Attention! Existing mortgage contracts across the country have begun to be “re-signed”!

Which loans need to be converted?

Loans that need to be converted should meet the following three elements at the same time:

1. Loans that have been issued before January 1, 2020, or loans that have been signed but have not been issued;

2. The reference is the loan benchmark interest rate pricing;

3. The loan is originally a floating interest rate Priced.

Which loans do not need to be converted temporarily?

The following three situations do not need to be converted at present:

1, provident fund personal housing loans;

2, personal housing loans due before December 31, 2020;

3, policy loans, such as national student loans, small guaranteed loans for laid-off and unemployed people wait. When will the conversion of

be completed? The conversion time for

will start on March 1, 2020, and will in principle be completed before August 31, 2020.

Some banks will start the conversion at the end of March or early April, and some banks have not yet determined the start time of the conversion. Customers will be notified via text messages, phone calls, etc.

How should I choose the loan interest rate?

Regarding which loan interest rate method should be chosen, we cannot absolutely determine that interest rates will continue to decrease in the future. We can only speculate from historical changes and international conditions. In the medium and long term, the overall interest rate trend is downward.

For a detailed analysis of the trend of mortgage interest rates and the calculation method of LPR points, you can refer to this article we have published before (click to read): The new mortgage interest rate policy only gives you one chance, don’t hesitate, choose it!

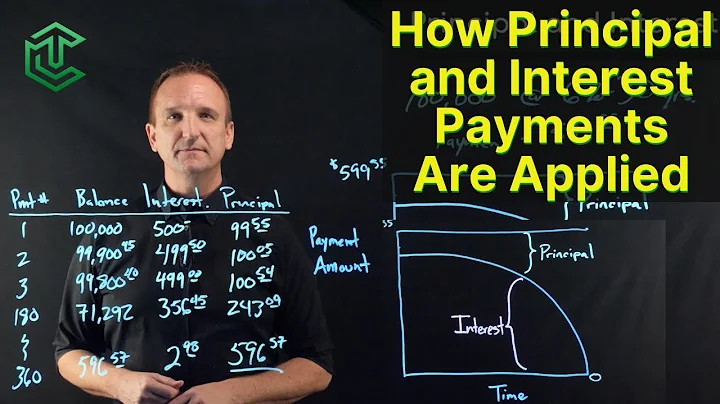

Let’s look at a picture:

Because the added points are fixed and only the LPR changes, so assuming that the LPR drops to 4% or rises to 5% in the future, the corresponding loan interest rate can be calculated: If the interest rate goes down, the peg The floating interest rate of LPR is obviously more economical; if the interest rate rises, the monthly mortgage payment will increase.

This is a game. In the future, LPR may decrease, or it may rebound and increase. However, in the long term, a downward trend is more likely. Therefore, our suggestion is:

1. If the previous loan interest rate discount is large, such as 15% off or 30% off, and the loan repayment period is only about 5 years, you can choose a fixed interest rate , which is more secure, after all, the interest rate The downward trend is formed slowly;

2. If the discount is small or even upward, and the loan period is more than 5 years, you can choose the LPR interest rate , which will give you a greater chance to enjoy the dividends brought by the interest rate changes. .

Detailed explanation of the conversion methods of each bank

At present, the four major banks and other commercial banks have introduced the latest conversion methods, and many friends are consulting about the conversion method of Bank of Chengdu. Below we have sorted out the most popular conversion methods for you. Here are the operating details of some banks, I hope they can help you:

Bank of Chengdu

Conversion time: March 1, 2020 - August 31, 2020

Processing channels:

1, mobile banking (expected to be online in late March)

Use the mobile banking APP for self-service processing. The bank will push detailed operation guides after the conversion function module is online.

2. Loan agency

contact the loan agency to make an appointment and then handle it offline. Offline processing requires the main borrower and co-borrower to bring their valid identity documents and go to the loan agency at the same time. If an agent is entrusted to handle the matter, the entrusted agent shall hold the original copy of his/her valid identity document and the original notarized power of attorney from the principal.

ICBC

Conversion time: March 1, 2020 - August 31, 2020

Processing channels: Customers can apply through ICBC mobile banking, smart teller machines, loan service banks and other channels.

Attention! As for offline processing, you can choose any nearby ICBC loan service bank to make an appointment after the epidemic is over, and there is no need to go to the original loan handling bank.

