[Big Bit Introduction] 5G is coming, base station is in the dual base station era, with the trend of adding more than 10,000 5G base stations every week, 5G macro base stations and small base stations are also demanding base station power supplies in large quantities. It will drive the future vigorous development of industrial chains such as related basic components.

html At 11 a.m. on May 27, Chinese mountaineers successfully climbed to the summit of Mount Everest, and the footage was transmitted back to the Everest base camp in real time through 5G signals, allowing many audiences around the world to witness this historical moment at the fastest speed possible.On April 20, at an altitude of more than 5,000 meters, braving the severe cold of more than ten degrees below zero, China Unicom achieved full 5G coverage at the Everest Observation Deck and Everest Base Camp No. 1. So far, China’s three major telecom operators have 5G The Internet has climbed Mount Everest.

5G's ascent to Mount Everest also tested the maturity of my country's 5G technology, and further confirmed that under the guidance of "new infrastructure", my country has set off a wave of 5G base station construction across the country, driving the future prosperity of 5G base station power supplies and related basic components and other industrial chains. develop.

"More than 10,000 5G base stations are added every week"

In the 5G era, base stations can be divided into macro base stations, micro base stations, pico base stations, nano base stations, femto base stations, etc. according to their power levels. Among them, the frequency range of macro base stations is above 10W, and the coverage range can reach several kilometers.

Micro base stations, pico base stations, and flying base stations are all small base stations. Their power range is generally 50mW-10W and the coverage range is 10-200 meters.

From now on, base stations will enter the era of dual base stations with macro base stations as the mainstay and a large number of small base stations as the supplement.

At present, in the field of domestic macro base station construction, there are four main major equipment manufacturers, namely Huawei , ZTE , Ericsson . Among them, Huawei is undoubtedly the largest player. The industry estimates that Huawei will occupy about 50%. In terms of market share, ZTE, the second largest company, accounts for approximately 30% of the market share.

As for small base stations, according to incomplete statistics, there are currently more than 20 companies in the world that can provide small base station products. Domestic and foreign manufacturers that research and produce small base stations include Huawei, ZTE , Ericsson, Nokia , Datang Mobile , Intel , H3C, Sethus, Combacom , Baicaibang, Creative Information, Ruisikangda, etc.

It is reported that there are currently almost 5 million 4G base stations in the world, of which 3.4 million are in China. Since the wavelength of 5G is shorter than that of 4G, in order to achieve good signal effects, the number of newly built 5G macro base stations must be at least doubled.

Bu Haigang, Network Operation Center of China Mobile Shandong Company, believes that “5G belongs to the medium and high frequency band, which is about 2 to 3 times higher than the existing 4G signal frequency. The signal transmission distance and penetration effect are relatively weakened, so the base station construction needs to be denser. . To reach the coverage level of the existing 4G network, the total number of 5G base stations will be 2 to 3 times that of 4G base stations."

If we make a simple calculation based on this difference, the number of 5G macro base stations that need to be built in China will exceed 7 million, and the number of 5G macro base stations in the world will exceed 7 million. 10 million.

In crowded areas, one macro base station probably needs to be equipped with four small base stations, or even more, to achieve deep signal coverage and complete the functions that one macro base station can complete in 4G.

According to SCF predictions, the compound growth rate of the number of small base stations built globally from 2015 to 2025 will be 36%, and by then the number of small base stations will reach about 70 million. Assuming conservatively, in the next five years, the number of small base stations to be built will be 10 million, and the unit price of each small base station is about 10,000 yuan. The market size of 5G small base stations is expected to exceed 100 billion yuan in market value.

As of the end of February 2020, 164,000 5G base stations have been constructed and opened across the country. China Mobile has more than 80,000 5G base stations. Since China Unicom and China Telecom signed a sharing agreement, more than 50,000 5G co-construction and shared base stations have been opened in 31 provinces, autonomous regions and municipalities across the country, and 5G coverage has increased by nearly 60%.

Tong Jilu, chairman of China Tower, recently publicly stated that as of now, China Tower has built a total of 200,000 5G base stations.

