exceeds 72%, the system energy density can reach 255Wh/kg, the vehicle can achieve 1,000 kilometers of battery life, 10-minute fast charging, and mass production in 2023. Judging from the information recently released by CATL , Kirin battery is CATL’s third-generation iterative technology of CTP has achieved comprehensive improvements in battery life, fast charging, safety, lifespan, efficiency and low-temperature performance. At present, car companies such as Ideal, Lotus and have revealed their interest in using this battery.

html On June 25, at the Chongqing Auto Show, CATL Chairman Zeng Yuqun also said that in addition to all-solid-state batteries and semi-solid-state batteries, CATL is also developing new condensed matter batteries. Previously, relevant people from CATL pointed out that the company held at least 4 press conferences this year to introduce innovations in business models, battery structures, chemical systems, etc.

html On June 25, at the Chongqing Auto Show, CATL Chairman Zeng Yuqun also said that in addition to all-solid-state batteries and semi-solid-state batteries, CATL is also developing new condensed matter batteries. Previously, relevant people from CATL pointed out that the company held at least 4 press conferences this year to introduce innovations in business models, battery structures, chemical systems, etc. Since the beginning of this year, as the market competition for new energy vehicles has intensified, the degree of "involution" of the power battery industry has also intensified significantly. GAC Aion LX Plus equipped with "sponge silicon negative electrode battery technology" has become the first mass-produced model with a range of more than 1,000 kilometers. Tesla's 4680 battery, which has been popular for nearly two years, is officially "on the road" at the Berlin factory, Leapmotor released MTC plan, BYD launched CTB technology, SAIC Group released Rubik's Cube battery...

"We also have new plans to release in the second half of this year." An insider from a power battery company ranked among the top 10 in installed capacity told First Financial reporter said. .

Many aspects of "bayonet fighting"

Before the official release of Kirin battery, CATL experienced a long period of weakness in the first half of this year, and its market value once fell below one trillion yuan. Second-tier brands continue to break through and car companies are "going to Ningxia." Behind these difficulties faced by the CATL era is the rising smoke in the power battery industry.

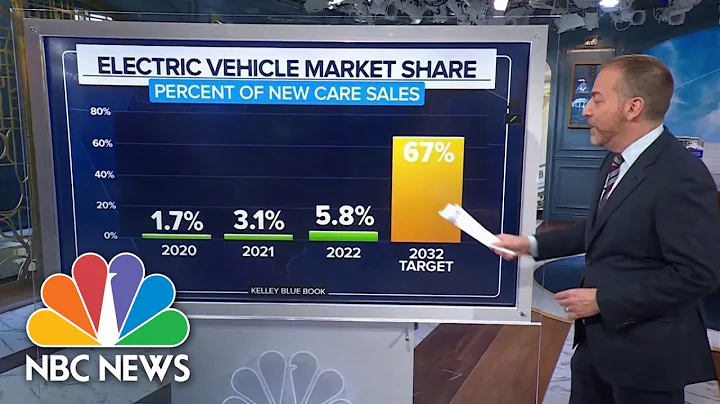

Data from the China Automotive Power Battery Industry Innovation Alliance show that CATL’s market share has been above 50% for two consecutive years, accounting for half of China’s power batteries. But since this year, the status of "Ning King" has been shaken. In the first five months, the market share of CATL's power battery installed volume fell to 47.05%, a drop of more than 5 percentage points compared with last year's market share (52.1%).

BYD, which ranked second, increased its market share to 22.58% in the first five months of this year, an increase of 6.38 percentage points compared to last year’s market share (16.2%). In April this year, BYD also overtook CATL in terms of market share of lithium iron phosphate battery with its " blade battery ".

Between advances and retreats, in mid-June, BYD's market value exceeded one trillion, and there were rumors of a dispute between "Ning Wang" and "Di Wang" in the market.

Until recently, CATL finally revealed its secret weapon. The innovation of Kirin battery this time mainly focuses on structural innovation. The original independent designs of horizontal and longitudinal beams, water-cooling plates and thermal insulation pads are eliminated and integrated into a multi-functional elastic sandwich. Through the world's first large-area cooling technology for battery cells, Kirin batteries can support 5 minutes of fast hot start and 10 minutes of fast charging.

From the preliminary indicators released by CATL, Kirin batteries surpass BYD's "blade batteries" in terms of volume utilization, system energy density, heat dissipation, and fast charging.

As for the Tesla 4680 battery, CATL is already full of "gunpowder" on the surface. As early as the preheating stage, CATL has repeatedly stated in public that under the same chemical system and the same battery pack size, the power of the Kirin battery pack is 13% higher than that of the 4680 system.

First Financial Chart

CATL has started a direct “fight” with its major customer Tesla . This may be directly related to the competition it faces. Panasonic is the earliest battery supplier that Tesla cooperates with, and it is also the fastest company in the 4680 battery layout. At the end of February this year, Panasonic announced that it would start supplying 4680 batteries to Tesla in 2023 and take the lead in mass production in Wakayama Prefecture, Japan. It also plans to build a factory in the United States. CATL obviously hopes that Kirin batteries can compete with 4680 batteries and continue to win Tesla's favor.

In addition to product roll-up, power battery companies are also accelerating the "roll-up" of production capacity in the first half of this year.According to incomplete statistics from Qidian Lithium Battery Big Data, in the first quarter of this year alone, battery companies such as BYD, Xinwangda , China New Aviation, Yiwei Lithium Energy , Gateway Power have successively announced multiple new investment and construction projects. , the overall investment and construction capital is as high as 228.77 billion yuan, and the annual construction capacity reaches 620GWh.

