cobalt mines in Congo are invested and constructed by Chinese-funded enterprises

not to mention nickel and graphite. As early as 2019, China controlled 64% of global graphite production. Nickel ore reserves are relatively evenly distributed around the world, but China already controls 65% of them. Not to mention the backward areas of Africa, China directly controls the ownership of many mines, that is, many mining companies in the West. Chinese companies are now either the second largest shareholder, or on the way to becoming the second largest shareholder. Although the second largest shareholder of

does not dominate the management of the board of directors, it is not your family that has the final say from now on whether to increase prices, how to increase them, and to whom.

According to Bloomberg statistics, China actually controls 80% of the world's new energy raw material refining, 77% of the world's battery production capacity, and 60% of component manufacturing. When U.S. President Biden took office, he promised to vigorously develop the new energy industry in the United States. However, according to U.S. Geological Survey predictions, in the next ten years, 78% of the lithium, cobalt, nickel and almost all graphite in the U.S. new energy industry will depend on China.

The lithium mine invested and produced by China Tianqi Lithium Industry in Australia

In addition, China has not bet all its treasures on the same boat. As early as the layout of the lithium-ion battery supply chain, it began to promote the development of other new energy sources, such as hydrogen fuel electric vehicles and methanol power batteries. To avoid over-reliance on a single lithium-ion battery.

Generally speaking, the development of electric vehicles will enter a new stage, in which the supply of raw materials and parts will be a real challenge for the electric vehicle industry. Fortunately, our country has made sufficient preparations in this regard and has taken a great advantage. As governments around the world gradually tighten their carbon emission policies, I believe my country will gain greater advantages in this field.

![Advanced English Conversation About Travel [The Fearless Fluency Club] - DayDayNews](https://i.ytimg.com/vi/bZYwZDqdsas/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLCywsP8_MTSbtnFk1FKM7iDfx5L6A)

![Travel English: Understanding Directions [5 Advanced Expressions] - DayDayNews](https://i.ytimg.com/vi/q_IThYAFPI0/hqdefault.jpg?sqp=-oaymwEcCOADEI4CSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLBkIO3nNqZTs-rru8cIQmkomLdEjQ)

![26 Must-Have English Phrasal Verbs for Travel [English Vocabulary Lesson with Practice] - DayDayNews](https://i.ytimg.com/vi/UuBwSnhbwmA/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLCFA1qufS5AlE715zoyWh4l1yraDA)