The Ministry of Industry and Information Technology predicts that the number of 5G base stations nationwide will exceed 600,000 by the end of this year, achieving continuous outdoor coverage in prefecture-level cities, key coverage in counties and towns, and indoor coverage in key scenes. At the “Ministerial Channel” of this year’s Two Sessions, Minister of Industry and Information Technology Miao Xuan said, “Now on the land of the motherland, more than 10,000 5G base stations are added every week, and 4 million 5G users were added in April."

In 2020, China Mobile, China Unicom, and China Telecom plan to cover 5G networks in major prefecture-level cities and above in China. Together with China Radio and Television construction plan, a total of 600,000 will be opened by the end of 2020. There is still a big market gap for 5G base stations.

5G base station construction has attracted the attention of upstream manufacturers

At the beginning of this year, 5G base station construction was included in the category of "new infrastructure" this year. Under the guidance of the "new infrastructure" policy, domestic 5G base stations have carried out various tasks and Industrial cooperation is in full swing. The construction of 5G base stations will inevitably require supporting base station power supplies, and various power supply companies are undercurrent.

industry chain companies are also paying attention to the growth of this market. Most business managers have expressed their expectations for this year's base stations. The construction market is promising, including manufacturers of power supplies and magnetic materials, transformers, inductors and other magnetic devices.

At the just-held National Two Sessions, Zhang Hongwei, deputy to the National People's Congress and chairman of Dongyangguang , said in an interview with the media , the Chinese government's action and mobilization power and the good development resilience of the Chinese economy have been fully demonstrated in this epidemic prevention and control war and the overall war.

At present, "new infrastructure" is surging, and waves of digital economy and industrial digitization are rising one after another. Zhang Hongwei sees the major opportunities coming in the "new infrastructure" era. Dongguan is an important supplier of key materials and components in the electronics industry.

It is reported that in terms of soft magnetic materials, Dongguan has developed high magnetic permeability, high frequency, low In addition to being used in 5G base station power supplies, loss and high magnetic induction intensity series magnetic cores can also be seen in electric vehicles and the industrial Internet.

Taiwanese passive component manufacturer Yageo and inductor manufacturer Chilisin will be in 6 A regular shareholder meeting will be held on May 5. Prior to this, Yageo Chairman Chen Taiming was the first to release to shareholders that Yageo Group will plan a blueprint for the 5G era.

Chen Taiming pointed out that in terms of product application layout, Yageo Group will focus on high unit price and high gross profit Niche products, including 5G Netcom, and multiple terminal markets closely related to future new communication technologies, expanding the application areas of high-end products.

"The 5G market is worth looking forward to, and the demand for 5G will be very strong this year." De Shao Guanghua, general manager of Weiss Electronics Co., Ltd., believes that “this market is very consistent with the country’s development policy this year. The country is very clear this year that it will vigorously develop 5G and support the development of many large projects. "

Judging from the actual situation of DeVos, according to Shao Guanghua, "Compared with last year, the demand for our 5G transformer-related products is roughly estimated to have increased by at least three times, and the growth trend is very obvious."

According to Haiwu Technology Product line director Zhang Kebo reflected on the industry situation he was exposed to. Currently, 5G power supply is a very hot market. He believes that the 5G base station power supply market is mainly a policy-oriented market, which is active based on the support of the national new infrastructure policy.

Outlook for this year Kangshu, a major power supply manufacturer, also said that in addition to continuing to expand industrial power supplies for edge computing, cloud data centers, artificial intelligence and big data, it will also be used in 5G communication power supplies in a large number of layouts.

Mobile Communications Company staff said , each mobile base station is equipped with a certain number of power modules to ensure the stable operation of the base station. Once the module is stolen, the base station voltage will be abnormal, which will affect the operation of the base station, thereby affecting the coverage of mobile signals, causing serious consequences. Social impact. According to invoices from mobile communication companies, the power module of a mobile base station is sold for about 800 yuan each.

It can be seen that the base station power supply is important to the normal operation of the 5G base station. At the same time, considering the future construction scale of the market , also reflects that the market has sufficient market size.

However, different power supply manufacturers have different positionings, and some manufacturers insist on doing their main business and do not want to swarm in. Xue Anzhong, general manager of Yantai Dongfang Electronics Yulin Electric Co., Ltd., said that they We will pay attention to the changes in the 5G base station power supply market, but currently, for Dongfang Electronics, Xue Anzhong is still focusing more on their power supply, which is why their company has long-term positioning in this regard.

