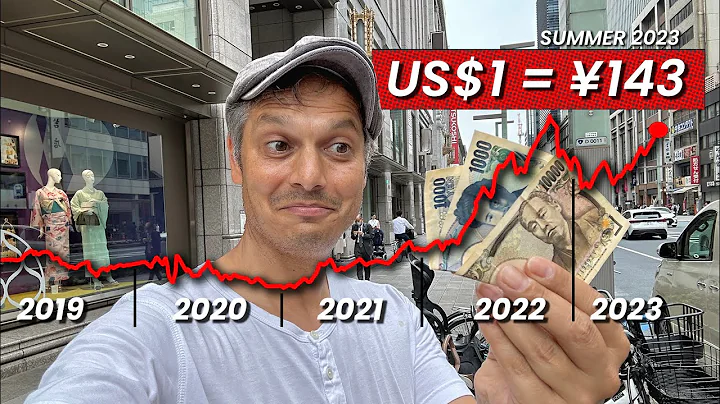

yen should be "falling in love" with speculators. Depreciation accelerated again today. The Japanese yen exchange rate fell below 1 US dollar = 139 yen again for the first time in about 24 years, with a minimum of 139.389 yen.

When converting to RMB, the Japanese yen is also miserable. 100 yen can only be exchanged for about 4.85 yuan. I remember that around 2012, 100 yen could be exchanged for about 8.3 yuan. If you deposited 410 million yen into Bank of Japan at that time, and withdraw it now, you will lose 345,000 yuan directly. What a big loss.

Why can’t the Japanese yen stop depreciating?

According to analysis, there are two main reasons:

First, the Japanese Liberal Democratic Party won a big victory in the Senate election. The previous Liberal Democratic Party was worried that the depreciation of the yen would affect the vote no longer exists. This made speculators excited and began to challenge the Japanese government's tolerance for the depreciation of the yen. Some analysts say that the Japanese government will have to wait until 1 US dollar = 147 yen to intervene in the yen exchange rate. The second reason is that the inflation of in the United States is accelerating . The US consumer price index released the day before rose by 9.1%, which is a new high since 40 years. The foreign exchange market believes that the Federal Reserve will raise interest rates by 41% at the end of July, instead of the 0.75% currently expected. The interest rate gap between Japan and the United States has further widened, so the speculative nature of selling Japanese yen and buying US dollars has increased.

Specifically today, especially after 3 pm Japan time, in just a few hours, the Japanese yen fell by more than 1 yen against the US dollar. Market stakeholders said that everyone firmly believed that Japanese Prime Minister Kishida, at the press conference held at 6 p.m., could do nothing to prevent the rapid depreciation of the yen, so the historic depreciation of the yen was accelerating.

As expected, Kishida only focused on the epidemic. I don't care about the depreciation of the yen.

The yen has plummeted like this, which is great for students studying in Japan. For example, the tuition fee is 1 million yen, which is only 48,500 yen when converted into RMB. This is more than 1/3 cheaper than a few years ago. Before the epidemic, it roughly cost 65,000 yuan.

Xiao Huan, who just arrived in Japan to study abroad a few days ago, was very happy. The depreciation of the yen allowed him to save a lot of tuition fees. In addition, his parents' income is good, which is more than enough to pay for his stay in Japan. He said: I told my parents before that I wanted to work in Japan? My mother directly rejected it, which may be due to the depreciation of the yen. Of course, many Chinese in Japan are very uncomfortable with the depreciation of the yen. For example, technical trainees. After working for several years, the yen I finally saved was pitifully small when converted into RMB.

Lin Yun (pseudonym) will return to China at the end of this month. She said: "The yen has depreciated in the past few years, which is a big loss. Saving 1 million yen a year is less than 50,000 yuan."

She said that if she never comes to Japan again and suffers, she might as well work in China. .

How long will the yen depreciate?

Some analysts said that this depends on the financial policies of the Bank of Japan and the Federal Reserve. If the Bank of Japan stops its financial easing policy and raises interest rates, or the Fed raises interest rates less than expected, the yen may turn around and enter an upward trajectory. (This article is for reference only and cannot be used as a basis for buying or selling Japanese yen, etc.)