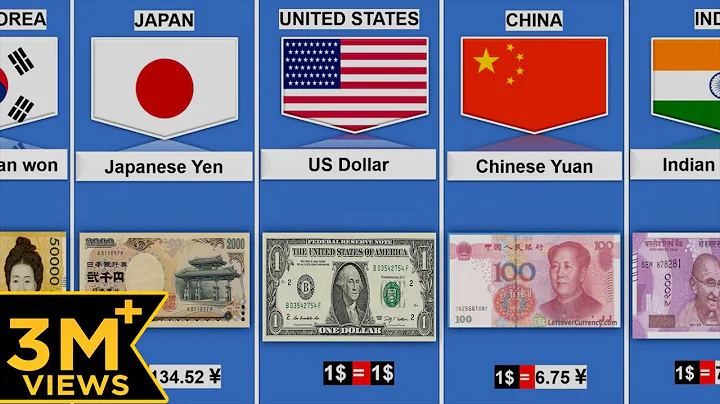

Although in recent years, it is globally recognized that the economic influence of the United States is far less than before, it is undeniable that the U.S. dollar can still affect the global currency market. As the Federal Reserve continues to raise interest rates , the global currency market has become turbulent. Asian currency markets are no exception, with many countries experiencing severe depreciation of their currencies.

Nowadays, the Japanese yen, Korean won and rupee have all experienced serious depreciation, and the "Three Kingdoms" has appeared in the Asian market. What is going on?

1. The Japanese lying flat

Speaking of currency depreciation, we have to mention Japan. Especially the recent depreciation of the yen has attracted the attention of countries around the world. After all, Japan once became the world's second largest economy, and it also has its presence in many high-end fields. Its economic capacity in history was once on par with the United States, or even exceeded it, but now Japan's economy is indeed in decline.

It is reported that the recent exchange rate of Japanese yen per US dollar has become 135:1, which is also the lowest performance of the exchange rate between the Japanese yen and the US dollar. Based on Japan's recent performance, many people are joking that Japan is basically flat in terms of exchange rate. Moreover, as the Federal Reserve continues to raise interest rates, Japan is also one of the few countries in Asia that chooses to adopt loose policies.

Although Japan has been flat in the face of exchange rate changes, it also understands that if the yen continues to depreciate, Japan's national capital will quickly flee. Therefore, recently, Japan's stock market has begun some policy actions and started an accelerated adjustment mode. Of course, although action was taken against the stock market, it was not too tough.

It can also be seen from this that Japan is also very entangled in facing this situation. After all, if it follows the Federal Reserve's interest rate hike policy, Japan's domestic economy will suffer an unprecedented blow. But if interest rates are not raised, the depreciation of the yen will continue. Of course, without raising interest rates, although the export of Japanese products has many benefits, Japan's import costs will also increase significantly.

This is where Japan is most troubled today. After all, Japan, as an island country, is itself a country with very short resources. Especially in terms of energy, Japan is highly dependent on imports from abroad. Therefore, if Japan chooses not to raise interest rates, Japan's energy import costs will become a pressure on the national finance.

The increase in the cost of energy imports will cause inflation in this country. This is also unbearable for Japan, whose economy is constantly declining. Many may cause chain reactions and eventually lead to the collapse of Japan's economic development.

Japan’s influence in Asia is still not small. Therefore, O’Neill, who was previously known as the “Father of BRIC”, said that if the yen falls below 150, then a financial crisis is likely to occur in Asia.

Of course, the reason why the Bank of Japan maintained a laissez-faire attitude towards the depreciation of the yen was not completely flat. Rather, the depreciation of the yen can bring benefits to Japan within a certain period of time. The weak performance of the yen is positive to Japan's overall economy to a certain extent.

Of course, not only the Japanese yen has depreciated in Asia, but the Korean won and the rupee have also depreciated.

2. The "Three Kingdoms Killing" in Asia

Nowadays, South Korea's won and India's rupee have experienced crazy depreciation. At present, India and South Korea have raised interest rates multiple times in response to changes in monetary policy. However, compared with the interest rate hikes in the United States, they pale into insignificance, so we are still in a more difficult moment. Some people also call the current currency depreciation of Japan, India, and South Korea in Asia the "Three Kingdoms Killing."

Coupled with the long-term depreciation of the Japanese yen, involution has become serious among Asian countries. In this weak global economy, currency devaluation to stimulate exports has basically become the only development strategy. In fact, the countries mentioned are not limited to raising interest rates. It can be said that the whole world is in the mode of raising interest rates.

The main reason is that during the two-year epidemic, countries around the world need to stimulate economic development. That's why the economy will be wildly flooded, and such an approach will lead to inflation. Just like the United States, in order to curb domestic inflation, it can only continue to raise interest rates.

As for whether there will be a serious economic crisis in Asia, it depends on the future development trend. If currencies such as the Japanese yen continue to depreciate in the future, the possibility of an economic crisis is still high. However, some experts said that the depreciation of the yen is already at the end, so the economic crisis in Asia will not come.

Conclusion

In short, the world economy is undergoing major changes. At this time, every country will encounter unprecedented challenges. This is why China emphasizes the development of internal circulation and external circulation. Having the world's largest consumer market is the confidence for China's development. So readers, do you think Asia will face an economic crisis? Welcome to like and leave comments!