There are too many people and too many base station power supply tenders.

Driven by the construction trend of 5G base stations, the demand for base station power supplies from 5G macro base stations and small base stations has also come in large quantities.

It is understood that 5G base station power supply providers mainly include ZTE, Huawei, Power Source, Yada, Wemax, Vertiv, Zhongda Dentsu , Zhongheng Electric, Megmeet, Jinweiyuan and dozens of others.

5G base stations have complex power requirements, including but not limited to combined power supplies, distributed power supplies, energy storage power supplies, multi-functional high-density power supplies, DC integrated power supplies, smart power supplies, etc.

According to the centralized procurement data of the three major operators in 2018, Huawei, ZTE, Zhongheng Electric, Power Source, China Telecom and Vertiv have accounted for more than 90% of the centralized procurement of operators. Companies such as Mingpu Opto-Magnetic, Yida, Yaao Boxin, Huamai Technology and other companies will share the remaining shares.

Entering 2020, communication operators’ new quarterly and annual bidding “contest” tracks are gradually unfolding, and players from all walks of life have also begun new competitions.

Take combined power supply as an example. Since this year, China Mobile and China Unicom have successively announced large bidding orders for combined switching power supply . A number of leading power supply companies have been able to get a share of the fierce bidding army. The main raw materials of

switching power supply are transformers, power devices, inductors, reactors, etc. In 5G base station power supply, 48V switching power supply is mainly used. 5G base station builders are undoubtedly the downstream end of this product.

At present, the switching power supply industry has formed a complete industrial chain. The upstream international mainstream component suppliers control the manufacturing technology of switching power supply IC chips. The upstream industry mainly includes transformers and power devices. The secondary components are mainly inductors. , magnetic materials, batteries, reactors, capacitors, etc. The midstream end is naturally a company involved in switching power supplies.

Zhang Kebo of Haiwu Technology told reporters that in terms of base station power supply, they mainly make switching power supplies. "Currently, they are switching power supplies for 5G macro base stations. Of course, we also have some 5G micro base station power supplies."

According to China Mobile Procurement and Bidding Network, on March 13, China Mobile’s 2020-2021 combined switching power supply centralized procurement winning candidates were announced. Zhongheng Electric came out on top, with a winning bid share of 40% and a bid price of 362 million yuan.

The remaining three winning bidders are ZTE Communications, Vertiv Technology, and Mingpu Optoelectronics, with shares of 30%, 20%, and 10% respectively, and the bidding prices are 331, 398, and 380 million yuan respectively.

It is reported that China Mobile’s centralized procurement of combined switching power supplies is about 37,500 sets, with a total scale of over 600 million yuan, and the procurement content is 48V combined switching power supplies.

China Unicom plans to purchase 16,285 sets of 48V switching power supplies, including 14,644 sets of combined types and 1,641 sets of discrete types, with a budget of 254.1 million. According to the announcement, the winning bidders for this project are Huawei, Beijing Power Source, and Vertiv Technology, with the share allocations being 55%, 30%, and 10% respectively.

Obviously, in addition to Huawei’s absolute advantages in many core 5G technologies, their strength in building supporting facilities for 5G base stations is also obvious to all.

Jiang Guanghui, power supply R&D strategy manager of Huawei Technology Co., Ltd., told reporters in an interview with "Magnetic Components and Power Supply" that their current 5G power supplies mainly include standard embedded power supplies and blade power supplies for the communications field. Outdoor, protection grade IP65 and above, rainproof and dustproof. In terms of base station power supplies, "We now have embedded module power supplies, plastic power supplies, open-frame power supplies, and smaller PSIP power supplies, which cover almost a full range of power supplies, large and small. What we are doing now This kind of power supply is basically compatible with AC and high-voltage DC."

