(Report Producer/Author: Minsheng Securities, Qiu Zuxue, Sun Erchun)

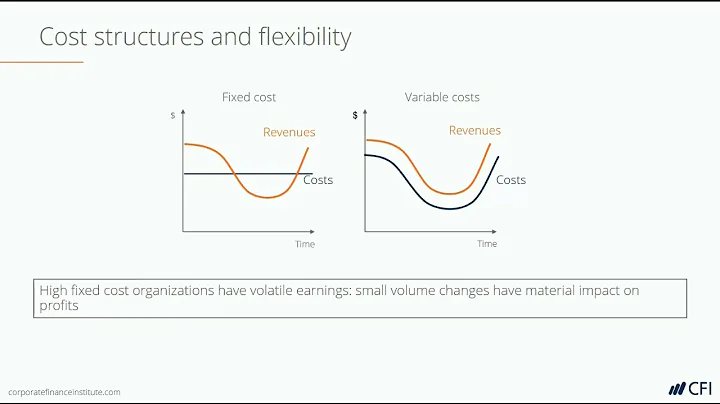

Steel market: No good luck, steel mill profits are expected to rebound in the second half of the year1.1 Overview: Weak demand and strong raw materials "double kill", steel mill profits in the first half of the year Falling sharply

Demand was weak in the first half of the year, and steel prices fell year-on-year. In the first half of 2022, due to the weakness of the real estate market and the disruption of the epidemic, steel demand performed worse than expected. However, with the gradual advancement of the "steady growth" policy, the market has given high expectations for economic recovery. The steel market has been in a game between weak reality and strong expectations, with prices rising first and then falling.

Raw material prices are strong, and profits of steel companies have been compressed. Compared with steel, raw materials were relatively scarce in the first half of the year and prices were relatively strong. In particular, the average price of coking coal in the first half of the year increased by more than 100% year-on-year, supporting a significant increase in coke prices. In the context of the year-on-year decline in steel prices, the strength of raw material prices has caused a sharp decline in the profits of steel companies. As of June 24, the profitability of 247 steel companies was only 15.15%, while the profitability of steel companies on June 3, 10, and 17 They are 51.52%, 58.87%, and 41.99% respectively.

The steel sector has fallen back since 2022. Due to weak downstream demand, steel profits remain low, and the SW Steel Industry Index has fallen back, down 6.74% so far in 2022, ranking 18th among the 31 SW sectors. The steel industry sector is further divided into general steel, special steel and steelmaking raw materials sectors. Among them, the special steel and steelmaking raw materials sectors fell 6.4% and 11.46% respectively, which was a larger decline.

1.2 Steel demand: With the advancement of the "steady growth" policy, demand is expected to pick up in the second half of the year

1.2.1 Domestic steel demand is dominated by real estate

The real estate market is the main force in steel demand. The construction sector is the main force in steel demand, accounting for 59%, and the real estate market is the main force in steel demand in the construction field, accounting for 44% of steel demand. In terms of types, rebar and wire rods are almost all used in the construction field. In addition to some coiled plate products being used in the construction field, they are widely used in machinery, automobiles, home appliances, ships and other fields in the manufacturing industry.

1.2.2 Real estate: Development and construction indicators have fallen year-on-year, and are expected to pick up in the second half of the year.

Since 2020, the "three red lines" have increased real estate regulation. In August 2020, the central bank, the China Banking and Insurance Regulatory Commission and other institutions proposed "three red lines" for real estate companies, emphasizing that real estate companies should de-leverage and limit land acquisition/sales ratios, exacerbating the financial constraints of real estate developers and making them " The "high leverage, fast turnover" model is difficult to reproduce, and the willingness to acquire land is not strong. Since the second half of 2021, the performance of land transactions in hundreds of cities has been sluggish. From January to May 2022, real estate development and construction indicators fell year-on-year. The cumulative area of newly started real estate construction was -30.6% year-on-year, the cumulative year-on-year construction area was -1%, and the cumulative year-on-year completion area was -15.3%. Due to the transmission relationship between land acquisition and new construction starts, the newly started construction area has been under pressure since the second half of 2021, which has dragged down the construction and completed area. The slowdown in real estate development progress has further dragged down off-plan sales, making the real estate market worse. As the bulk of steel demand, real estate dragged down steel demand in the first half of the year.

The real estate market will develop more steadily, and demand in the second half of the year will not be pessimistic. Under the tone of "steady growth", with the steady advancement of real estate control policies and the continued development of the affordable housing market and long-term rental housing market, the development of real estate development enterprises will be more stable, and the real estate industry is moving towards intensive, efficient, long-term, healthy and stable development. direction development and changes. High-frequency data shows that the weekly transaction area of commercial housing in 30 large and medium-sized cities is gradually improving month-on-month. It is expected that real estate demand is unlikely to see a cliff-like decline. After development and construction indicators stabilize, it is expected to pick up in the second half of the year, thereby supporting steel demand.

