Yesterday, the highest international gold price rose to around 1841, and the pressure price we gave was 1842, which can be regarded as good luck, although I did not successfully participate in the market. The main reason is that there were so many things going on yesterday that I was not in the mood to trade. I originally wanted to do something in the afternoon, but unfortunately the gold price sold off while I was cooking at home in the afternoon.

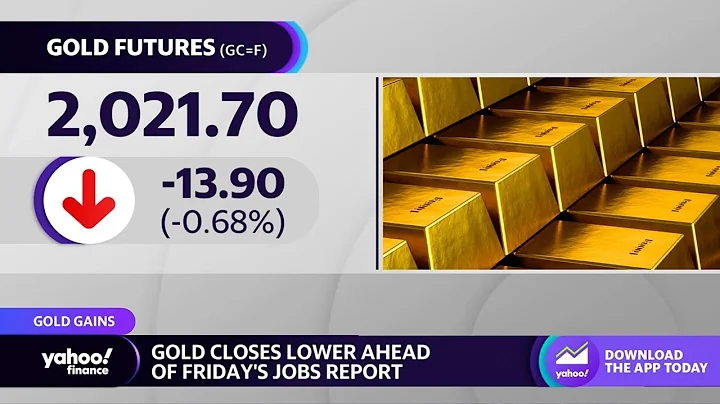

Looking at today, the international gold price is oscillating around 1825. Obviously the key 1832 support has fallen below, so today’s idea is very clear. Just focus on the 1832 pressure and watch the gold price fall to the 1813 line. From the perspective of the international environment, the U.S. dollar index dropped slightly to 103.9, but the ten-year U.S. bond yield is still around 3.2%, with little change. This means that real interest rates in the United States have not fallen, but have remained flat.

The next thing we must pay attention to is the annual rate of the PCE price index. Today is Tuesday, and the data will be released on Thursday. According to market expectations, inflation is going to rise, so we should focus on this PCE data. If inflation really rebounds and rises, it will trigger a rise in gold prices in the short term. And this rise can just give us the ideal opportunity to short and . Sentiment about the data comes into Thursday with specific analysis.

also noticed that , the world’s largest ETF gold holding, , began to continuously reduce its holdings, reducing its holdings by 4.64 tons. Obviously such a signal cannot support the rise in gold prices. Well, I have been bearish since April, when the gold price was around 1997, until now. The volatile trend in June is also very boring. On the one hand, I would like to remind everyone not to look at the long term in the near future. After all, the market is a volatile trend. If you have profits, you should take them as soon as possible.

However, if the price advantage is relatively large, it is still recommended to leave a bottom position. After all, it takes time to change from quantitative to qualitative change, and obviously the current shock of one and a half months, I personally feel that short positions may come at any time, and the corresponding opportunities should be when the PCE data is released, non- Agricultural data, these times. It must be understood that today is June 28th, and the monthly line will be closed on the 30th. After the arrival of July, the Federal Reserve will continue to increase and reduce the size of its balance sheet.

began to reduce the balance sheet in May, increased the scale in June, and continued to increase in July. Combined with the continuous interest rate hikes , I judge that the decline in inflation should be a matter of time. Although the current international oil prices are very high, they are obviously not continuously fluctuating at historically high prices. There are also corrections and declines. Therefore, with regard to U.S. inflation, the current monetary policy may make it more difficult for gold prices to rise. And the decline may only occur in the blink of an eye.

gold today's technical analysis:

gold intraday thinking, if it rises to around 1832, it will be bearish. If the market outlook breaks through, then consider going short at 1838 relying on trend line pressure. These two prices are the average prices in 2021 and are also key top-to-bottom conversion positions. And 1838 is a technical trend line suppression. Judging from the recent shocks, today’s fluctuation range is expected to be small. Therefore, the large range of 1813-1838 is pushed, and the small range is between 1820-1832.

As a trader, I have been working hard in the market for five years. The above content represents my humble opinion and does not serve as a basis for investors' operations. If you agree with my point of view analysis. Welcome to follow, like and forward. If you don't agree with my views, you are welcome to give me advice and corrections. Personal creation, it is not easy to do. It is not allowed to be reproduced or moved without permission. Thank you for understanding