In addition, in January this year, China Mobile also conducted a "China Mobile 2019-2020 Integrated Power Supply Product Centralized Procurement", which involved integrated 1kW, module Assembled 2kW and 3kW, this procurement is also China Mobile's first centralized procurement of 5G integrated power supply. Zhongheng Electric won 19.57%, 14.49%, and 17.39% of the shares in these three bidding sections, becoming the big winner of this bidding. .

reporter also learned from the official release channel of Mingpu Opto-Magnetic that Mingpu Opto-Magnetic also won the bid for this project. The specific winning products are 2kW and 3kW products of assembled outdoor integrated power supplies.In addition to the "China Mobile's 2020-2021 Combined Switching Power Supply Product Centralized Procurement Bidding Project" that they won, Mingpu Opto-Magnetic has achieved good results in both integrated power supplies and combined power supplies.

Zhang Kebo believes that because the 5G micro base station market is relatively large, there are many companies participating. According to his analysis, the last time communication operators participated in the centralized procurement, there were more than 30 manufacturers, and these were only the manufacturers participating in the centralized procurement.

"As far as I know, there are still some manufacturers that have been making products in this area. Although these manufacturers have not participated in centralized procurement, it may be due to problems such as customer resources or their own lack of strength, but these companies They also want to enter this market. They will sell their products through some other channels. If they want to enter this market, they need to establish channels, establish market relationships, and try to break the current balance."

Base station energy storage power supply alleviates power consumption problems

As we all know, due to the significant increase in the number of antenna channels and site capacity of 5G equipment, the overall power consumption of base stations has increased.

Zhang Kebo believes that the power supply and backup power of 5G base stations need to be upgraded and expanded. This demand has also promoted the application of energy storage power supplies in the 5G market. In energy storage systems, lithium batteries with smaller size, lighter weight, higher energy density, longer life and better performance have been used to replace lead-acid batteries. It is the general trend.

This trend can also be felt from the procurement situation of 5G builders.

public information shows that the demand for lithium iron phosphate for newly built and renovated 5G base stations in 2020 will be approximately 10GWh. The market demand for lithium iron phosphate batteries will continue to increase in the future.

Earlier, China Mobile issued an announcement that it plans to purchase a total of 610.2 million Ah (specification 3.2V) lithium iron phosphate batteries for communication use of no more than 2.508 billion yuan.

html On March 4, China Mobile issued a bidding announcement, planning to purchase a total of 1.95GWh of lithium iron phosphate batteries for communications with no more than 2.508 billion yuan.On March 11, China Tower also announced an external tender, planning to purchase 2GWh of lithium iron phosphate battery pack products for backup power, with a demand fulfillment period of one year.

In just one week, two communications giants have successively released base station energy storage bidding projects, with a total demand of nearly 4GWh, attracting industry attention to the base station energy storage market.

The industry generally believes that as one of the important areas of "new infrastructure", the 5G construction boom is bringing greater market space for the application of lithium batteries in communication base station energy storage. Ningde era, Yiwei Lithium Energy, BYD and other leading power battery companies have also stepped up their deployment.

Narada Power stated that they provide backup power products for 5G communication base stations, and Narada Power is a long-term supplier of backup power for Huawei base stations.

According to the 2020 lead-acid battery framework bidding project procurement, Narada Power is the winning supplier of the 2020 lead-acid battery framework bidding project, with a winning share of 70%.

Industry insiders said that under the background of rising demand for energy storage in 5G base stations, more and more companies will flood in, competition will become more intense in the future, and the market structure may undergo adjustments and changes.

Base station power supply pain points have been further overcome

Although the prospects of 5G communication base station power supply are very promising, due to the wide coverage and high density of the 5G system, the operating scenarios of its base stations are far more complex than those of 4G.

Regarding capacity expansion, Zhang Kebo believes that after 5G comes out, the switching power supply configuration capacity in the previous macro base stations is no longer enough. “Now there is a project called the switching power supply transformation project, which is to replace the old power supply with a new one, and the new power supply The capacity has increased on a large scale, and the capacity has increased a lot compared to before."

In terms of total power supply capacity, the previous capacity must be at least doubled, such as 200 amps. Now generally 200 amps is not enough. Now at least To 6 million, it may almost triple. Therefore, it is inevitable that the operator's investment costs have also increased a lot.

Even if the investment cost is increased, many base stations still face various power supply difficulties such as insufficient load capacity of power supply lines, no reliable power supply for a large number of distributed base stations, and high power consumption of a single station. While embracing opportunities, power supply manufacturers must also go beyond power supply. Consumption mark.

