Sino-Singapore Jingwei Client, April 21 (local time) On Monday, local time, the WTI May crude oil spot contract on the New York Mercantile Futures Exchange closed down $55.90 to -$37.63/barrel, marking the first time in the history of international crude oil futures that it closed at a negative value. The drop was as high as 305.97%. In that day's trading, the WTI May spot contract fell as low as -$40.31/barrel. Oil prices fell into negative territory, which means sellers need to pay buyers to take the crude off their hands. Yan Jiantao, deputy general manager of

Longzhong Information, believes that the current most important factor affecting oil prices is not production costs, but inventory, especially in inland oil-producing areas. The epidemic has caused problems such as poor infrastructure and transportation logistics, making it difficult to export or store crude oil. Shutting down wells and stopping production purely for economic reasons is risky, so production must continue. If storage tank capacity is insufficient or storage costs are too high, producers would rather accept negative oil prices and have to lose money to let buyers take them away.

Wang Jing, senior analyst at Jin Lianchuang Energy, pointed out that tight storage capacity has caused oil prices to fall into a capital squeeze frenzy. Although from a numerical point of view, the WTI spot contract price fell into the negative space, it seems that the market has entered a situation where "U.S. shale oil producers need to pay crude oil buyers to deal with the excess crude oil produced." , but considering that due to the special delivery background, investors in the crude oil market have completed the transfer of positions from the spot contract that is about to be delivered to the second-line active contract at an earlier time node than before, and currently most of the world's The pricing of regional crude oil spot trade has already switched to the June contract. Therefore, the negative decline of the WTI May contract should be interpreted as a pure capital carnival, rather than meaning that crude oil has lost its processing value and use value under the current market supply and demand background. .

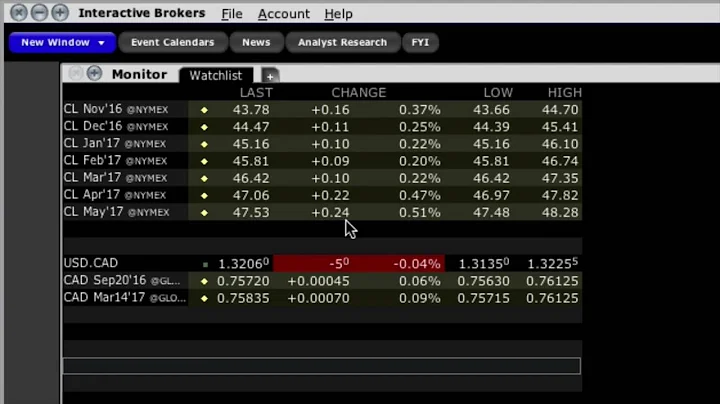

On Monday, the Intercontinental Exchange Brent crude oil spot contract for June closed down $2.51 to $25.57 per barrel, a decrease of 8.94%.

Reuters reported that the price of international benchmark Brent crude oil futures also fell sharply, but it was far less weak than U.S. crude oil because there is more oil storage space around the world.

On the morning of the 21st Beijing time, the WTI crude oil futures May contract returned to positive value, with a maximum price of $2.54 per barrel, an increase of over 103%.