According to a report on the Bloomberg News website on June 22, as risk assets rebounded, investors fled from safe havens, and the exchange rate of the yen against the US dollar hit a 24-year low.

In Tokyo, the yen fell more than 1% overnight, trading at 136.5 yen per dollar in early trading on Wednesday, its lowest since 1998.

Wells Fargo strategist Brendan McKenna said: "Demand for safe-haven currencies fell today, and the yen was under pressure as a result."

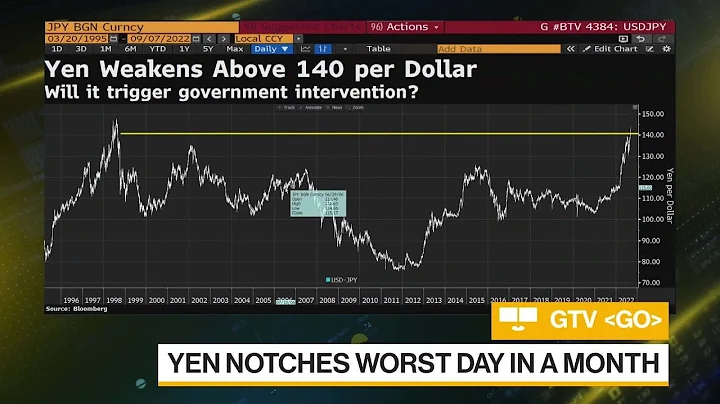

The yen hit a 24-year low against the U.S. dollar (Bloomberg)

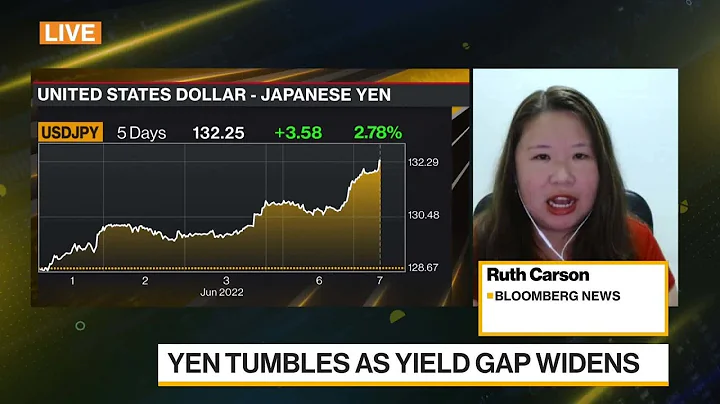

On the one hand Japan Bank ( central bank ) maintains the lower limit of interest rates to boost the local economy. On the other hand, the Federal Reserve aggressively raises interest rates in order to curb inflation . The Japanese yen, which is under pressure, is the worst performing G10 country this year. (also known as the Paris Club , composed of ten countries including the United States, the United Kingdom, France, Italy, Germany, Japan, the Netherlands , Canada, Belgium and Sweden - Note on this website) currency.

reported that speculators further believe that the Bank of Japan will eventually have to adjust its monetary easing policy. However, the Bank of Japan decided to temporarily maintain low interest rates at its interest rate meeting last week.

professionals believe that if the yen exchange rate falls further than 140 yen per US dollar, it may trigger the Bank of Japan to adjust its current policy.

reported that signals from the options market indicate that there will be more fluctuations in the yen exchange rate. The yen's monthly volatility, a measure of how much a currency fluctuates over a defined period of time, is close to the peak of market panic in March 2020 during the COVID-19 pandemic.

Commonwealth Bank of Australia expert Joseph Capurso wrote in a note today: "Two drivers of yen weakness are the narrowing of Japan's current account surplus and the sharp increase in the interest rate differential between the dollar and the yen. Although it has not yet been introduced, the reasons for Japan to adopt monetary tightening policies are gradually increasing. "

According to a report by "Nihon Keizai Shimbun" on June 22, on the 22nd, the exchange rate of the yen against the U.S. dollar in the Tokyo foreign exchange market once fell below 1. The dollar exchange rate is 136.5 yen. This is the lowest value in 24 years since October 1998.

reported that in order to curb inflation, the Federal Reserve stepped up its monetary policy tightening, resulting in high interest rates in the United States. On the other hand, the Bank of Japan made it clear that it would control interest rates, and the Japanese yen continued to be sold out of expectations that the interest rate gap between Japan and the United States would widen.

21 In the U.S. market, speculators-centered selling of the yen and buying of the U.S. dollar contributed to the depreciation of the yen. The U.S. dollar strengthened further as funds flowed into the U.S. amid sharp gains in U.S. stocks and the easing of excessive worries about an economic recession caused by tightening money.

As oil prices remain at a high level of around US$110 per barrel, some observations believe that Japan's trade deficit will expand. This also creates pressure to sell the yen.

As the Bank of Japan continues to pursue the quantitative easing policy, the market generally believes that it is difficult for the government to buy yen and sell dollars to intervene, which also encourages the behavior of selling yen to gain a sense of security.

However, the Japanese yen exchange rate fell by nearly 8 yen in June. The Japanese yen depreciated and the US dollar appreciated rapidly. It is reported that the Japanese Senate election announcement will be released on the 22nd. The rising prices accompanying the depreciation of the yen will also become one of the focal points of the election. Political speeches may also affect the market.

Source: Reference News Network