[Top left] Follow Red Weekly to get more high-quality content

Hello everyone, welcome to the new column "Lao Ma Tea Room" created by "Red Weekly"! I am an old horse. Due to the redesign of the column, we will share it every Sunday. Lao Ma works with you to discover investment secrets, look at the general trend, look at trends, and win the future.

The market temperature

A shares continued to rise in the first two days of this week, reaching 3400 points on Tuesday afternoon. After a slight rise on Wednesday, the volume fell back to 3361 points, and it rose again to above 3400 points on Thursday, but failed in late trading. Holding the 3,400-point integer mark, it closed negative due to the impact of the external market on Friday.

The Shanghai Index closed at 3387 points for the week, up 37 points or 1.13% from last week's closing. The Shenzhen Main Board was slightly stronger than the Shanghai Index. The Shenzhen Component Index rose 1.37% for the week. GEM and Science and Technology Innovation Board had slight adjustments. GEM Comprehensive The index fell 0.67%, and the Science and Technology Innovation Board 50 Index fell 1.13%.

The average daily trading volume of A-shares this week was 1.1954 billion yuan, an increase of 100 billion yuan from last week. In terms of the number of rising and falling stocks, there were 2,413 rising stocks and 2,225 falling stocks. The ratio of rising and falling stocks was about 1.1:1, basically half up and half down.

This is the performance of various markets this week:

![[Top left] Follow Red Weekly to get more high-quality content. Hello everyone, welcome to the new column](https://cdn-dd.lujuba.top/img/loading.gif)

A rare five consecutive positives appeared on the weekly chart of the Shanghai Stock Exchange Index. However, in terms of trading volume, it has been shrinking in the past two weeks.

![[Top left] Follow Red Weekly to get more high-quality content. Hello everyone, welcome to the new column](https://cdn-dd.lujuba.top/img/loading.gif)

The news that has a greater impact on the market mainly includes the following:

First, the Ministry of Finance issued the "Notice of the Ministry of Finance on the release of the local budget for additional subsidies for renewable energy electricity prices in 2022." Additional subsidies for renewable energy electricity prices in 11 provinces and autonomous regions including Shanxi, Inner Mongolia, Jilin, Zhejiang, Hunan, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Gansu, Qinghai and Xinjiang, totaling 2.755 billion yuan. Among them, wind power subsidies are 1.47 billion yuan, photovoltaic subsidies are 1.25 billion yuan, and biomass energy subsidies are 28.9 million yuan.

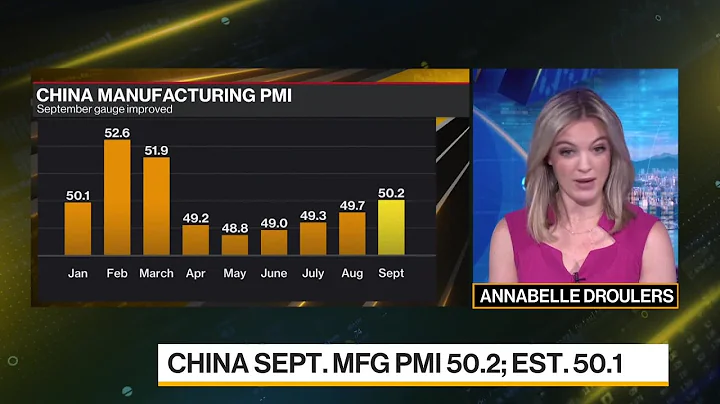

On Friday, the National Bureau of Statistics released data for June, in which the manufacturing purchasing managers index (PMI) was 50.2%, 0.6 percentage points higher than in May, ending the contraction trend in the previous three months and returning to expansion. interval. In June, the non-manufacturing business activity index was 54.7%, an increase of 6.9 percentage points from the previous month, returning to the expansion range. The non-manufacturing business boom level has rebounded significantly for two consecutive months.

Third, affected by poor economic expectations, European and American stock and commodity markets fell again this week. From Monday to Thursday, the Dow fell 2.3%, the S&P fell 3.23%, the Nasdaq fell 4.99%, Germany fell 2.55%, and France fell. 2.48%. In the commodity futures market, Lun zinc, Lun aluminum, Lun nickel, Lun copper, and Lun lead have closed negative for four consecutive weeks, all hitting new lows for the year. Affected by the external market, most domestic commodities fell, which had a greater impact on related sectors of A-shares.

