show that "highly volatile" inflation and precarious consumer spending are launching a double attack on the US economy.

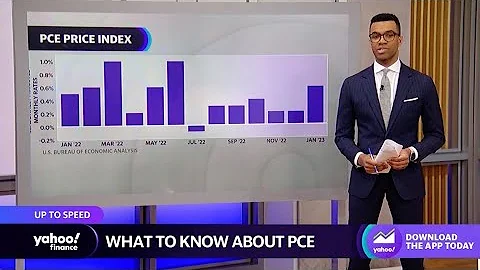

Data released by the U.S. Department of Commerce’s Bureau of Economic Analysis (BEA) on the 30th local time showed that after excluding volatile food and energy prices, the U.S. core personal consumption expenditures (PCE) price index rose 4.7% year-on-year in May, compared with 4 The monthly data was 4.9%, down 0.2 percentage points for , and increased by 0.3% month-on-month, remaining unchanged for 4 consecutive months. Core PCE data is the most favored measure of inflation by the Fed .

In early trading on Thursday, the three major U.S. stock indexes opened lower and moved lower. As of press time of First Financial reporter, the Dow Jones Industrial Average fell 1.8%, the S&P 500 Index fell 1.82%, and the Nasdaq Composite Index fell 2.45%. The ten-year U.S. bond yield is around 3.034%.

30 Dow component stocks all fell, Goldman Sachs led the decline of 3.4%. technology stocks were the top losers, Amazon fell 4.7%, Netflix fell 3.9%, Microsoft fell 2%, Apple fell 2.9%.

In terms of Chinese concept stocks , Alibaba fell by 3.6%, Jingdong fell by 2.6%, Pinduoduo fell by 4.5%, Baidu fell by 2.9%, Xpeng Motors fell by 4.5%, Ctrip fell by 5.2% , Tuniu rose 17.5%.

Accelerating inflation and rising interest rates have triggered a months-long decline in the U.S. capital market . The S&P 500 index has fallen by more than 21.55% since the beginning of the year, heading towards its worst first-half performance since 1962. ; The Nasdaq Composite Index is relatively The historical high reached on November 22 last year fell by more than 30%. Since the beginning of the year, Netflix has fallen by 71%, and Meta, the parent company of Facebook, has fallen by about 51%. During the same period, Apple and Google parent company Alphabet each fell by about 22%.

Inflation " High fluctuations "

Data show that the overall PCE price index in the United States in May rose 6.3% year-on-year, which was the same as last month and fell 0.3 percentage points from the 40-year high record set in March. Among them, energy prices increased by 35.8% year-on-year, and food prices increased by 11.0% year-on-year.

html The PCE price index increased by 0.6% month-on-month in May, a significant rebound from the 0.2% value in April, of which energy prices increased by 4.0% and food prices increased by 1.2%.Michael Pearce, senior U.S. economist at Capital Economics, said the smaller-than-expected increase in core PCE was not enough to justify the Fed's need to "shift to a less aggressive rate hike." However, he added that this at least shows that inflation is "not as bad as the CPI data shows."

Affected by soaring energy prices, the U.S. Consumer Price Index (CPI) rose by 1.0% month-on-month in May, much higher than the 0.3% month-on-month increase in April; it rose 8.6% year-on-year, reaching the highest level since December 1981.

Currently, the Chicago Mercantile Exchange’s FedWatch Tool shows that traders expect an 80.8% probability of announcing a 75 basis point interest rate hike after the Federal Reserve’s monetary policy meeting on July 27. The probability of raising interest rates by at least 175 basis points before the end of the year is expected to reach 83.2%.

Katie Nixon, chief investment officer at Northern Trust Wealth Management, said: "That's the biggest risk right now - inflation and the Fed." She said she would be watching economic data closely in the coming months to gauge the impact of rising interest rates. impact on economic growth.

On Wednesday (29th), Federal Reserve Chairman Powell once again reiterated his determination to combat inflation when attending the European Central Bank Forum and stated that the Federal Reserve "will not allow the transition from a low-inflation environment to a high-inflation environment."

Powell said there may be a "risk of going too far" during this period, causing the U.S. economy to slow down or even shrink, but "failing to restore price stability would be a bigger mistake."

Consumer spending slowed significantly

Data showed that personal consumption expenditures in the United States rose by 0.2% month-on-month in May, a significant decline from the revised 0.6% data in April.

The decrease in consumer spending on goods has offset the increase in service spending to a certain extent. Last month, the largest contributors to the increase in services spending were housing, other services related to international travel, and health care.On the goods spending side, lower consumption of cars and parts was offset by increases in gasoline and other energy commodities.

Wells Fargo economist Shannon Seery wrote in a report: "After being hit yesterday by the GDP data downward revision, this report gives us another uppercut."

html On the 29th, data from the U.S. Department of Commerce showed that the annualized quarterly rate of U.S. real GDP in the first quarter was -1.6% from the final value, 0.1 percentage point lower than the revised value announced in May. At the same time, U.S. personal income rose by 0.5% month-on-month in May, the same as the previous value; after excluding inflation and tax factors, real disposable personal income fell by 0.1% in May.Seeri expects that consumers will increasingly rely on savings to fund spending in the short term, with spending on services still driving consumer spending throughout the summer.

"However, after September comes, the boost in service spending may not be able to support the positive growth of overall consumer spending." Siri added.

A survey released by Deutsche Bank recently showed that about 90% of investors expect the United States to enter a recession before the end of 2023 . A growing number of economists are worried that the Federal Reserve's aggressive tightening policies are dragging the U.S. economy into recession.

Historical data seems to support this concern. There are only a handful of successful cases of the Federal Reserve achieving a "soft landing" for the economy during the process of tightening monetary policy. Research from the Federal Reserve Bank of St. Louis shows that among the six monetary policy tightening cycles since the 1980s, the U.S. economy has fallen into recession four times.