Agricultural Bank of China

Conversion time: March 1, 2020 - August 31, 2020

Notification method: Notify

by SMS, etc. Processing channel: Customers handle it through the self-service operation of mobile banking. In the future, online banking, self-service processing at branch super counters and manual processing at branch counters will be added.

Bank of China

Conversion time: March 1, 2020 - August 31, 2020

processing channel: From 7:00 on March 1, you can apply through mobile banking and online banking; depending on the epidemic prevention and control situation, Offline acceptance channels will be reopened.

China Construction Bank

Conversion time: March 1, 2020 - August 31, 2020

processing channels: mainly mobile banking and online banking. In the future, based on the progress of epidemic prevention and control, offline channels will be gradually opened to support customers to handle business at smart teller machines (STM), counters, and personal loan centers at any CCB branch nationwide. The specific opening time will be notified separately.

Bank of Communications

Conversion time: Officially launched on March 1, 2020.

Processing channels: For personal loans that meet the requirements announced by the People's Bank of China, and the remaining term is more than 1 year, customers can log in to the mobile banking loan section to self-convert.

Postal Savings Bank of China

Conversion time: March 1, 2020 - August 31, 2020

Processing channels: Online banking, mobile banking or contact the original loan business agency. Customers can check the details of the existing loan business by themselves and provide the required information For businesses that convert pricing bases, negotiate with our bank for specific conversion terms.

China Merchants Bank

Conversion time: Unified switch to

in early April Notification method: Notify you of this floating rate loan pricing benchmark conversion through one or more of China Merchants Bank App, China Merchants Loan App, SMS, email, etc. announcement of.

Processing method: The bank will uniformly convert the pricing benchmarks of commercial personal housing loans within the conversion range to LPR.

If you do not want to make the switch and still maintain the original contract arrangement, please contact the post-loan service center of each branch of China Merchants Bank to apply for processing before August 31, 2020.

Minsheng Bank

Conversion time: from March 1, 2020 to August 31, 2020

Processing channels: In addition to counter processing at business outlets, adjustment methods such as remote face-to-face interviews and online signing of mobile banking are also available, including mobile phone The opening time of the bank's online contract signing service will be announced separately.

China Everbright Bank

Conversion time: July 21, 2020 Batch conversion

Notification method: Release this announcement through portal websites, business outlets, mobile banking, personal online banking, etc.

Processing channels: No comments during the announcement period, it will be announced in 2020 On July 21, 2020, the pricing benchmark for individual floating-rate housing loans will be converted in batches.

If you do not agree to the conversion, you must log in to China Everbright Bank Online Banking (Professional Edition) or China Everbright Bank Mobile Banking APP (Professional Edition) to sign the "RMB Personal Stock Floating Rate Housing Loan" from the time specified by the bank to August 31, 2020. Confirmation of Opinions on Conversion of Pricing Baseline" shall be registered.

Industrial Bank

Conversion time: If the personal loan pricing benchmark interest rate conversion supplementary agreement has not been signed and confirmed as of July 31, 2020, the existing personal loans will be converted in batches with reference to the common practice in the banking industry.

processing channels: Sign and confirm the loan pricing benchmark interest rate conversion supplementary agreement through business outlets, mobile banking, online banking and other channels. Among them, mobile banking, online banking and other channels will carry out pricing benchmark conversion work from April 15, and business outlets will take into account the control situation of the new crown pneumonia epidemic.

Hua Xia Bank

Conversion time: Pricing benchmark conversion channels such as mobile banking will be gradually opened to handle business at the end of March.

processing method: Business outlets will carry out pricing benchmark conversion in a timely manner based on the control situation of the new coronavirus epidemic. At that time, customers will be notified through website announcements, phone calls, text messages, mobile banking and other channels.

CITIC Bank

conversion time: March 1, 2020 - August 31, 2020

processing method:

1, online processing time is as of July 21, 2020, offline processing time is as of August 31, 2020

2. On July 21, 2020, commercial personal housing loans that have not been converted will be uniformly adjusted to LPR floating interest rate pricing in accordance with standardized conversion rules. If you have any objections, you can negotiate with us through "offline processing".

Judging from the published operation plans, China Merchants Bank, China Everbright Bank and China CITIC Bank are the most worry-free. As long as customers choose the LPR interest rate method, they do not need to perform any operations, and the banks will convert them in batches. The current main conversion processing channels of other banks are mobile banking. As the epidemic ends, they will gradually start over-the-counter processing at branches. The conversion work will take a slightly different time. However, don’t worry, all conversions must be completed. It will last until the end of August!