Real estate policies in various places continue to be relaxed. After lowering mortgage interest rates and down payment ratios, another place is trying to cooperate with banks to meet the needs of citizens for purchasing houses by adding new mortgage repayment methods. Recently, Wenzhou Municipal Housing and Urban-Rural Development Bureau and Hua Xia Bank Wenzhou Branch launched a housing consumer financial service product called "Anju Loan". First-home mortgage customers with a loan period of more than 10 years can only pay interest for the first three years. Previously, the model of repaying interest first and then repaying principal has appeared in business loans, consumer loans and other fields. According to industry insiders, the original intention of this measure is to provide home buyers with a certain "buffer period" for loan repayments. However, the overall repayment burden of home buyers has not been reduced, and its attractiveness to home buyers remains to be seen.

launches "Anju Loan" with a new repayment method

The term of the first home loan is more than 10 years, and you can choose to pay only interest in the first three years. Are you excited after seeing this mortgage policy? Recently, Wenzhou Housing and Urban-Rural Development Bureau’s official WeChat public account “Wenzhou Housing and Urban-Rural Development” announced that Wenzhou Municipal Housing and Urban-Rural Development Bureau and Hua Xia Bank Wenzhou Branch launched a housing consumer financial service product called “Anju Loan”. First-time home mortgage customers with a loan term of 10 years or more (inclusive) who apply for an "Anju Loan" can break through the two traditional repayment methods of "equal principal and equal principal and interest" and choose "interest first, principal later" or "small amount of principal" Flexible mortgage repayment methods such as "Gold plus interest" can last up to three years, that is, the borrower can choose to pay only interest in the first three years, and start paying back the principal and interest in installments from the fourth year.

html On June 16, a reporter from Beijing Business Daily learned from multiple branches of Hua Xia Bank in Wenzhou that repayment methods such as "Anju Loan" and "Interest First, Principal Later" have not yet been implemented. A mortgage manager at a branch of Hua Xia Bank in Wenzhou revealed that at present, the lowest mortgage interest rate for the bank's first home is 4.25%, and the repayment methods are temporarily "equal principal" and "equal principal and interest", "Anju Loan" and "interest first, principal later". The system is still under debugging.Talking about the reasons why Wenzhou Municipal Housing and Urban-Rural Development Bureau and Huaxia Bank Wenzhou Branch launched the "Anju Loan" flexible repayment mortgage product, Guan Rongxue, an analyst at Zhuge Housing Data Research Center, believed that on the one hand, although Wenzhou's property market transactions showed a rebound in May signs, but the market recovery process is still slow. Wenzhou has actively responded to adjust differentiated housing credit policies to speed up the recovery of the property market; on the other hand, the inflow of Wenzhou’s population has gradually increased, and the “Household Loan” is more inclined to alleviate the problems of newly graduated college students, new entrants and This move will, to a certain extent, stimulate the reasonable release of the immediate demand for home purchases in the local property market.

As for the reason for the flexible repayment method of "Anju Loan", the relevant person in charge of Hua Xia Bank Wenzhou Branch also said before: "The epidemic has repeatedly increased the uncertainty of economic development, so a large part of the population has a wait-and-see attitude towards home purchases. The newly launched The repayment method can, on the one hand, reduce the early repayment pressure of rigid and improvement loan home buyers; on the other hand, it also hopes to support the demand for home purchases through financial relief plans and promote the stable and healthy development of the real estate market. "

" is similar to 'first interest'. "Houben' has actually been implemented in some other banks across the country, but due to the tighter mortgage policies in the past few years, there are relatively few actual cases." Yan Yuejin, research director of the Think Tank Center of the Yiju Research Institute, believes that the current financial policies for new citizens in various places. The support is very strong. In terms of housing loans, it mainly focuses on the reduction of down payment ratio and the reduction of housing loan interest rates. Judging from the mortgage loan repayment pattern of home buyers, the first three years are the most stressful, because some home buyers may make their down payment through borrowing or fundraising. The flexible repayment method of "Anju Loan" reduces the number of home purchases to a certain extent. The risk of mortgage default within three years.

A reporter from Beijing Business Daily contacted Hua Xia Bank regarding issues related to "Anju Loan". As of the time of publication, no reply has been received.

Reduce the pressure of early loan repayment and increase the overall repayment cost

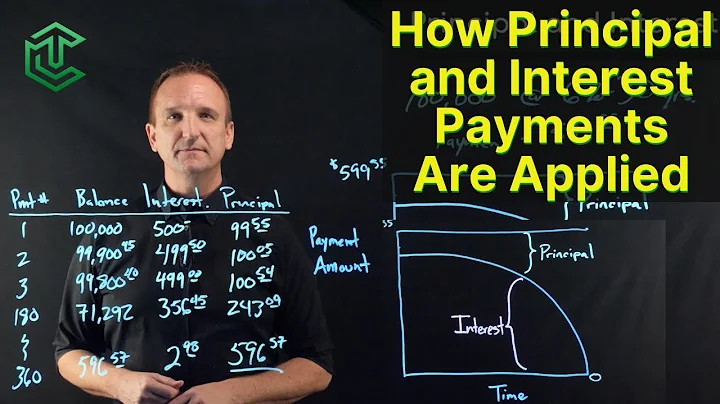

Although the original intention of "Anju Loan" to provide "interest first, principal later" and other repayment methods is to provide home buyers with a certain "buffer period" for loan repayment, analysts believe that home buyers The overall repayment burden has not been reduced. “Mortgage interest rates and principal repayment time determine the cost for homebuyers.Since the interest will not be reduced with the repayment of the principal amount, bank funds will be occupied for a long time, and the total repayment interest will be higher than the equal principal repayment method. "Zhang Dawei, chief analyst of Centaline Real Estate, believes.