1.2.3 Infrastructure: "Stable growth" supports the gradual release of infrastructure demand

From January to May 2022, the cumulative year-on-year growth rate of infrastructure investment was 8.2%, and "steady growth" supports the gradual release of infrastructure demand. The infrastructure industry occupies an important position in my country's economic development and is an important means to ensure the steady growth of my country's economy.Fiscal expenditures in 2021 show obvious "post-position" characteristics. Special bond issuance is concentrated in the second half of the year, and the issuance progress is significantly slower than the same period in previous years. It is expected that at least 1 trillion special bond projects under construction will be carried over to 2022 to form physical bonds. workload. Fiscal expenditure in 2022 shows obvious "front-loading" characteristics. As of June 14, the scale of new special bond issuance in 2022 was approximately 2.27 trillion yuan, with 62% issued. On May 31, the “Package of Policies and Measures to Solidly Stabilize the Economy” issued by the State Council clearly stated that the issuance and use of special bonds issued this year should be accelerated, and the issuance should be basically completed by the end of June, and the use should be basically completed by the end of August. In addition, the national general public budget fiscal expenditure will reach 26.7 trillion in 2022, a year-on-year increase of 8.4%. It is expected that in the second half of the year, as the impact of the epidemic subsides and high-quality projects are released, the infrastructure sector will continue to boost steel demand.

1.2.4 Manufacturing: Manufacturing investment is still resilient, and the subsidence of the impact of the epidemic will boost demand in the second half of the year.

Manufacturing investment demand is still resilient. Manufacturing fixed asset investment cumulative year-on-year rate from January to May was 10.6%. As consumption recovers after the impact of the epidemic subsides, related manufacturing investment will continue to improve in the second half of the year. At the same time, driven by the domestic friendly credit environment and the "dual carbon" national policy, enterprises' "green transformation" and high-tech manufacturing-related investments will continue to benefit, which will boost manufacturing investment and benefit steel demand. In the manufacturing sector: The automobile and home appliance markets have been greatly affected by the epidemic. The cumulative year-on-year output from January to May was -7.2% and 2.18% respectively. In the second half of the year, as the impact of the epidemic subsides and consumption recovers, the output of automobiles and home appliances is expected to continue to rebound. The demand for ship steel consumption has increased significantly. From January to May, my country's ship orders on hand accumulated 21.71% year-on-year. Against the backdrop of global shipping capacity shortages, China's new ship orders will surge by 131.84% in 2021, and are expected to continue to support ship steel consumption in 2022.

1.2.5 Demand summary: With the advancement of the "steady growth" policy, demand is expected to pick up in the second half of the year

The demand for plate products is better than that of long products. The overall performance of steel demand in the first half of 2022 is relatively weak, but with the support of a good domestic credit environment, manufacturing investment is still resilient, and plate demand is still supported at the bottom; in the construction field, especially the real estate market, due to strict policy supervision, and The impact of the epidemic is more obvious, and the demand performance is not as good as that of long products. Combined with the current domestic policy guidance, it is expected that the demand performance of plate products will be better than that of long products in the long term. The "steady growth" policy continues to advance, and demand is expected to pick up in the second half of the year. In December 2021, the Central Economic Work Conference clearly stated that economic work in 2022 must take "stability as the top priority and seek progress while maintaining stability" to cope with the triple pressure of shrinking demand, supply shocks, and weakening expectations. With the advancement of stabilizing growth policies and the subsidence of the impact of the epidemic, demand for real estate, infrastructure and manufacturing is expected to be boosted in the second half of the year. Demand for steel is expected to continue to rebound, and consumption margin improvement is expected to increase.

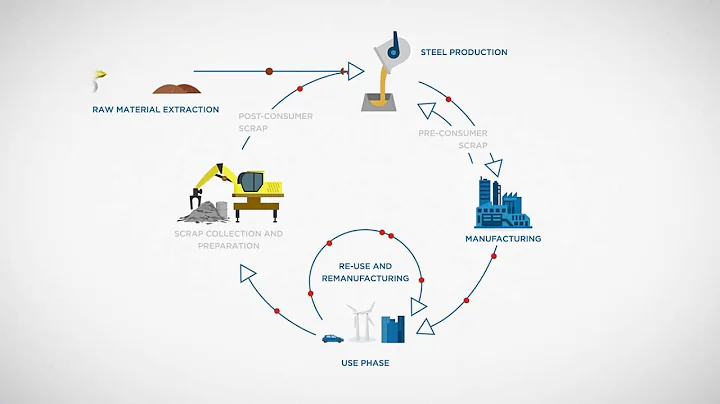

1.3 Steel supply: Crude steel production continues to be reduced, and the demand for scrap steel has dropped significantly.