It is true that energy storage power supply can solve the problem of high power consumption of base station power supply on the surface, and bring development dividends to some energy storage power supply and its supporting industries. But this measure is not a cure-all.

In view of the high power consumption of 5G base stations, Zhongheng Electric adopts innovative fusion R&D technology to provide integrated solutions for equipment energy integration, energy simplicity and 5G-PAD intelligent energy products for 5G communications to achieve extremely fast 5G base stations. , minimalist and efficient website building.

As a manufacturer of magnetic components, Devis Electronics’ approach to solving power consumption mainly focuses on design processes and raw materials, especially magnetic core materials. Shao Guanghua said that they will often communicate closely with core manufacturers about their needs for reducing power consumption.

As a power supply manufacturer, Zhang Kebo said, "Our first priority is to find ways to improve the energy efficiency of switching power supplies. Secondly, it is to reduce the energy consumption of the air conditioning system. Not only our link, the entire industry chain must consider energy conservation."

From the perspective of basic components, Haiwu Technology mainly starts with materials and devices. For example, use low-power MOS tubes and diodes. The selection of magnetic cores and transformers must choose low-loss materials, which are generally in the direction of high energy efficiency.

He also said that if the power consumption is too extreme, the cost will increase significantly, so all parties are more likely to adopt a compromise approach to promote cooperation.

As an expert in "optical and magnetic", Mingpu Opto-Magnetic also has great achievements in 5G power supply solutions. In terms of 5G power supply system, Mingpu Opto-Magnetic has been researching and developing it since 2016, and it can be said to be an "expert" in power supply systems.

After unremitting efforts, Mingpu soon came up with its own 5G power supply solution. On the one hand,

uses high-power density and efficient power modules to reduce the size of the product, ensuring that the output power can be increased while maintaining the same volume; on the other hand,

develops a multi-energy hybrid power supply management system to meet the needs of users. The power supply needs of scenario 5G applications; at the same time, in terms of power management of the power supply system, innovative functions such as time-sharing power supply, input power limit, and peak shaving and valley filling have been added to make the 5G power supply solution more intelligent, more energy-saving, environmentally friendly, and all-round. Formally solve the power supply problem of 5G base stations.

Ye Zihong, R&D Director of Mingpu Opto-Magnetic Energy Division, said: "Mingpu Power Supply System has provided power supply products to more than 100,000 communication base stations in the three major operators and tower groups for many years, forming a complete product development system. Production system and service team."

Currently, Mingpu's 5G power supply system has been used in base stations in many 5G pilot cities such as Beijing, Shanghai, Guangzhou, and Shenzhen.

The 5G base station construction bow is not full of components and the "arrow" can still be wound

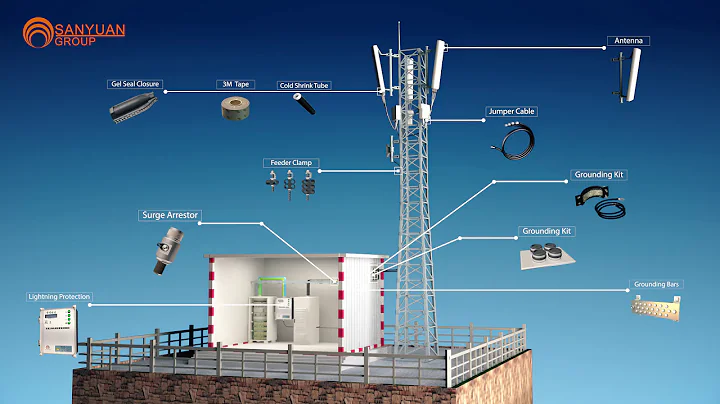

From the internal structure of the 5G base station power supply, it is mainly composed of basic components, batteries and other components. These basic components undoubtedly include passive components such as inductors, resistors, and capacitors. components, as well as many electronic transformers .

Huawei Power R&D Strategy Manager Jiang Guanghui said that 5G base station power supplies use a lot of magnetic components such as inductors and electronic transformers. They are basically used in every power supply, especially transformers, which are basically required for isolation. used.

Zhang Kebo said that the switching power supplies they mainly make for 5G macro base stations and some 5G micro base station power supplies require the use of a large number of magnetic components. This configuration is necessary. The main power board contains industrial mode inductors and differential mode power supplies. Inductors, and transformers.

Shao Guanghua said that in the 5G base station power supply market, many magnetic component manufacturers currently communicate with power supply manufacturers. According to him, DeVos is currently also a secondary supplier to an important domestic 5G base station power supply manufacturer. Their products mainly supply power supplies for 5G base station modules.

"New infrastructure", the coming wave of 5G commercialization, and the expansion of domestic demand during the epidemic have been affected by many external environments. The entire electronics manufacturing industry has all set its sights on 5G and its surrounding markets. For magnetic component manufacturers, 5G consumer terminals have not yet taken shape on a large scale. Before that, 5G infrastructure construction was a watchtower guiding magnetic component manufacturers to come ashore.

Based on this, some powerful, foresighted and well-known magnetic component manufacturers have already made plans in the 5G base station power supply and other markets.

Among them, companies that are deeply involved in the construction of 5G infrastructure naturally include the Mingpu Opto-Magnetic Company mentioned above. Ye Zihong said that Mingpu Opto-Magnetic will continue to conduct in-depth research on power supply system technology and provide a richer range of power supply system products based on the future technological development of 5G to meet the needs of more complex application scenarios.

It is reported that in terms of 5G base station power supply, Mingpu Opto-Magnetic mainly provides embedded power supplies, combined power cabinets, wrap-around power supplies, DC power supplies, DC integrated power supplies, wall-mounted power supplies and communication power modules.

However, from the perspective of Mingpu Opto-Magnetic’s main industry, whether it is in power supply, optical communication, or magnetic components, they can show their talents in 5G base station power supply and future 5G terminal commercial equipment or consumer terminals.

, as a subsidiary of Maijie Technology, Jinzhichuan, is supplying components such as base station power inductors and flat-panel transformers to Huawei and ZTE.

In the field of 5G base station business, Sunlord Electronics has participated in the pre-research of 5G projects very early. The company has been working closely on R&D cooperation with 5G base stations and mobile phone terminal customers. Sunlord Electronics can supply magnetic devices (including radio frequency and Power type) and microwave devices and other products, Sunlord Electronics has core customers in the industry chain and is continuing to increase the marketing of new products in the 5G market.

html In April, when answering questions from investors, Igor Company stated that the toroidal vertically wound power inductors produced by Igor are mainly used in energy storage devices, UPS power supplies, 5G communication power supplies and other power supply devices ranging from 1KW to dozens of KW. A kind of high frequency switching power supply equipment. html On May 15, Hengdian DMC stated on the investor interaction platform that the magnetic materials, circulators and other products they produce will be used in some new infrastructure industries, which will help positively promote the development of DMC-related industries.Ren Hailiang, general manager of Hengdian DMC, said at the event that the company was affected by the epidemic this year, and some product orders were canceled or delayed. This year, 5G construction was accelerated, and orders for related 5G products were saturated.

The construction wave of 5G base stations is still going on. Not only domestically, but many foreign countries are also accelerating the pace of construction. It is understood that the 5G power supply of power supply factory Costar has also been exported to South Korea.

Recently, Huizhou Customs announced that since this year, Huizhou companies have exported more than 200 batches of 5G base station supporting facilities, including more than 20,000 base station energy storage batteries and 48 base station power control systems.

In the future, domestic communication operators will also focus on purchasing power products from time to time. Some foreign countries are not to be left behind. They will pay attention to their country's 5G construction situation and adjust their procurement needs in a timely manner.

Regardless of domestic demand or foreign orders, power supply manufacturers that meet the requirements of operators are actually mainly concentrated in a few companies. Due to various considerations such as performance, delivery time, cost, etc., the basic components required by these power supply manufacturers can be sourced from more sources. Extensive, this is also the market that many magnetic cores, inductors, and electronic transformers are eagerly looking forward to.

The bow is not full, but the arrow can still be strung! Let’s see how the upstream component suppliers under the construction of 5G base stations aim at the bull’s-eye and make a profit!

This article is an original article by Big Bit Information. If you want to reprint, please indicate the source

before the article.