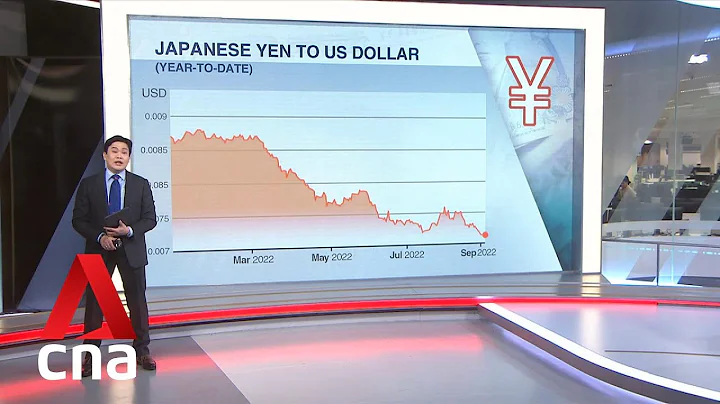

Foreign Exchange Sky Eye APP News: During the New York session on Monday (August 12), the U.S. dollar against the Japanese yen maintained a weak trend of shock and decline. During the day, the exchange rate of the currency pair hit a new low in seven months. Stock markets fell as concerns over a global economic slowdown boosted safe-haven demand for the yen, providing continued support, while expectations of a Fed rate cut put pressure on the U.S. dollar, which also put pressure on the U.S. dollar against the yen.

U.S. stock index futures fell on Monday, with the S&P 500 futures falling 0.72%, Dow futures falling 0.7%, and Nasdaq futures falling 0.79%.

Last week, the S&P 500 Index and the Nasdaq Composite Index recorded their largest single-day declines this year, falling 0.46% and 0.56% respectively during the week. The Dow once fell more than 900 points, the sixth largest single-day decline in the history of the Dow, and fell 0.75% for the week.

The CBOE Volatility Index (VIX), which measures market panic, once rose to 24.81, the highest level this year.

Investors continue to closely monitor signs that the U.S. economy may be in recession. In terms of the spread between the 3-month and 10-year U.S. Treasury yields, which are highly watched by the global market, the spread once reached 36 basis points, and the inversion has lasted for nearly two months.

In history, the inversion of the U.S. Treasury yield curve is a leading indicator of U.S. economic recession. At the same time, the yield curves of major Western economies such as the United Kingdom, Canada, and Germany have all shown an inversion trend, showing the market's consistent expectation that the global economy will enter a recession.

The Bank of Japan has little to do in the face of the appreciation of the yen

Some analysts believe that after nearly six years of large-scale stimulus, the Bank of Japan has few tools to effectively deal with the strengthening of the yen.

Shigeto Nagai, a former Bank of Japan official and Japan-based economist at Oxford Economics, warned of the risks of a rising yen. International trade frictions, Brexit, etc. may prompt global investors to turn to the safe-haven asset Japanese yen. But in his view, the Bank of Japan has few tools to effectively deal with a stronger yen after nearly six years of massive stimulus.

Nagai Shigeto said, "Of course, Bank of Japan Governor Kuroda Haruhiko will have to try to deal with it. The depreciation of the yen has strengthened the confidence of Japanese companies and is conducive to companies formulating long-term business plans. But he has stood aside while the yen strengthened. , is equivalent to confirming to business leaders that the central bank is powerless."

If the US dollar continues to fall against the yen, the Bank of Japan will undoubtedly be under the greatest pressure. This will force the Bank of Japan to take measures to curb further appreciation of the yen. However, in this round of global easing competition, the Bank of Japan, which already lacks further backup policy tools, is obviously very passive.

Japan's Ministry of Finance, Financial Services Agency and Bank of Japan have held an emergency meeting on the recent sharp rise in the yen, and stated that if the yen exchange rate continues to fluctuate excessively and poses a threat to Japan's export-oriented economy, the government is ready to respond. . But it is clear that Japanese companies are not reassured and have lowered their profit expectations for this year.

Institutions commented on the prospects of the Bank of Japan’s market intervention

At present, the Bank of Japan only stated that it is “prepared to deal with the impact of the continued appreciation of the yen on the Japanese economy.” When asked whether it would intervene in the yen exchange rate, the Bank of Japan No direct reply was given.

Well-known investment bank Goldman Sachs warned that if the U.S. dollar falls below 100 against the yen, it may trigger intervention by the Bank of Japan.

Kathy Matsui, chief Japan strategist at Goldman Sachs, said that the Japanese economic data released last Friday was good and the Bank of Japan may breathe a sigh of relief. But amid the current global uncertainty, the Bank of Japan will still have to "remain vigilant and be more prepared."

Kathy Matsui also pointed out that if market conditions deteriorate, the Bank of Japan's options are "very limited." Kathy Matsui said that if the dollar against the yen falls below the 100 mark, the Bank of Japan may be forced to take more action. The Bank of Japan can certainly lower its existing negative interest rates, but the Japanese banking industry will pay the price, and interest rate spreads that are already bad due to negative interest rates will further deteriorate.

Kathy Matsui believes that Japan may rely more on fiscal policy rather than monetary policy in the future, such as adjusting tax rates and fiscal spending to stimulate the economy.

Mitsubishi UFJ Financial Group (MUFG) also believes that the Bank of Japan is still in a passive response state. Once the U.S. dollar falls below the 100 level against the yen, it will force the Bank of Japan to introduce policies to calm the pressure of appreciation. The latest data from

Foreign Exchange Sky Eye shows that the US dollar is trading at 105.14/16 against the Japanese yen.