The Paper reporter Hou Jiacheng

Will Japan intervene in the yen exchange rate?

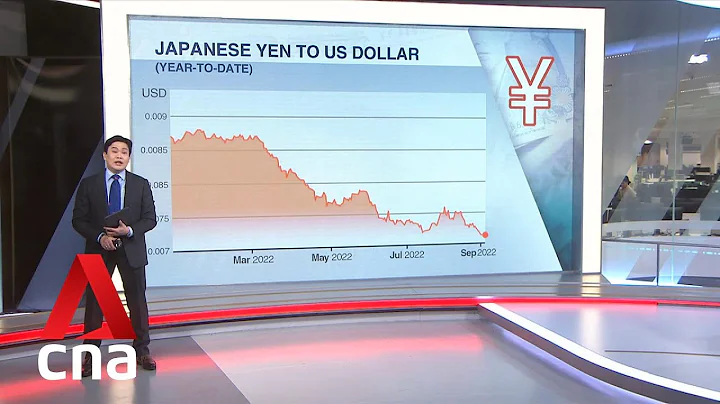

Recently, the divergent policy trajectories of the Federal Reserve and the Bank of Japan have continued to depress the yen exchange rate. The exchange rate of the US dollar against the yen stood at 136 this week, continuing to hit a new high since 1998. At the same time, speculation about Japan's willingness to intervene to support the yen has also become one of the factors exacerbating volatility in the foreign exchange market.

On June 23, local time, Takehiko Nakao, Japan’s former head of foreign exchange policy, said in an interview with Bloomberg that the possibility of Japan directly intervening in the foreign exchange market to prevent the yen from falling cannot be completely ruled out. Affected by his remarks, the yen-dollar exchange rate once rose to around 135.13 from 135.77 before the mid-end speech.

"The possibility of unilateral intervention should not be ruled out." Nakao said that it is difficult to obtain support from foreign institutions; unless there is excessive market volatility or some kind of crisis, intervening in the exchange rate through coordination with external institutions is usually Very difficult.

Nakao also said that although it may be difficult to obtain cooperation from the United States to support the yen exchange rate, Japanese institutions may still enter the market to intervene in the exchange rate without incurring direct opposition from the United States. He gave the example of planning intervention in the foreign exchange market in 2011 during his tenure at the Ministry of Finance to prevent the yen from strengthening. Currently, Nakao is not consulting with policymakers on the intervention.

What is the impact of the weakening yen?

html On June 17, the Bank of Japan issued an interest rate resolution, maintaining the benchmark interest rate at a historical low of -0.1%, and maintaining the 10-year government bond yield target near 0% (i.e. bond yield curve control policy YCC) , without setting a cap, to purchase the necessary amount of long-term Treasury bonds.Nomura Japan Chief Economist Takashi Miwa told The Paper that the purpose of maintaining easing this time is to support the recovery of the Japanese economy after the epidemic, and the current recovery progress lags behind the United States and Europe; at the same time, as The resumption of economic activity and the tightening of labor supply and demand can help create an economic environment in which rising inflation leads to higher wages.

Regarding the weakening of the yen, Nakao believes that although the monetary policy of the Bank of Japan has contributed to the weakness of the yen, some recent trends are also speculative. He added that the yen's weakness was one of several negative factors for the central bank's efforts to control yields. And given the risk of a sharp rise in bond yields, exiting the current easing program will be very difficult.

"The Bank of Japan's continued easing policy has brought various negative factors," Nakao said, one of which is a weaker yen; while other negative factors include easing the government's policy by keeping the government's borrowing costs at very low levels. Fiscal discipline, which makes it more difficult for financial institutions to profit from the "narrow" spread between short-term and long-term interest rates. At the same time, loose policies will also interfere with market functions.

Nakao also said that the current decline of the yen is detrimental to the Japanese economy in terms of speed and magnitude because it exacerbates the high import costs of energy and food.

Looking specifically at prices for industrial producers, data released by the Bank of Japan showed that Japan's PPI rose 9.1% year-on-year in May; PPI in April rose 10% year-on-year, the largest increase since December 1980. At the same time, Japan’s export price index in May was 126, up 1% month-on-month and 16.7% year-on-year. The import price index was 167.2, up 3% from April and 43.3% from May 2021.

Nakao said some Japanese companies are currently suffering "pain" because they are unable to pass on rising costs to consumers, which means they have to sacrifice profitability and wages for workers.

On the short-term impact on foreign trade, Nakao said that given that Japanese goods account for only a small portion of U.S. inbound goods, it is unclear to what extent the slight rebound in the yen will actually translate into more expensive U.S. imported goods. This shows that he believes that Japan's currency intervention will have limited actual impact on the U.S. economy.

"When the yen is weak, it is obviously wrong to say that everything is fine economically," Nakao said. Basically, there is little benefit from devaluing the domestic currency because it reduces the value of Japan's assets and companies in the eyes of overseas competitors.

Editor in charge: Zheng Jingxin Picture editor: Jiang Lidong