Yangtze Business Daily Reporter | Ming Hongze

"riding on" the new energy vehicle concept Dongfeng , the stock price of Heli Technology (603917.SH) is soaring.

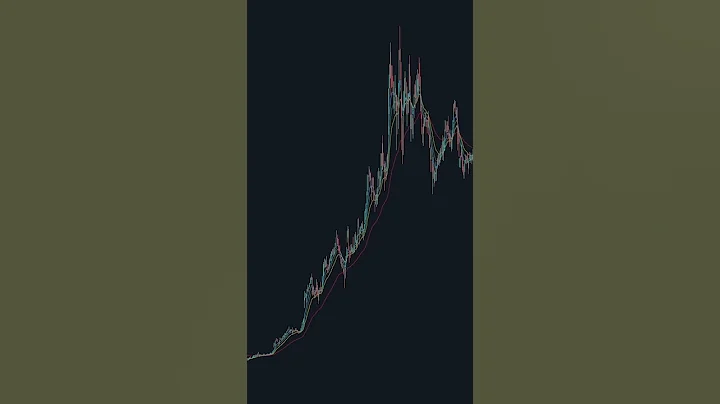

html On the evening of June 28, Heli Technology issued a stock trading risk warning announcement. The stock price has increased by 46.45% in the past four trading days. The company said that the short-term stock price has increased significantly, but the company's fundamentals have not changed, and investors need to pay attention to risks.K line chart shows that in the two months since April 27 this year, the share price of Heli Technology has risen from about 11 yuan/share to 24 yuan/share, more than doubled.

This is the second round of sharp surge in stock prices in the past year. In November last year, the share price of Heli Technology soared from about 11 yuan per share to a maximum of 27.97 yuan per share, more than doubling.

What’s interesting is that before the stock price rose sharply for two rounds, the actual controller of Heli Technology chose to transfer 11% of the shares at a low price, cashing out only 167 million yuan. At that time, the company stated that the actual controller agreement transfer was to optimize the equity structure.

In fact, the actual controller's substantial reduction in holdings may have something to do with the company's poor operating performance. From 2019 to 2021, Heli Technology’s net profit after deducting non-recurring gains and losses (referred to as “non-net profit”) attributable to shareholders of listed companies has declined for three consecutive years. In the first quarter of this year, the net profit after deducting non-recurring profits fell again .

The stock price has soared, and the directors may cash out

Recently, new energy vehicles have become the most beautiful companies in the A-share market.. Heli Technology also benefited significantly from this. The

K line chart shows that on April 27 this year, Heli Technology’s stock price was as low as 10.01 yuan/share and the closing price was 11 yuan/share, an increase of 4.76%. Since then, the stock price has been rising all the way. On June 2, the stock price hit the daily limit, rose 7.05% on the 6th, and continued to hit the daily limit on the 10th and 13th. Compared with the moderate rise some time ago,

started to rise crazily on June 23. In the four trading days from June 23 to 28, Heli Technology closed four consecutive daily limits, with a cumulative increase of 46.45% in the four trading days.

html On June 29, Heli Technology issued a warning announcement on stock trading risks, stating that the company’s stock trading prices fluctuated greatly in the short term, but there were no major changes in the company’s fundamentals, and there was no major undisclosed information that should be disclosed. As of the close of trading on June 28, the company's stock price had a rolling price-to-earnings ratio of 84.60 times.According to the latest price-to-earnings ratio data released by China Securities Index Co., Ltd. official website, the rolling price-to-earnings ratio of the company's industry "special equipment manufacturing" is 31.56 times, and the rolling price-to-earnings ratio of "automobile manufacturing" is 32.07 times. The company's current rolling P/E ratio is significantly higher than that of its peers. A sharp rise in the stock price of

often leads to reduction of holdings and cash out. Heli Technology announced that on March 26, the company disclosed the "Announcement on Directors' Plan to Reduce Shareholdings through Centralized Bidding". The company's director Wu Zhengui plans to reduce the company's stock holdings by no more than 29.22% through centralized bidding from April 20th to October 19th this year. Ten thousand shares, the reduction ratio shall not exceed 0.1864% of the company’s total share capital. There is the possibility of reducing the company's stock holdings in the future.

If calculated based on the closing price of 24.97 yuan/share on June 28, if Wu Zhengui reduces his holdings, he will cash out 7.2962 million yuan.

In the two months since April 27 this year, Heli Technology’s share price has risen from 10.50 yuan/share to 24.97 yuan/share, a cumulative increase of 137.81%.

Why did the stock price soar this time? Market participants believe that this is due to the surge in new energy vehicle concepts. Since April 27 this year, Zhongtong Bus has experienced a cumulative increase of nearly 4 times.

html On June 27th and 29th, Heli Technology continued to appear on the Dragon and Tiger list. In the past two days, institutions were among the top five in trading volume. This shows that it is not just hot money speculation.A reporter from the Yangtze River Business News found that in the past year, Heli Technology’s stock price has staged two rounds of rapid rises.