In the first half of the year, the cumulative output of hot metal and crude steel fell year-on-year. As the output of crude steel and molten iron was at a low level in the fourth quarter of 2021, it will take time for steel plants to resume production, and the combined demand is relatively weak, resulting in a cumulative year-on-year decline in the output of molten steel and crude steel in the first half of the year. From January to May 2022, the country's crude steel production totaled 435 million tons, a year-on-year decrease of 38.08 million tons, a year-on-year decrease of 8%; pig iron production was 361 million tons, a year-on-year decrease of 19.03 million tons, a year-on-year decrease of 5%, while the steelmaking end Scrap demand is expected to decline by 18.5% year-on-year. Scrap supply shortage boosts demand for molten iron. The supply of iron elements in crude steel mainly comes from pig iron and scrap steel. In the first half of the year, the supply of scrap steel was relatively scarce and the price remained high, which raised the cost of short-process steel. In the case of relatively weak steel demand, even the short-process steel mills in Gudian Electric Power Co., Ltd. It is also difficult to make profits in production and is forced to reduce production on a large scale; at the long-term process end, the higher price of scrap steel gradually loses its cost performance compared to molten iron, causing steel mills to reduce the proportion of scrap steel used in converters and continue to increase molten iron production in 2022 In May 2020, crude steel production fell by 2.9% year-on-year, while hot metal production increased by 3% year-on-year.

Crude steel output in Hebei, Shandong, and Jiangsu has declined significantly, while Fujian, Jiangxi and other places have increased year-on-year. From January to May 2022, as the main producing areas of steel, the crude steel production in Hebei, Shandong and Jiangsu fell by 12.48, 8.05 and 3.93 million tons respectively year-on-year, which was a larger decline; while the crude steel production in Fujian and Jiangxi was less constrained by supply. From January to May, the year-on-year increase was 2.73 million tons and 430,000 tons respectively.

The carbon emissions of the domestic steel industry account for 18.92%, which is one of the important driving forces for emission reduction. In September 2020, " carbon peak , carbon neutral " was proposed. As a highly energy-intensive industry, the steel industry is the largest contributor to carbon emissions among 31 categories of manufacturing. In 2019, carbon emissions Reaching 1.853 billion tons, accounting for 18.92% of the country’s carbon emissions. Therefore, in order to achieve my country’s goal of “peaking carbon emissions before 2030 and striving to achieve carbon neutrality before 2060”, the steel industry is one of the main efforts.

Under the background of "dual carbon", the task of reducing crude steel output will continue to be implemented. The proposal of “carbon peaking and carbon neutrality” is gradually changing the supply structure of the steel market. Crude steel output in 2021 will fall by 33 million tons year-on-year, and steel supply will be severely constrained. On April 19, 2022, National Development and Reform Commission spokesperson Meng Wei said that in 2022, the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Ecology and Environment, and the National Bureau of Statistics will continue to reduce crude steel production nationwide. In the second half of the year, the output of crude steel and molten iron is expected to increase year-on-year and decline month-on-month. Under the tone of "steady growth" and the impact of the epidemic subsides, demand for steel in infrastructure, real estate, and manufacturing is expected to pick up in the second half of the year, and crude steel production is also expected to turn positive year-on-year. However, considering that it is difficult to increase demand throughout this year, and crude steel production If the reduction continues, the output of molten iron and crude steel will most likely fall back on a month-on-month basis. (Report source: Future Think Tank)

1.4 Raw material end: Supply is expected to recover in the second half of the year, and the performance may be weaker than steel prices

1.4.1 Scrap steel: After the impact of the epidemic subsides, the supply of scrap steel gradually increases

The short-term supply of scrap steel is tight, and short-process steel mills Loss. In early March, the new policy of Renewable Resources Finance and Taxation Document No. 40 was officially implemented. With the spread of the epidemic in Shanghai starting in April, scrap recycling and logistics continued to be affected. The supply of scrap steel in the market was tight, prices were relatively strong, and short-process steelmaking enterprises using scrap steel as raw materials were common. As of June 24, the capacity utilization rate of the 85 independent electric arc furnace steel plants surveyed by Mysteel fell to 43.85%, far lower than the 81.26% level in June 2021. Recently, as the epidemic in Shanghai has been brought under control, the resumption of work and production in manufacturing, logistics and other industries has accelerated, and the arrival of scrap steel has begun to rebound. The supply is expected to gradually loosen, and the price performance in the second half of the year may be weaker than that of finished products, thus helping steel mills to repair profits at the smelting end.

