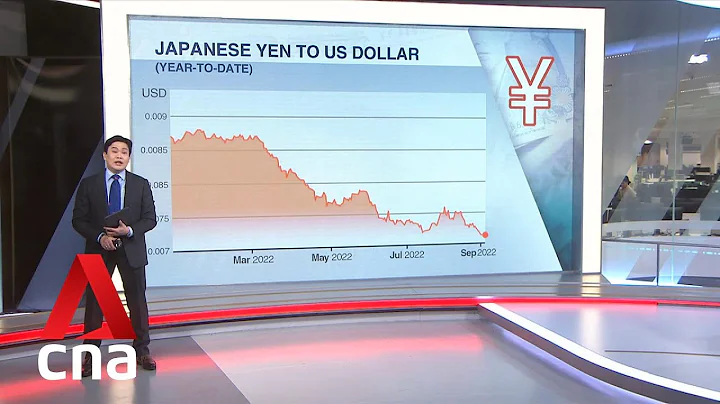

Wang Ye said financial news: Recently, the currency that has fallen the most is the Japanese yen.

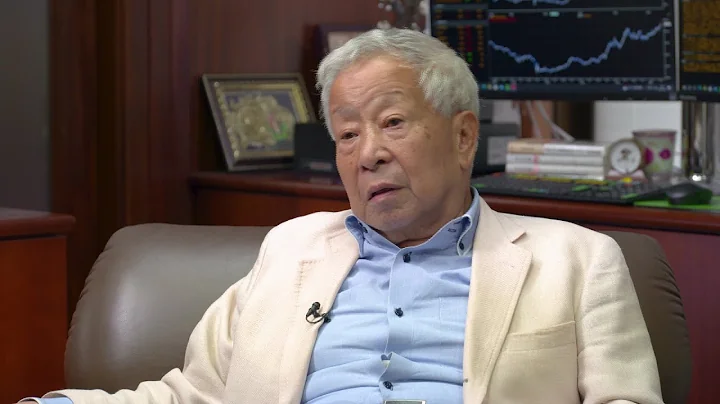

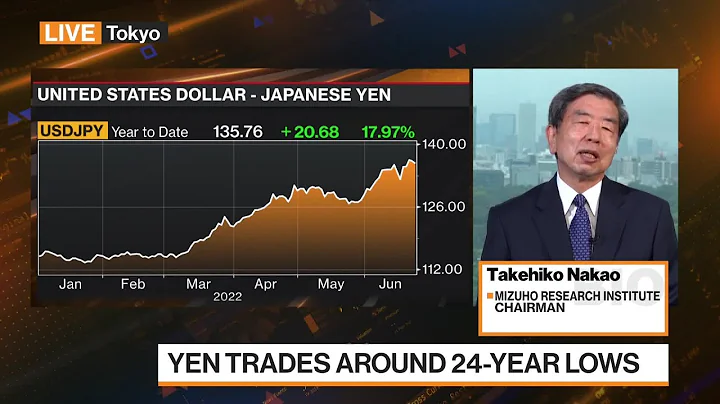

In response to this, Xie Jinhe, a financial expert and chairman of Caixin Media, wrote an article saying that the yen once depreciated to 137 yen per US dollar, the lowest in 25 years . There is no doubt that this is the collapse of the Japanese economy. , but from another perspective, this may also be a turning point for Japan.

Xie Jinhe pointed out that the depreciation of the yen has a great stimulating effect on Japan's tourism economy, because foreigners can buy more things in Japan.

Of course, the plummeting yen has also made economists even less optimistic about the Japanese economy.

In this regard, Xie Jinhe said that, in fact, Japan has been squatting on the ground for 30 years from 1990 to now. This is the "lost 30 years" !

This financial expert emphasized: "After the ' World War II ' ended, Japan was a defeated country, and the yen against the US dollar was 360 to 1 US dollar. By the 2011 earthquake and tsunami in Japan, the yen once plummeted to the bottom, but the yen appreciated to 75.35. Against 1 U.S. dollar, no country in the world can withstand such a huge exchange rate appreciation. "

As the saying goes: everything has two sides.

In this regard, Xie Jinhe analyzed and commented that from another perspective, the Japanese economy is indeed very resilient.

"This time the yen has plummeted and depreciated. From the economic fundamentals, this is the 'collapse' of the Japanese economy, but from another perspective, this may also be the turning point for Japan to 'put it to death and survive.' "

Xie Jinhe analyzed and commented that looking back on Japan in the 1960s and after the 1964 Tokyo Olympics, Japan's home appliances, automobiles, semiconductors, machine tools, etc. were leading the world, and Japan's economic scale was catching up with the United States. Even in 1985, a " "Square Protocol " changes everything.

From that time on, the Japanese yen began to skyrocket, starting a long path of appreciation. By 1989, the "bubble burst" and Japan entered an era of loss.

However, Xie Jinhe said that as long as a person catches a big wave in his life, his assets and wealth will change dramatically. This time may also be a major turning point in history.

"Regarding the depreciation of the yen, some people see Japan's economy sinking, but others see Japan's great opportunities. In fact, most people are unaware of every major change," Xie Jinhe said with emotion in the end.

What do you think about this? What do you think will happen to the Japanese economy next? What will happen to the yen?

Thank you for reading. You are welcome to leave a message and comment on . If you like our article, you can directly like and recommend below↓↓↓.