On November 2 last year, the closing price of Heli Technology was 11.27 yuan/share, an increase of 0.99%. Since then, the stock price has risen rapidly, reaching the daily limit on November 3, 8, 9, 12, 16, and 17. By December 1 last year, the stock price reached a maximum of 27.97 yuan per share, with a cumulative increase of 148.18%.

At that time, the company stated in the stock trading risk warning announcement that the company’s main products were automotive molds and aluminum alloy parts, which were not directly related to new energy vehicles. There were no major customers that solely produced new energy vehicles. The company indirectly supplied new energy vehicles. The product revenue of energy vehicles is very small.

Interestingly, on September 17 last year, Heli Technology’s controlling shareholders and actual controllers Shi Liangcai, Fan Kaishu, Shi Yuanzhi, Shi Dingwei, Cai Zhenxian, He Chaoyang and Yang Weiben, a shareholder holding more than 5% of the company’s shares, planned to transfer to Heli Technology through an agreement. Fuzhou Development Zone Zhongqing Fund Management Co., Ltd. (on behalf of the "Zhongqing New Energy Strategic Investment No. 1 Private Equity Investment Fund" to be established and managed, referred to as "Zhongqing Fund") and Shanghai Daixi Investment Management Co., Ltd. (on behalf of its The "Dai Xi Strategic Emerging Industry Growth No. 1 Private Securities Investment Fund " to be established and managed (hereinafter referred to as "Dai Xi Investment") will transfer a total of 17.248 million shares of the company (accounting for 11% of the company's total share capital). The transfer price of

is 9.68 yuan per share, and the total transfer price is approximately 167 million yuan. This transfer price is basically the average price of Heli Technology from the beginning of 2019 to September 2021.

Single champion company’s net profit is in reverse

Heli Technology’s stock price has soared, but its net profit is declining. There is a serious deviation between the two.

Heli Technology is mainly engaged in the research and development, design, manufacturing and sales of automotive casting molds, hot stamping molds, aluminum alloy parts and automotive braking systems . The company said that it adheres to its main business and focuses on new energy and lightweight layout, forming three major business segments: molds, aluminum alloy parts and Heli brakes, providing various types of aluminum products to domestic and foreign customers in the fields of automobiles, rail transit, mechanical engineering and other fields. One-stop service for alloy and high-strength steel mold development, product manufacturing, material research, and technical support. The company said that it designs and manufactures various types of large-scale integrated die-casting molds, thermoforming stamping molds, low-pressure casting molds, gravity and tilt casting molds, molding lines, hot and cold core boxes and other tooling, etc., and has ranked first in the domestic market share of casting molds for many years. At the forefront, it has a strong competitive advantage.

In its financial report, Heli Technology claims to be the leading domestic supplier of large-scale high-end precision molds and components, and the national manufacturing champion.

However, such advantages have not been translated into real business performance. From 2014 to 2016 before

was launched, Heli Technology achieved operating income of 330 million yuan, 385 million yuan, and 456 million yuan respectively, with year-on-year growth rates of 33.42%, 16.67%, and 18.67%. The corresponding net profits were 59 million yuan, 74 million yuan, and 78 million yuan, with changes of 45.24%, 24.35%, and 6.14%.

In December 2017, Heli Technology landed on the A-share market. In the year of listing, its operating performance continued its growth momentum. Its operating income and net profit were 539 million yuan and 82 million yuan respectively, a year-on-year increase of 18.22% and 4.35%. In 2018, its operating income and net profit were 610 million yuan and 98 million yuan respectively, a year-on-year increase of 13% and 19.56%.

Starting from 2019, Heli Technology’s operating performance began to reverse. From 2019 to 2021, the company achieved operating income of 720 million yuan, 717 million yuan, and 704 million yuan respectively. In 2020 and 2021, the operating income continued to decline slightly year-on-year. In the past three years, the company's net profits were 84 million yuan, 84 million yuan, and 65 million yuan respectively. In 2019, it dropped 14.29% compared with 2018. The net profit in 2020 was basically the same as that in 2019, and in 2021 it dropped 22.98% year-on-year. . Net profits after deducting non-profit items were RMB 66 million, RMB 65 million, and RMB 43 million respectively, with year-on-year changes of -23.23%, -1.30%, and -32.47%.

In the first quarter of this year, this downward trend continued. The company's operating income was 133 million yuan, a year-on-year decrease of 13.44%. The net profit and non-net profit were 12 million yuan and 50 million yuan respectively, a year-on-year decrease of 22.46% and 54.09%.

The above data shows that from 2019 to 2021, the company's net profit and non-net profit are lower than those in 2018, and the net profit after non-profit in 2021 is even lower than the 55 million yuan in 2014, and the operating performance is very obvious.

Yangtze River Business News APP

Yangtze River Driving Force Economic Wind Vane

Exclusive in-depth recommendation: