In many cases, input certificate is a pain in the eyes of many general taxpayer companies. input invoices must not only enter the certification platform for certification, but also check whether the actual business of the invoice business meets the deduction requirements and deduct the company's output tax. Moreover, if the invoice exceeds the 360-day certification period, it will involve a lot of bad things. Son.

However, today, the tax bureau has clearly canceled all these cumbersome matters!

Wukong Finance and Taxation learned that the Taxation Bureau recently issued the "Announcement of the State Administration of Taxation on Canceling the Certification and Confirmation Period of Value-Added Tax and Deduction Vouchers and Other VAT Collection and Administration Issues". clearly stated that the certification and confirmation period of VAT Deduction Vouchers should be cancelled. .

special VAT invoices , customs import VAT special payment invoices, unified vehicle sales invoices, and toll road toll VAT electronic general invoices issued by January 1, 2017 or later, are obtained from Certification confirmation is no longer required within 360 days from the date of invoice. For overdue unconfirmed invoices, taxpayers can also confirm their purpose through the provincial (autonomous regions, municipalities directly under the Central Government, planned cities ) value-added tax invoice certification platform after March 1, 2020.

Special VAT invoices, special VAT payment vouchers for imports and unified vehicle sales invoices issued by general VAT taxpayers on or before December 31, 2016, which exceed the time limit but meet relevant conditions, can continue to be deducted from input. tax.

General taxpayers can choose the deduction time for special VAT invoices, customs import VAT special payment documents, unified vehicle sales invoices and toll road toll VAT electronic general invoices issued on or after January 1, 2020, regardless of the time. Subject to first 360 days.

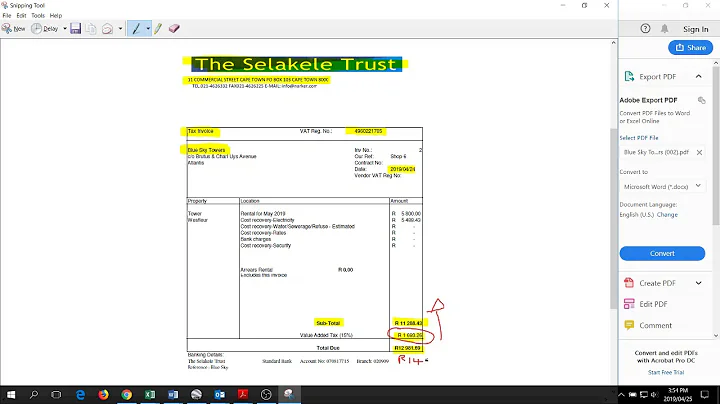

In addition, according to regulations, after a general VAT taxpayer issues a special VAT invoice, if it encounters sales returns, wrong invoices, suspension of taxable services, etc. that do not meet the conditions for invoice cancellation, or due to partial refund of sales and sales subsidies , a dedicated red-letter invoice should be issued . In November 2019, the certification platform changed. Now the editor of Wukong Finance and Taxation would like to share this process with you.

The certification platform has changed in November 2019. Now I will share with you the process.

1. Enter the checking system:

2.

3. Select the invoice to be checked. If there are invoices that have not been certified in the previous period, you can select the time (as shown in the figure below)

4. After confirming that the check is correct, click Confirm. This is required Check whether the input invoice amount in hand is consistent with the amount in the certification system (as shown below)

5. Confirm that the check is correct and click Confirm (as shown below)

6. In the deduction check box, select the deduction check statistics (as shown below)

6. In the deduction check box, select the deduction check statistics (as shown below)

7. Click to apply for statistics (as shown below)

7. Click to apply for statistics (as shown below)

8. Confirm the signature (as shown below)

9. Confirm after the information is correct (note here, after clicking Confirm, the amount of the certification input for this period has been determined and cannot be withdrawn. Please check) (as shown below) Picture)

9. Confirm after the information is correct (note here, after clicking Confirm, the amount of the certification input for this period has been determined and cannot be withdrawn. Please check) (as shown below) Picture)

10. Scroll down to export details (as shown below)

Note: All completed prompt interface (as shown below)

Our company, Wukong Finance and Taxation (Service) Co., Ltd., has a professional accounting team to handle related financial and taxation matters, and provide real-time Track the latest tax policies to protect the development of your company.

![Unbelievable Cosmic Phenomena Beyond Our Galaxy | Secrets Of The Universe [All Episodes] | Spark - DayDayNews](https://i.ytimg.com/vi/sHEwTKEDVM0/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLAOHCCVwEK0S3PEAiMgW9rL4mC6YQ)