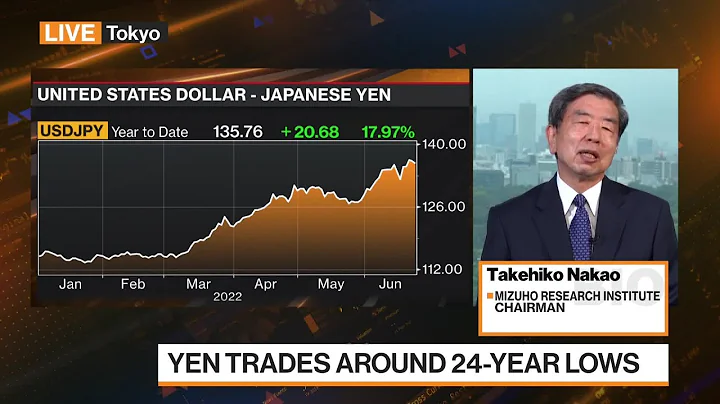

Zhitong Finance APP has learned that Takehiko Nakao, the former head of foreign exchange policy at the Ministry of Finance of Japan, said that the possibility that Japan will directly intervene in the foreign exchange market to curb the continued decline of the yen exchange rate cannot be ruled out. And his speech seemed to trigger fluctuations in the yen exchange rate.

"The possibility of unilateral intervention should not be ruled out," Nakao said in an interview with Bloomberg TV. He also pointed out that it is difficult to obtain support from foreign institutions. "Unless there is excessive market volatility, or there is some kind of crisis, it is usually very difficult to intervene in exchange rates by coordinating with external agencies," he said.

He said in another comment that although the Bank of Japan's monetary policy has caused the yen to weaken, some recent speculative activities have also guided the yen's exchange rate trend. He added that the weak yen is one of several negative impacts of the Bank of Japan's easy monetary policy.

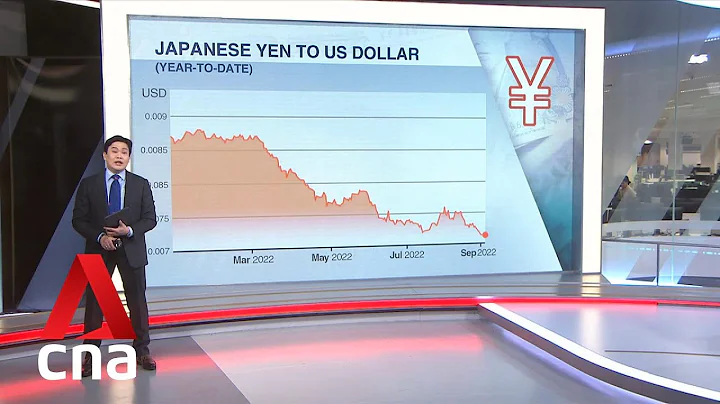

It is reported that the exchange rate of the US dollar against the Japanese yen dropped to 135.13 yen from 135.77 yen before Nakao's speech.

Comments by former foreign exchange policy chief Takehiko Nakao spurred moves in the yen

This comes after the yen hit a 24-year low against the dollar on Wednesday as The divergent policy trajectories of the Federal Reserve and the Bank of Japan continued to push the yen go lower. Speculation about Japan's willingness to intervene in currency markets to boost the yen has been one of the factors exacerbating volatility in the foreign exchange market.

Although it may be difficult to obtain the cooperation of the United States to support the yen exchange rate, Takehiko Nakao said that it is still possible for Japanese institutions to enter the market to intervene in the exchange rate without incurring direct opposition from the United States. He gave the example of 2011. During his tenure at the Ministry of Finance, he planned to intervene in the currency market to prevent the yen from strengthening.

He said it was unclear to what extent the slight rebound in the yen would actually translate into higher costs for U.S. imports, given that Japanese goods account for only a small portion of U.S. imports. This shows that he believes that Japan's intervention in the exchange rate has a limited actual impact on the US economy.

![Yao Ming vs Dirk Nowitzki Beijing Olympics Full Duel Highlights (16.08.08) Yao/25, Dirk/24 [1080p] - DayDayNews](https://i.ytimg.com/vi/oHxl0ECE02A/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLDdIKDLMQJJu54-XqMWv9pzVwGqew)