China has entered an accelerated period of steel scrapping, and it is expected that the scrap recycling volume will reach 333 million tons in 2025. The sources of scrap steel mainly include three parts: self-produced scrap steel (new scrap from the steel and product manufacturing process), socially recycled scrap steel (processed scrap steel and old scrap steel) and imported scrap steel. Among them, social scrap steel recycling is the main source, accounting for 83.3% in 2019. According to statistics from the Iron and Steel Industry Association, the average use cycle of China's steel products is 20-27 years. China's steel consumption began to grow rapidly around 2000, and the scrapping of steel products has entered an accelerated period. According to "China's Scrap Steel Resources" by Jia Yiqing and other scholars "Utilization Trend: Analysis and Forecast 2020-2035" uses the life cycle method to predict that, without considering imported scrap steel, China's scrap steel utilization is expected to reach 333 million tons by 2025, and the proportion of scrap steel recycled by society will increase to 86.6%. About 85% of scrap steel can be used for steelmaking (converter + electric furnace). Taking into account the scrap import volume, it is estimated that the scrap steel that can be used for electric furnace steelmaking is expected to reach 289 million tons by 2025, which can fully meet the raw material demand for domestic electric furnace development.

1.4.2 Iron ore: Mainstream mine shipments are expected to gradually increase

Supply and demand are tight in the first half of the year, and port inventories are rapidly depleted.Due to the shortage of scrap steel in the first half of the year, the production of relatively cost-effective hot metal continued to increase, and it has turned positive year-on-year since April, making the demand for iron ore in the first half of the year exceed market expectations; on the supply side, there was more rainfall in the first half of the year, due to the epidemic The labor shortage and the debugging of production during the conversion period of old and new production capacity have caused the supply of the four major mines and non-mainstream mines to be significantly reduced compared with last year. The conflict between Russia and Ukraine and India’s increase in iron ore export tariffs have further aggravated the tension between iron ore supply and demand. As a result, iron ore port inventories were rapidly depleted and prices continued to rise. Platts prices reached a maximum of US$162.75/ton, a rebound of 86.64% from the lowest point in the fourth quarter of US$87.2/ton.

Mainstream mine shipments are expected to pick up, and price performance may be weaker than that of finished products. With the end of the rainy season, iron ore shipments from Brazil and South African mines are likely to pick up. Shipping from Vale, Anglo American, HBIS and other mines will continue to pick up in the second half of the year, especially Vale, which is gradually recovering due to the mining disaster in 2019. The shut down production capacity will become the main force in the future increase in iron ore supply. In Australia, the June financial reporting season is the peak shipping period for BHP Billiton and FMG. With the launch of the new mining area Gudai-Darri, shipping volume will also increase significantly in the second half of the year. Therefore, shipments from mainstream mines are expected to gradually increase, while hot metal production on the demand side is likely to fall month-on-month. The tight supply and demand for iron ore is expected to be alleviated. In the second half of the year, prices will follow the fluctuations of steel, and the performance may be weaker than that of finished products, thereby assisting the smelting end of steel plants. Profit repair.

Centralized procurement of iron ore is expected to be implemented. The steel industry is the backbone of the national economy, and the price of iron ore, which is a raw material for steel, is particularly important. China is the world's largest consumer of iron ore and relies on imported ore as high as 80%. However, since the Vale mining disaster in 2019, iron ore prices have remained high, seriously eroding the profits of domestic steel mills. In 2021, the crude steel output of my country's top 10 steel companies accounted for only 41.5% of the country's total, which is still at a lower level compared with the United States, Japan, South Korea and other countries, while the iron ore output of the four major mines accounted for nearly 50% of the world's share, which is relatively low. The degree of concentration puts my country's steel companies in a relatively weak position in terms of iron ore price bargaining. If a centralized iron ore procurement system is implemented and a centralized management group is established to integrate the country's iron ore import business, it will effectively enhance my country's bargaining power for iron ore, thereby boosting the profitability of my country's steel mills.

1.4.3 Double coke: coking coal imports are expected to rebound, and coke cost support is weakening

Coke cost support is gradually weakening. As hot metal production is still at a high level and coke production is not high, inventories remain low and coke supply and demand remain in a tight balance in the short term. However, as mentioned above, the output of molten iron in the second half of the year is likely to fall month-on-month, and the supply of cost-end coking coal is expected to be restored, thereby improving the profits of coking plants. The support for the spot cost of coke will gradually weaken, and the performance in the second half of the year may be weaker than that of finished products, thereby supporting the steel industry. Profits at the smelting end of the plant have been restored.