In terms of exchange rate , the exchange rate of RMB against the US dollar continues to build a platform near 6.7, while the exchange rates of the euro, pound and Australian dollar against the US dollar fell again this week. The reason why the U.S. dollar is still showing strong performance after a sharp interest rate hike may be related to the following news: The latest data released by the International Monetary Fund shows that at the end of the first quarter of this year, the RMB accounted for 2.88% of global foreign exchange reserves. The month-on-month rate was higher than the 2.79% in the fourth quarter of last year, and the year-on-year rate was higher than the 2.5% in the same period last year, setting a new high and ranking fifth in the world.

The Shanghai Composite Index was blocked above the 3400-point platform, showing obvious signs of slowing down, and there is a possibility of adjustment in the near future.

![[Top left] Follow Red Weekly to get more high-quality content. Hello everyone, welcome to the new column](https://cdn-dd.lujuba.top/img/loading.gif)

Among the top ten industries that contributed to the Shanghai Stock Exchange Index this week, cyclical industries such as beverage manufacturing and coal mining accounted for 6, and their performance was significantly stronger than growth industries such as semiconductors, and cyclical industries once again dominated.

![[Top left] Follow Red Weekly to get more high-quality content. Hello everyone, welcome to the new column](https://cdn-dd.lujuba.top/img/loading.gif)

Most of the top ten industries that drag down the Shanghai Stock Exchange Index are also cyclical industries, such as securities, insurance, steel, etc., indicating that the market is divided.

![[Top left] Follow Red Weekly to get more high-quality content. Hello everyone, welcome to the new column](https://cdn-dd.lujuba.top/img/loading.gif)

Other indexes performed differently. The Shenzhen Component Index continued to rise after breaking through the upper edge of the range; the ChiNext Index was blocked at the high point in March, shrinking and gathering momentum; the Science and Technology Innovation Board Index continued to trade sideways within the shock range. tidy.

attitude

The top ten sectors with the highest gains this week are as follows. Sector rotation is still the main feature of the current market.

![[Top left] Follow Red Weekly to get more high-quality content. Hello everyone, welcome to the new column](https://cdn-dd.lujuba.top/img/loading.gif)

Although A shares continued to rise this week, the fluctuation range of the Shanghai Stock Index expanded upward to 3417 points. However, it can be seen that the growth rate has slowed down, and the market has become more differentiated. Many sectors and stocks have fallen sharply after a short period of speculation. Lao Ma believes that the current market will still be dominated by range fluctuations.

Laoma recommends taking a 3-4 position to participate in active theme sectors and individual stock prices. The market is about to enter the mid-term report hype season. It is recommended to focus on the pre-increased topics of the interim report. For example, the energy and metal sector index in the picture below continues to rise this week. It is ahead of . The broader market hit a new high for the year, and it is in line with the mid-term performance of constituent stock . It is related to the expected performance increase.

![[Top left] Follow Red Weekly to get more high-quality content. Hello everyone, welcome to the new column](https://cdn-dd.lujuba.top/img/loading.gif)

Similar sectors include lithium mine , phosphorus chemicals, photovoltaic equipment, beverage manufacturing, etc.

The last sentence: The market is divided, pay attention to the pre-increase in shares in the interim report.

The article involves stocks, which are only used as examples for article writing and are not investment recommendations. Some data come from Wind.

Follow "Red Weekly", Lao Ma will meet you here every Sunday!

[Heart] Welcome to like and share~

![[Business Daily] Ep.631 - China fossil fuel ban / Thriving web portals _ Full Episode - DayDayNews](https://i.ytimg.com/vi/I4PeyuuirbU/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLDOZyvYuyDAd-slRYNCfUgIY9bm-A)

![[Business Daily] Ep.614 - Hole-in-the wall eateries / Korea-China economic ties _ Full Episode - DayDayNews](https://i.ytimg.com/vi/Y3D5FRM0DlA/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLCiEANA5g4WhxQwSzNh_z6U9OWmdg)

![[Business Daily] Ep.633 - Collaborative robots / Stock market overlook _ Full Episode - DayDayNews](https://i.ytimg.com/vi/uTe3I3m2EXw/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLBFaIpOOCak3L8DUqJ_yebOHfRFZg)