After completing the ramp-up of production capacity of CATL’s existing power battery production lines, the total designed annual production capacity will reach 260GWh~280GWh. In addition, coupled with the newly added annual production capacity of 353GWh, it is expected that by 2025, CATL’s cumulative annual production capacity will reach 613GWh ~633GWh.

This is not because competition in domestic power batteries has intensified. Panasonic and LG New Energy, which have long occupied the top three positions in global power battery installations, are also coveting the dominance of CATL.

It is reported that LG New Energy is expected to increase global battery production capacity to 520GWh by 2025, an expansion of 1.6 times compared with 200GWh at the end of this year. The expansion rate of production capacity in the next three years will be slightly faster than that of the CATL era. Panasonic announced in early June that by 2028 (fiscal year 2029), the company plans to expand its annual power battery production capacity to approximately 200GWh, which is four times the current annual production capacity of 50GWh, and is mainly concentrated in the North American market.

Zeng Yuqun said at an investor event in May this year that the expansion of power battery production capacity requires huge financial support. At present, peers are frequently announcing hundreds of GWh of production capacity planning , which requires hundreds of billions of capital investment, so it still depends on the final implementation. Condition. At the same time, we also need to look at the compatibility between products and technologies that will be continuously updated in the future and existing processes and equipment.

On the evening of June 22, CATL just announced that 45 billion yuan in raised funds has been received. These funds will mainly be used to expand power battery production capacity.

In April this year, Panasonic issued a statement that it plans to invest approximately 20.5 billion yuan in "growth areas" including electric vehicle battery cells from 2022 to 2024. It will also invest in hydrogen energy led by An additional investment of nearly 10.2 billion yuan was made in the “technical pillar” area.

In July last year, LG also stated that it would invest nearly 85 billion yuan in the battery field in the next 10 years, of which nearly 64.5 billion yuan will be used to develop next-generation battery technology, ensure the establishment of the production technology required for smart factory , and add production lines. More than 14 billion yuan will be used to develop cutting-edge battery material technology and expand battery cathode material production capacity.

The era of energy density involution has passed?

For a long time, in order to solve consumers' "range anxiety" problem about new energy vehicles, competition among power battery companies has mainly focused on improving energy density.

Kirin battery also takes its energy density as the focus of publicity, highlighting the highlight of "it can easily achieve 1,000 kilometers of battery life for the entire vehicle." Many netizens left messages on public channels, saying, does this mean that the era of electric vehicles has truly ended and fuel vehicles have come?

But in fact, new energy vehicles with a range of more than 1,000 kilometers have already been launched. At the beginning of this year, GAC Aion LX Plus was officially launched. Equipped with self-developed "sponge silicon negative electrode battery technology", the car has a maximum range of 1,008 kilometers. However, after subsidies, the price is as high as 459,600 yuan, which is 600 yuan more than its 600-kilometer equivalent. The model with a mileage range is 173,000 yuan higher. Data shows that this year, AION LX Plus’s monthly sales have not exceeded 500 units, and it has not caused waves in the market.

In addition to GAC Aion, as early as the beginning of last year, NIO also released a 150kWh semi-solid battery pack that can give the ET7 a endurance of over 1,000 kilometers. The expected delivery time is the fourth quarter of this year. At present, the price of the ET7 with a battery life of 1,000 kilometers has not been announced, but the price of the ET7 with 100kWh and a battery life of 675 kilometers has been as high as 536,000 yuan.

The deputy general manager of a new energy vehicle brand said in an interview with China Business News that 1,000 kilometers of battery life is more like an "arms race" between companies to show that they have leading technology. In fact, new energy vehicles A cruising range of 700 kilometers is sufficient.

Tesla CEO Musk also said in March this year that Tesla could make the Model S with a range of 600 miles (965 kilometers) a year ago, but due to concerns about resource utilization, vehicle control, and acceleration experience After comprehensive consideration of other factors, he believes that ultra-long-range electric vehicles are no longer meaningful, and even a range of 400 miles (approximately 644 kilometers) is enough for most people.

In addition to improving energy density, Tesla's 4680 battery pays more attention to cost reduction. It is expected that the new battery can increase the vehicle's cruising range by 16% and reduce the cost by 14%. This will be combined with battery factory planning and positive and negative electrode material research and development. In full cooperation with battery vehicle integration and other dimensions, Musk estimates that the cost per KWh of new batteries can be reduced by 56%.

Wang Chuanfu, chairman of BYD, is also very concerned about cost. He said at the China Electric Vehicles Conference of 100 forum held at the end of March this year that the cruising range has now crossed the stage threshold, and the battery energy density will increase in the future. The importance will continue to decrease, and safety, cost and cycle life may become the most important considerations.

"At present, the breakthrough of power battery material system has encountered a big bottleneck. Nowadays, the innovation in the industry is mainly focused on structural innovation, and the marginal benefit of structural innovation is getting smaller and smaller." Inside a power battery company Managers told reporters that the difficulty in making upward breakthroughs has caused the current phenomenon of horizontal involution, and that this phenomenon may continue to exist in the next 10 years.

600 kilometers of battery life, coupled with the increasingly mature fast charging system in the future, can basically solve the problem of consumers' mileage anxiety. The above-mentioned personnel said that future batteries will pursue fast charging, convenience and flexibility, and battery companies are more likely to go Differentiated routes.