Imports are still increasing, and the tight supply and demand of coking coal may be alleviated. On the demand side, hot metal production is expected to fall month-on-month in the second half of the year; on the supply side, domestic coking coal production remains stable, imports of Mongolian coal have continued to rebound due to the slowdown in customs clearance due to the impact of the epidemic in May, Russian coking coal imports have remained high, and China-Australia relations have released signs of recovery. , causing the market to pay attention to Australian coal imports. Currently, the market is increasingly concerned about overseas demand. International coking coal prices have fallen, and the price gap between domestic and international prices has widened again. There is still room for incremental imports of coking coal in the future, thus boosting coking coal supply. As the tight supply and demand for coking coal eases, the squeeze on coking plant profits will also be significantly weakened.

1.5 Steel market summary: Steel supply and demand are expected to improve, and the supply cycle will be the main driver in the future.

Steel inventory depletion was slow in the first half of the year, and steel mill profits were relatively sluggish. Steel production continued to increase in the first half of the year, but demand was affected by weak real estate and disruptions from the epidemic, and the performance fell short of market expectations, resulting in a relatively slow depletion of steel inventories. At the same time, due to supply disruptions on the raw material side, prices have been relatively strong, causing steel mills' profits to drop significantly and fall below the cost of short-process off-peak electricity. Although the area of production reduction at the short-process end continues to expand, it has not effectively improved the fundamentals of steel itself.Steel supply and demand are expected to improve in the second half of the year, and cost pressures will gradually ease. In the context of "double carbon", reducing crude steel production is a long-term task. National Development and Reform Commission spokesperson Meng Wei said that the national crude steel production reduction work will continue in 2022. In the second half of the year, crude steel and hot metal production will increase. The probability of falling month-on-month; on the demand side, under the tone of "stable growth", the impact of the epidemic has subsided, and the demand for steel in infrastructure, real estate, and manufacturing industries is likely to pick up in the second half of the year, and steel supply and demand are expected to improve; on the raw material side, the supply of scrap steel, iron ore, and coking coal is expected to be in the second half of the year As prices pick up, price performance may be weaker than that of finished products, which will help steel mills to recover profits at the smelting end.

my country’s steel demand will maintain low growth for a long time, and the supply cycle will be the main driver in the future. Our country has entered a period of economic transformation, and real estate deleveraging is a typical manifestation of this period in our country. It is inevitable that the growth rate of steel consumption will slow down. However, since my country's economy is still in the process of development and urbanization construction has not yet been completed, it is not appropriate to have overly pessimistic expectations about real estate or even all steel demand. We predict that my country's steel demand will maintain low growth for a long time in the future. On the supply side, "carbon peaking and carbon neutrality" is a task that my country needs to implement in the long term, which constrains the supply elasticity of steel products for a long time. Driven by the supply cycle of steel, the price center will also be significantly boosted.

2 Investment Analysis

Baosteel Co., Ltd. : Steel leader, optimistic about performance recovery in the second half of the year

Optimize coal and ore blending structure to achieve extreme cost reduction. Against the background of limited production and capacity, the company further optimized its product structure with the strategy of cost reduction as its core. The company exceeded the originally expected goals and completed the full-year cost reduction plan of 1.15 billion yuan. During the period, the company continued to improve the operating efficiency of iron, steel, and rolling, and deepened reforms with improving product quality and reducing quality costs as the main benchmarks. Achieve stable growth in the company's operating income.

company's output continues to increase, and product structure optimization is accelerated. The new three-blast furnace system project at the Dongshan base has been put into operation, with an annual increase of 4.02 million tons of molten iron, 3.6 million tons of molten steel, 4.5 million tons of hot-rolled products, and 1.66 million tons of cold-rolled products. At present, the No. 3 blast furnace was ignited on January 7, 2022, and the No. 3 blast furnace system has been put into trial production. Zhanjiang Iron and Steel, a subsidiary company, plans to build a hydrogen-based shaft furnace system project for Baosteel Zhanjiang Iron and Steel. The construction scale is equivalent to an iron-making production capacity of 856,000 tons. It is expected to be put into operation at the end of 2023. Among them, it plans to provide the company's controlling shareholder China Baosteel with a capacity replacement indicator transaction. Yangtze Iron and Steel Co., Ltd. and Bayi Steel Co., Ltd., both subsidiaries of Wuhan Iron & Steel Co., Ltd., purchased 550,000 and 176,000 tons of iron-making capacity respectively, for a total of 726,000 tons of iron-making production capacity. Wuhan Iron and Steel Co., Ltd., a subsidiary of the company, plans to acquire a subsidiary of China Baowu Steel Co., Ltd., the controlling shareholder of the company. Shandong Xinhai Industrial Co., Ltd. sold 1.02 million tons of steelmaking capacity, which has been discontinued. In terms of silicon steel products, in order to speed up the structural optimization of non-oriented silicon steel products and meet the incremental demand for new energy vehicle drive motors, the company approved the "New Round Silicon Steel Production Capacity Development Plan", with the high-end oriented silicon steel production capacity target being 1.5 million tons/year. , the production capacity of non-oriented silicon steel reaches 3.8 million tons/year, and the production capacity of high-grade non-oriented silicon steel reaches 2.1 million tons/year. It is expected that the thermal load test of the entire line will begin at the end of February 2023.

