In the market adjustment since the beginning of the year, a hedge fund in the industry reduced its net stock position to zero. How did such a decisive strategy come about?

This week, Banxia Investment Li Bei, who has always dared to speak and act, spoke out, revealing the details of his stock positions since the beginning of the year, and said that fund managers have encountered more difficult challenges than in 2008.

Li Bei's representative product has a return of -9% during the year, which is ahead of many macro strategy peers.

After Li Bei also called out "difficulties", how macro-strategy private equity responds to this year's market volatility is a topic worthy of attention.

html "Slightly Down" in 3 Years

According to the Private Equity Ranking Network, as of April 22 this year, the annual return of Banxia Investment, a representative product managed by Li Bei, was -8.94%, outperforming the CSI 300 and CSI 500 in the same period.

Banxia Investment is a macro strategy private equity company with a current management scale of over RMB 5 billion. Li Bei, the founder of

, has always been known in the market for her "outspokenness". She worked at Bank of Communications Schroders and Honghu Investment in her early days and has extensive experience in commodities, stocks, derivatives, etc.

According to third-party research data, Li Bei's strategy is an all-weather macro strategy. As long as the driving factors have obvious trends, investments in the three types of assets, stocks, commodities, and bonds, have profit opportunities in bull markets or bear markets. "Macro off-years" with no obvious trend in driving factors usually last for a short period of time, and macro hedging strategies have strong market applicability.

"Twists and turns" in stock positions

Li Bei recently expressed through social media: The current net position of Banxia Investment in stocks is around 0.

She also said: "As a hedge fund that pursues absolute returns, this is not unusual. It is normal to take long positions when there is an opportunity and not to do so if there is no opportunity."

Zishido learned that this year Li Bei's judgment on stock assets has gone through a process.

In January this year, the monthly average net stock position of the fund she managed was less than 10%, and there was no net exposure risk. Based on the expectations of different styles, the stock index hedging positions held long on the CSI 500 and short on the CSI 300 and SSE 50 suffered a certain retracement, which ultimately led to a 2% retracement of the equity category as a whole.

In fact, Li Bei was "rebellious" at that time.

She once reflected on fund holders: At that time, domestic interest rates were lower and US interest rates were higher. The normal logic was that assets priced by domestic investors, such as CSI 500 and CSI 1000, should be relatively strong, and foreign investors such as SSE 50 and CSI 300 should be relatively strong. Assets with a larger proportion of holdings should be relatively weak. But the final trend is that foreign capital is much calmer, with net inflows from the north in the first three weeks of January. Ultimately, the SSE 50 and CSI 300 fell much less than the CSI 500.

In February this year, strategically, we continued to hold long positions on the CSI 500 and some individual stocks, as well as hedging positions on the CSI 300 and SSE 50, and achieved some positive returns.

In March, the average equity net position of Banxia Investment was around 0. The loss from holding individual stocks was slightly greater than the income from hedging options, and the equity category had a small loss of 0.5%.

What is the root cause of the net value retracement?

A review found that the retracement of Pinellia ternata investment products mainly comes from commodity positions.

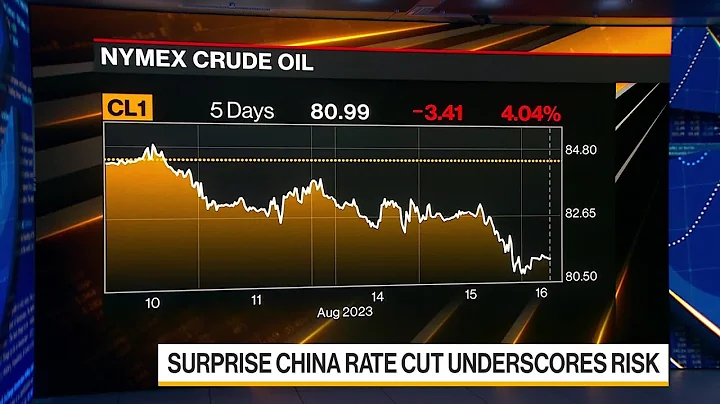

Zishido learned: This private equity company originally predicted that real estate companies will continue to face challenges throughout the year, new real estate construction starts will decline, and the demand for building materials will be a weaker area of the economy. Coupled with the recovery of supply, steel will be The worst performing variety among commodities. After observing another weakening of demand and a super-seasonal accumulation of inventories at the end of February, the agency opened a small short position in steel.

However, after the geopolitical incident broke out, market participants generally had high expectations for the economy in the second half of the year and actively stocked up for the long term. Steel prices fluctuated to new highs.

This caused Banxia Investment to suffer a loss of more than 4% in commodity positions, becoming the main source of the retracement in March.

However, this private equity company said to its holders: We still believe that building materials, represented by steel, will inevitably have a sharp decline during the year. However, due to the market’s optimistic expectations for demand in the second half of the year, it is temporarily impossible to prove whether it is true or not. Only relying on the current supply and demand and The deterioration of inventory cannot drive prices down, so we have further reduced our previously small positions and only retained symbolic positions to keep tracking and thinking. Wait for market expectations to change and the trend to change before adding another position.

Optimistic about China's government bonds

Zishido learned that Li Bei regards long positions in China's short-term government bonds as her current main position, which is an asset she is currently relatively optimistic about.

In January this year, Banxia’s product held a long position in China’s short-term government bonds and a small short position in U.S. government bonds as a hedge, achieving a profit of more than 1% in the bond category. There was a small loss in government bond holdings in February because the social financing data released in January exceeded expectations, triggering a significant correction in government bonds.

In the complicated and chaotic month of March, domestic interest rates fluctuated and showed no trend. Banxia Investment holds a large amount of Chinese short-term government bonds, and periodically shorts a small amount of U.S. bonds, achieving a positive return of 0.2% throughout the month.

Li Bei’s judgment is: Although the central bank may not necessarily further cut interest rates in the short term, it is at least absolutely impossible to tighten interest rates. In the current environment, Chinese government bonds, especially short-term bonds, are still the safest assets. Further interest rate cuts and monetary easing in the future should be inevitable, it is just a matter of time.

This article comes from Wall Street News, welcome to download the APP to view more