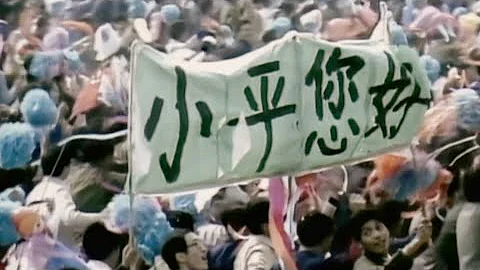

The reform and opening up 40 years ago started a new journey for Chinese citizens to go abroad and embrace the world. However, the initial journey abroad was not smooth. The cumbersome visa process, the inconvenience of purchasing foreign exchange, the lack of money, and the fear of the distant and unknown world all discouraged people. Over the past 40 years of reform and opening up, China's economy has developed rapidly, and Chinese citizens have become more confident in seeing the world. In 2017, the number of Chinese students studying abroad exceeded 600,000; the number of overseas tourists reached 131 million. With the rapid growth in the number of people traveling abroad, the demand for a large number of visas, cross-border payment settlements, and overseas consumption is also increasing. As the first domestic commercial bank to launch overseas financial services, China CITIC Bank has always been committed to improving products, services, and processes around the needs and pain points of overseas customers, and is at the forefront of domestic commercial banks.

Keenly capture the market demand

Create a unique competitive advantage

In 1998, when developing retail intermediary business, China CITIC Bank sensitively captured the market demand for a large number of people who leave my country to apply for visas every year. Non-immigrant visa application fees and the business of delivering visa information for re-entry to the United States have become the bridge and link between the embassy and people going abroad. Through this, we have become the leader in domestic overseas financial services and the "paveer" for Chinese citizens' dream of going abroad.

Based on the good cooperative relationship with the US embassy, relying on its powerful system and efficient service, CITIC Bank has been recognized by more and more embassies, and has gradually established cooperative relationships with embassies in nine countries to handle visa payment and delivery for customers. Serve. In 2015, CITIC Bank launched the "Global Visa" product, which expanded the scope of visa services to 70 countries and regions by strictly selecting high-quality visa service agencies. In November 2016, in response to the U.S. Customs and Border Protection new ten-year U.S. visa policy changes, China CITIC Bank immediately proactively contacted the U.S. Embassy and the U.S. Department of Homeland Security and took the lead in obtaining authorization from the U.S. Department of Homeland Security to use EVUS. Trademark and joint promotion, and innovatively developed the EVUS translation system to help customers fill in the EVUS information form in Chinese, accurately translate it and then upload it to the EVUS system to complete the registration, allowing customers with ten-year US visas to eliminate doubts and travel smoothly. This year, China CITIC Bank has cooperated with the British Embassy Visa Center to launch the "British Visa" service, which invites the embassy visa officers to the bank to handle fingerprint collection and material collection services for customers, eliminating the tedious round-trip travel for non-embassy visa center customers. There are also services such as French accompanying visa, Canadian priority visa delivery, and door-to-door visa, which have established a unique competitive advantage in the visa business.

Return to the origin of financial services

Innovate and develop personal foreign exchange business

Visa business has enhanced CITIC Bank’s overseas financial brand and expanded customer acquisition channels, but for banks, it is a value-added service after all. To return to the essence of financial services, it must be in foreign exchange A breakthrough in business.

CITIC Bank has had a natural advantage in foreign exchange business since its establishment. At the end of 1984, with the reform and opening up and the needs of national economic development, Mr. Rong Yiren, then chairman of China International Trust and Investment Corporation (referred to as CITIC Corporation), sent a special letter to the central government requesting the establishment of a bank under the CITIC Corporation system to comprehensively operate foreign exchange banking business. , and has been achieving great success in foreign exchange business ever since.

The innovative development of CITIC Bank’s personal foreign exchange business is also based on the insight into and satisfaction of changes in customer needs. In the 1990s, cross-border payment products were still very scarce. At that time, the only way for individuals to make cross-border remittances was wire transfers, which took a long time. There were also problems such as the remittance not arriving in full and the progress unable to be checked. China CITIC Bank took the lead in introducing MoneyGram business into the country, which greatly improved the efficiency of remittances. In 2018, China CITIC Bank further relied on SWIFT global payment innovation technology to upgrade its overseas wire transfer function and launched the function of accelerating the arrival of remittances and the ability to push and query the remittance progress at any time. In terms of foreign currency investment and financial management, CITIC Bank leverages its natural advantages in foreign exchange business to launch a variety of foreign currency asset allocation products such as foreign currency profit-increasing pot, foreign currency salary pot, dual currency treasure, intelligent foreign exchange settlement and sales, etc. to help customers with foreign currency assets. Increasing the value of.