equity incentives help the company's long-term development. In order to attract and retain outstanding talents, fully mobilize the enthusiasm of core employees, and combine the interests of the company with employees, the total number of restricted stocks planned to be granted shall not exceed 500 million shares, approximately accounting for the total share capital of the company at the time of the announcement of the draft plan. 2.2453% of 2,2268,411,600 shares. Among them, 460 million shares were granted for the first time, accounting for 92% of the total rights and interests granted this time, accounting for approximately 2.0657% of the company's total share capital when the draft plan was announced; 40 million shares were reserved for grant, accounting for 8% of the total rights and interests granted this time, accounting for approximately 0.1796% of the company's total share capital when the draft plan was announced. The source of the stock is the company's A shares of the company's common shares repurchased from the secondary market.

Fangda Special Steel : Refined management ensures cost competitiveness, and the company's performance is steadily released.

The stock incentive plan lays the foundation for the company's long-term development.In February 2022, the company announced the A-share restricted stock incentive plan (draft). The company plans to grant 21,559 incentive targets to 1,230 incentive targets including the company’s directors, senior managers, core (management, marketing, technology) personnel and key employees. 10,000 restricted shares, accounting for 10% of the company's total share capital of 2,155,950,223 shares at the time of the announcement of the incentive plan. The grant price is 4.29 yuan/share. The stock incentive plan (draft) has been approved at the shareholders' meeting on March 10. The company's stock incentive plan's performance appraisal goals are set higher than the industry average, which reflects the company's confidence in future development and also puts forward higher requirements for incentive targets. Through the stock incentive plan, some of the company's directors, senior executives, and core employees gradually hold company stocks. The company's interests and personal interests are linked, which is conducive to ensuring the stability of the core team, mobilizing employees' enthusiasm, and laying the foundation for the company's long-term development.

's refined management ensures that the company's profitability is at the forefront of the industry. With refined management as the main line, the company has established a cost reduction and profit creation system covering all functional departments at all levels from procurement, production, sales to technology, equipment, operations management, logistics support, etc., and has formulated effective and executable measures. To ensure that cost reduction and efficiency improvement are implemented. Refined management ensures that the company maintains outstanding cost competitiveness. The cost per ton of steel and the three fees per ton of steel are lower than those of its peers, pushing the company's profitability per ton of steel to be at the forefront of the industry.

High cash dividend returns to shareholders, enhancing the company's value investment appeal. The company's proposed profit distribution plan for 2021 is: the company plans to distribute a cash dividend of 11.10 yuan (tax included) to all shareholders for every 10 shares, with a total cash dividend of 2.393 billion yuan (tax included), and the cash dividend ratio reaches 87.60%. The company's continued high cash dividends have brought generous returns to shareholders, enhancing the company's value investment appeal.

Jiuli Special Materials: The company's production capacity continues to be released, and the company's leading position in the industry is stable.

Research and development assists the expansion of production capacity, and the company's leading position is stable. The company attaches great importance to research and development. Through continuous technological transformation and product structure adjustment, it has become the largest industrial stainless steel pipe manufacturing enterprise in China. It currently has an annual production capacity of 135,000 tons of industrial stainless steel pipes, and its products cover a variety of industrial special products. Stainless steel, nearly a hundred varieties of industrial stainless steel pipes. The company's market share has ranked first in the domestic industry for many years, with obvious industry leadership and scale advantages. It is a qualified supplier for many world-class well-known enterprises. New production capacity projects are gradually put into operation to enhance the company's core competitiveness. At present, the progress of the company's convertible bond projects "5,500km annual output precision pipe project" and "10 million tons aerospace materials and products project" are 100% and 90% respectively. After being put into production, the company's high-end stainless steel pipe production capacity will be increased, and the product The structure is expected to be further optimized. In addition, the "annual output of 5,000 tons of special alloy pipe prefabricated parts and pipe maintenance service projects" and the "annual output of 15,000 tons of special alloy welded pipes for oil and gas transmission projects" will also help the company continue to expand its production capacity and continue to release its performance. (Report source: Future Think Tank)

Yongjin Shares: Multiple projects have been put into production in an orderly manner, driving the company's stable performance.