Guan Rongxue believes that the use of repayment methods such as "interest first, principal later" or "a small amount of principal plus interest" only reduces the initial repayment amount, but the principal repayment is later compared to The repayment amount will be higher in the equal principal and interest repayment method, and the repayment pressure will increase in the later period. Therefore, the effect of this move on alleviating the pressure of home purchase remains to be seen.

It is understood that the repayment method of mortgage loans usually adopts "equal principal amount" and "equal amount". There are two types of "principal and interest", and "interest first, principal later" is mostly used in business loans or consumer loans. On June 16, a reporter from Beijing Business Daily learned from many bank outlets in Wenzhou that currently, the interest rate for first-time home loans in Wenzhou has It has dropped to 4.25%-4.45%, but there are only two repayment methods: "equal principal and interest" and "equal principal and interest". "Our bank's current lowest interest rate for first home loans is 4.25%, and there are only two repayment methods: 'equal principal and interest' and 'equal principal and interest'. Generally, customers will choose these two methods, which will reduce the subsequent repayment pressure. Interest first and then principal are generally used for mortgage loans. "The loan manager of a branch of a joint-stock bank in Wenzhou said.

"If the principal is not repaid for three years, subsequent interest will be calculated based on the original principal owed. If the principal and interest are repaid together for three years, the principal will decrease year by year, and the interest will also decrease. . "The loan manager of another bank in Wenzhou said that "interest first, principal later" is suitable for home buyers who need to buy a house but are short of funds due to the impact of the epidemic in the short term. However, if the home buyer does not have monthly payment pressure, it is recommended to adopt "equal principal". The traditional repayment methods of "equal principal and interest" and "equal principal and interest".

Looking at the two repayment methods of "equal principal" and "equal principal and interest", the repayment cost of "equal principal" is lower. Assume that a home buyer needs a loan 1 million yuan, repaid in 20 years. Calculated based on the mortgage interest rate of 4.25%, the total interest of equal principal and interest is about 486,200 yuan, and the total interest of equal principal and interest is about 426,800 yuan. The latter can save 59,400 yuan.

Talking about the people suitable for various repayment methods, Guan Rongxue said that "equal principal" has a larger repayment amount in the early stage, and then decreases month by month, so it is more suitable for borrowers with strong repayment ability in the early period. Of course, Some slightly older people are also more suitable for this method, because as they age or retire, their income may decrease; "equal principal and interest" refers to repaying the same amount of loan (including principal) every month during the repayment period. and interest), this method is more suitable for people with stable income; the "interest first, principal later" method is more suitable because the early repayment pressure is relatively small, and the principal repayment is delayed, which may lead to greater later repayment pressure. Groups such as newly graduated college students have unstable jobs or low salary levels in the early stage, and then gradually gain experience, and their jobs and incomes will increase.

The real estate market recovery process is expected to accelerate

since the central bank and the China Banking and Insurance Regulatory Commission issued the "About Adjustment of Differentiated Housing Credit". After the "Notice on Policy Related Issues" announced that "the lower limit of the commercial personal housing loan interest rate for first-home housing will be adjusted to no less than 20 basis points minus the loan prime rate (LPR) of the corresponding period," various localities responded positively to the previous reduction in the 5-year LPR. 15 basis points to 4.45%, and the first-home loan interest rate of many banks in many places has dropped to 4.25%. According to incomplete statistics from the Zhuge Housing Data Research Center, nearly 40 cities have lowered their mortgage interest rates since the beginning of the year, and the extent of the reduction varies from city to city. , and roughly including 9 cities such as Suzhou, Tianjin, Zhengzhou, Qingdao, Jinan, and Hohhot, the first-home loan interest rate has dropped to as low as 4.25%; at the same time, about 35 cities have reduced the down payment ratio for home purchases, including commercial loans and provident fund loans. The down payment ratio for first-time home buyers has dropped to 20% in many places in Mainland China.

Regarding the effects of the above policies and subsequent mortgage policy measures, Guan Rongxue believes that overall, lowering first-home loan interest rates and lower down payment ratios can reduce home buyers’ repayments. As well as the short-term cost pressure of home purchase, it will help to ease the wait-and-see sentiment and increase the willingness to buy a home. In the long term, it is expected that the subsequent market recovery process will accelerate, especially in the second half of the year. In addition, the subsequent trend of mortgage interest rates and various regions are expected to accelerate. The implementation of housing loan policies still closely follows market feedback, and the possibility of broadening cannot be ruled out.

However, as real estate-related policies in various places are gradually relaxed, there are also rumors in the market that loan models such as "relay loans" and "remortgage" are re-emerging, causing controversy. Talking about how various localities can reduce the burden on home buyers under the premise of safety, controllability and compliance, Guan Rongxue said that on the one hand, they should strengthen the review of credit qualifications of loan applicants; on the other hand, they should strengthen the supervision of bank credit services, especially In the overlapping phenomenon of multiple loan preferential policies, we should avoid avoiding the most important and neglecting the least, and further create a safe, controllable and compliant credit environment.

Beijing Business Daily reporters Meng Fanxia Li Haiyan