At the beginning of 2018, CITIC Bank put forward the vision and goal of "building a leading bank for personal foreign exchange business". Through efforts to promote superior personal foreign exchange products, it has made breakthrough progress. As of the end of November 2018, the balance of CITIC personal foreign currency deposits reached US$5.144 billion. , an annual increase of US$1.199 billion. The balance of personal foreign currency deposits ranks second among the nine joint-stock commercial banks, and the increase ranks first.

Create overseas financial professionals

Improve customer service experience

China CITIC Bank’s overseas financial team training is in a stepped manner. There are more than 2,000 overseas financial specialists and personal foreign exchange specialists in the bank. CITIC Bank ensures that this batch of overseas financial specialists are trained through regular training and assessment. The team can master the basic knowledge of the bank's overseas finance and personal foreign exchange, key products, marketing key points and market activities, and provide basic services to front-line customers.

Since 2015, China CITIC Bank has been cultivating and selecting top talents in overseas financial services across the bank - overseas financial international planners. This team is the top team selected from the best among thousands of overseas financial specialists. They have been selected at all levels by the head office and branches, and have received professional training at the head office. They are not only proficient in overseas finance and personal foreign exchange business knowledge, but also understand international tax laws, visas, and study abroad policies. They are also outstanding in English skills and represent CITIC Bank abroad. The highest level of financial services. At present, the bank has trained 400 all-round international planners. They work hard on the front line and participate in the design of training courses at the head office, the writing of the "Study Abroad Blue Book", market research, etc., provide suggestions for product innovation, and assume the responsibilities of branches. Responsible for writing localized magazine feature articles, recording audio programs, and publicizing market activities, etc., it has become the mainstay of the bank's overseas financial and personal foreign exchange business. This unique professional team in the industry has effectively established the soft power of CITIC Bank’s overseas financial business in terms of talent teams, and further enhanced CITIC Bank’s professional image in the market.

Twenty years of professional experience

Careful overseas financial services are heating up

2018 is the 20th anniversary of China CITIC Bank's overseas finance. CITIC Bank has served more than 20 million overseas customers. The slogan "If you want to go abroad, look for CITIC" is deeply rooted in the hearts of the people. Based on 20 years of professional service accumulation, CITIC Bank has completely upgraded its brand and services, and proposed a new brand appeal of "a distant country with a familiar temperature around you". Through cross-border integration of study abroad, tourism, With advantageous resources such as hotel reservations and overseas car rentals, we extend our services overseas and create a one-stop financial + non-financial service ecosystem for overseas customers.

CITIC Bank has published the Study Abroad Blue Book for three consecutive years. By analyzing more than 5,000 study abroad samples and search data of hundreds of millions of Internet users, it continues to track the latest trends in the study abroad market and derives intermediary rankings to provide practical reference and help for families studying abroad. They make rational choices.

In order to fulfill corporate social responsibilities and leverage its advantages in the field of overseas financial services to serve the society, China CITIC Bank has joined the public welfare project launched by the China Children's Fund to promote cultural confidence, academic achievement, and the development of talents in the new era of serving the country. The "Escort Plan" integrates overseas financial services into public welfare plans, and serves the families of students studying abroad and returning abroad through service measures such as exclusive bank cards, aviation accident insurance for international students, and Air China luggage discounts.

At the World Internet Conference in November 2018, China CITIC Bank adhered to the concept of "one-stop access and warm companionship". On the basis of integrating the original overseas financial business, it launched a new service content, customer scope, and service channels. , service journeys, service methods and other aspects of the overseas financial service platform, it has created a new online one-stop service ecosystem for overseas finance, with more comprehensive service content and more flexible service channels.

China CITIC Bank's overseas financial brand was born in 1998. It has witnessed nearly 20 years of changes in going abroad. From the slogan "If you want to go abroad, look for CITIC", it handles visas, credit certificates, overseas loans, foreign exchange settlement, global The five major categories of asset allocation products provide comprehensive overseas financial solutions for the five major categories of customers: study abroad, business, tourism, immigration, and expatriates. It has established an internationally renowned business brand and established close cooperation with embassies in 9 countries on 5 continents around the world. , its business covers 70 countries and regions around the world, and has opened up a unique path of overseas financial services. "If you want to go abroad, look for CITIC" is no longer just a slogan, but the innovative creation, advancement with the times and considerate service created by the craftsmen of CITIC Bank. Never forgetting the original intention, Fang De’s always-ingenious spirit is infiltrated into CITIC Bank’s belief in overseas finance. CITIC Overseas Finance starts with your dream of going abroad and persists because of your dream of going abroad!