Multiple projects have been put into production in an orderly manner. It is expected that the company's cold-rolled stainless steel output CAGR will reach 21.43% from 2021 to 2025. The company's multiple stainless steel cold-rolling projects (7 domestic and 3 overseas) are under construction and put into production in an orderly manner. The company's cold-rolled stainless steel output is expected to increase to 4.625 million tons in 2025, with a CAGR of 21.43% from 2021 to 2025. In terms of precision cold-rolled stainless steel, the 125,000-ton relocation project of the Zhejiang headquarters has been put into trial production in December 2021. With the Jiangsu Yongjin IPO project reaching full production in May 2022, the 195,000-ton convertible bond investment project will be put into production at the end of 2022. , the company's precision stainless steel output will reach 265,000 tons in 2025, and its market share is expected to further increase. In terms of wide-width cold-rolled stainless steel, as domestic projects in Guangdong, Jiangsu, Gansu and other countries as well as overseas projects in Vietnam, Thailand, and Indonesia are gradually constructed and put into production, the company's wide-width cold-rolled stainless steel production will reach 4.36 million tons in 2025. The output CAGR from 2021 to 2025 will reach 21.37%. The company's scale effect will gradually emerge, driving high performance growth.

has production capacity close to raw material companies and self-developed production equipment, and its product cost advantage is obvious. The two major production bases of Fujian Yongjin and Guangdong Yongjin are adjacent to raw material production enterprises. While purchasing prices are favorable, they can shorten the raw material procurement cycle and reduce the capital occupation of raw material inventory. In addition, the company has always focused on technological innovation and the improvement of R&D capabilities. Compared with imported equipment, the independently designed and developed twenty-roller reversible precision cold rolling mill and other equipment can reduce related investment costs by 30-40%, effectively reducing maintenance, depreciation and other costs. . High turnover rate drives the company's ROE level to be at a relatively high level. The company's main production base is close to the upstream hot-rolling factory. The procurement cycle is short and the production cycle is also very fast. The superposition company mainly adopts a cash-on-delivery sales model. The company's accounts receivable and inventory turnover rate are much higher than those of comparable companies. Although The company's gross profit margin level is lower than that of comparable companies, but its fast production process and sales settlement model drive the company's ROE level to a relatively high level.

Upstream smelting capacity is released + downstream demand is growing steadily, and the supply and demand pattern of the cold-rolled stainless steel processing industry is improving. There are many stainless steel smelting projects planned in China and Indonesia. It is expected that 13.54 million tons of stainless steel smelting capacity will be built and put into operation in the next 2-3 years. There are sufficient sources of raw materials for cold-rolled stainless steel processing. On the demand side, benefiting from the upgrading of traditional consumption areas and the growth of emerging fields, the growth rate of demand for wide-width and precision cold-rolled stainless steel is much higher than the overall demand growth rate of stainless steel. We estimate that the CAGR of wide-width cold-rolled demand will reach 10.72% from 2021 to 2025, and the demand for precision cold-rolled stainless steel will grow at a CAGR of 10.72%. The CAGR of cold rolling demand reached 7.20%, and the supply and demand pattern of the cold rolled stainless steel processing industry is gradually improving.

Emerging cast pipe : Ductile iron pipe leader, the downstream demand for pipes is expected

Ductile iron pipe market concentration is high, and the company is the industry leader. The company's existing cast pipe production capacity is 3 million tons, and it has formed a ductile iron pipe production capacity layout covering major regions at home and abroad. In 2020, the company's cast pipe domestic market share reached 32.78%, ranking first in the country. In 2021, the sales growth rate of sewage pipes has exceeded 20% for five consecutive years. Thermal pipes are promoted and used in many northern provinces and cities. The products are exported to more than 120 countries and regions in the world. The sales network covers Asia, Europe, Africa, and the Americas, firmly controlling the Marketing terminal. The company conducts independent research and development on new materials, products, processes, and intelligence for ductile iron pipes, and its products are highly competitive. The company's production scale and comprehensive technical strength rank first in the world, and its leading position in the ductile iron pipe industry is clear.

Steady growth will be the main theme in 2022, and the downstream demand for ductile iron pipes is expected. The Central Economic Work Conference has emphasized that economic work in 2022 must "take stability as the top priority and seek progress while maintaining stability." As a countercyclical adjustment tool, infrastructure investment is expected to stabilize and pick up in investment growth in 2022. Water conservancy, environment and public facilities will be one of the driving forces for infrastructure investment in 2022, which may help the demand for steel pipes usher in a surge. Due to its many advantages such as good toughness, high strength, corrosion resistance, convenient construction and high cost performance, ductile iron pipes are widely used in water supply and gas supply, drainage and sewage treatment in municipal projects. Therefore, under the background of stable growth, the domestic cast pipe market will usher in new development opportunities, and the downstream demand for ductile iron pipes is expected to be gradually released.

Product upgrades are accelerating, and the production and sales of high-quality special steel are rising. The company promotes product structure adjustments based on market changes and company development needs. In 2021, the company's production of high-quality special steel was 2.0741 million tons, a year-on-year increase of 29.96%; sales volume was 2.2759 million tons, a year-on-year increase of 42.87%. The company's high-quality special steel products mainly include high-quality special steel wire and bar products such as Φ6 to Φ280mm cold-headed steel , steel strand , ductile steel, bearing steel, fastener steel. In 2021, the company developed 31 new product brands, including steel for vehicle axles, steel for bucket teeth, steel for grinding balls, steel for automotive fasteners, steel for high-strength bolts for wind power plants and steel for home appliance bolts, etc., railway vehicles Axle steel has been supplied in batches.

Fangda Carbon: dual carbon drive + production capacity release, graphite electrode leader sets sail again

"dual carbon" opens up demand space, and the tightening of production capacity approval boosts the long-term high prosperity of the graphite electrode industry.The CO2 emission per ton of electric furnace steelmaking is only about 0.5 tons, less than 1/4 of the emissions from blast furnace steelmaking. In order to effectively reduce carbon emissions in the steel industry, policies encourage an increase in the proportion of electric furnace steel. At the end of the "14th Five-Year Plan", the output of electric furnace steel The proportion of crude steel production is expected to reach 20%. The composite growth rate of graphite electrode consumption in electric furnace steelmaking is expected to be 18.48% from 2021 to 2025, indicating broad industry demand. Graphite electrode itself is a high-energy-consuming industry. Affected by policies such as dual energy consumption control, some provinces and cities have introduced policies to restrict the approval of mid- to low-end production capacity. The turning point of the industry is gradually emerging, and graphite electrode prices are expected to rise in the long term.

’s ultra-high power graphite electrode production capacity has been put into centralized production, and the performance release is just around the corner. With a total of 125,000 tons of ultra-high-power graphite electrode projects in Hefei Carbon, Meishan Fangda, and Chengdu Rongguang gradually put into production, the company's ultra-high-power graphite electrodes are expected to account for 67.3% in 2025, and the product structure is further optimized. The company's ultra-high-power graphite electrode sales in 2020 were 67,200 tons, with a domestic market share of 21.65%. As the ultra-high-power graphite electrode project is gradually put into production, the company has a stronger voice in the high-end graphite electrode market. Special graphite projects are gradually increasing in volume, fully benefiting from the accelerated development of downstream photovoltaic and other industries. Subsidiary Chengdu Carbon plans a total of 30,000 tons of special graphite projects. The first phase of the 10,000-ton production line has been put into operation and has reached capacity. The remaining production capacity will be gradually completed and put into production. It is expected that the company's isostatic graphite output is expected to reach 27,000 tons in 2025, 2021-2025 The compound growth rate reaches 25%. Benefiting from the accelerated development of downstream photovoltaic solar energy, semiconductor, nuclear engineering and other industries, the market demand for isostatic graphite is expected to grow rapidly in the future. We believe that as the Chengdu Carbon Specialty Graphite Project is put into operation and the production volume is increased, the contribution of special graphite to the company's performance will steadily increase.

integrates raw material production capacity upwards, and the integrated layout effectively eliminates the risk of raw material price fluctuations. The prices of needle coke and petroleum coke, the main raw materials of graphite electrodes, fluctuate greatly. In order to effectively smooth out the price risks of upstream raw materials, the company has continuously laid out the raw material industry chain in recent years. Among them, Fushun Fangda has a calcined coke production capacity of 200,000 tons, and Fangda Xikemo It has a needle coke production capacity of 60,000 tons, and Jiangsu Fangda has a soft asphalt production capacity of 300,000 tons. Based on the equity production capacity of needle coke and petroleum coke, the company's raw material self-sufficiency rate will exceed 60% in 2020. The company's various carbon product manufacturing companies and raw material companies have gradually formed an industrial structure with resource sharing and complementary advantages. The integration is expected to further enhance the company's performance stability.

(This article is for reference only and does not represent any investment advice on our part. If you need to use relevant information, please refer to the original text of the report.)

Selected report source: [Future Think Tank]. Future Think Tank - Official website