My name is Thomas • Piketty

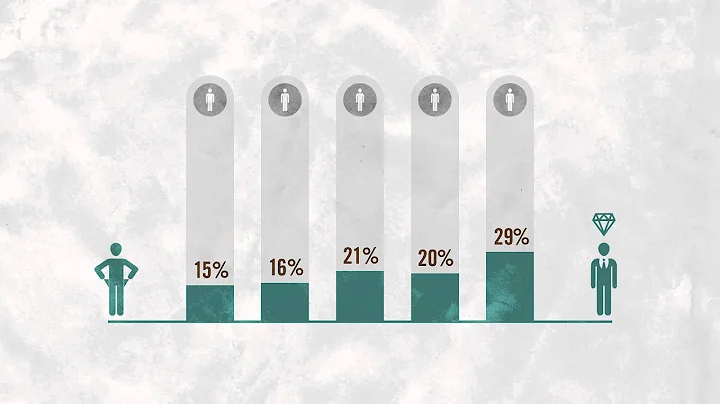

Although Kuznets once optimistically predicted that with economic growth, income distribution will worsen at first, but it will gradually improve - because the river of economic growth will All boats are raised. But through a large amount of historical data analysis, I have to come to a regrettable conclusion: we are regressing back to the era of "inherited capitalism", where the economic commanding heights are not only determined by wealth, but where family background is more important than acquired efforts and talents.

Since the richest people did not create wealth because of their labor, it was just because they were rich themselves. So, how should the labor value of ordinary workers be measured? Do the rich deserve such high income? Life is not created equal. How can we eradicate this phenomenon completely?

November 15th, let’s discuss the answers to all the questions together.

CITIC Academy Frontier Forum

Capital in the 21st Century

2014.11.15 Grand Ballroom of Sofitel Wanda Hotel in Beijing

Thomas Piketty (Thomas Piketty) Author of "Capital in the 21st Century", French economist

Dialogue: Thomas Piketty Katie

Kong DanFormer Chairman of CITIC Group

Yao YangDean and Professor of the National Development Research Institute of Peking University

Li ShiProfessor of the School of Economics and Business Administration of Beijing Normal University

Mei JianpingDeputy Dean of the Cheung Kong Graduate School of Business, Professor of Finance

Hosted by: He Fan Deputy Director of the International Finance Research Center of the Academy of Social Sciences

The authors of this article are Zheng Shiliang, Xie Bingqiang, Zhu Wenqian, and Ding Xiongfei. The article was published in "Oriental Morning Post·Shanghai Book Review" on August 10, 2014, and has been abridged.

Acknowledges “meritocracy”, left and right do not please

Duncan Kelly, senior lecturer in the Department of Politics and International Studies at the University of Cambridge, UK, in The Times Literary Supplement on June 24, 2014 Published a long article "Orders of Magnitude", which conducted a relatively comprehensive discussion of Piketty's "Capital in the 21st Century". Kelly believes that Piketty’s work is important and enlightening, although he disagrees with one of Piketty’s fundamental judgments. The fundamental judgment of

is how to evaluate "meritocracy". In Kelly’s view, although Piketty’s book discusses the relationship between capital and inequality, the core issue is actually elite rule. Piketty gives a positive evaluation of elite rule. He believes that only with elite rule can we select and appoint talents, and only then can we have the foundation for modern democratic politics. However, Kelly deeply disagrees with this - because since the 1970s, neoliberalism has been in power and elite rule has been reshaped by new political and economic forces: on the one hand, it has made inequality deeply entrenched; on the other hand, it has made inequality deeply entrenched. , but it is cloaked in the guise of democracy.

Piketty discusses in the book that the "rentier society" in which the return on capital was higher than the overall economic growth was destroyed by the two world wars. People then ushered in the "manager society" and "the composition of capital changed." changes”. Kelly said that by following the ideas in the book, we can easily come to the conclusion: sooner or later, modern society filled with wealthy managers will usher in inevitable major social disasters like the rentier society that was destroyed by war. crisis. But Piketty refuses to make such a conclusion. In his view, modern democratic societies based on elite rule are different from previous rentier societies. The former is based on ability and diligence, while the latter mainly relies on nepotism and rent. Kelly believes that Piketty’s statement will please neither the left nor the right: The left is unhappy because Piketty acknowledges the legitimacy of elite rule and in fact acknowledges the legitimacy of inequality; in the view of the right, inequality is The problem is simply not worth paying attention to.

Kelly said that it is not difficult to see from Piketty's book that even if politicians are intentional, they can't do anything about current inequality: inequality has been accumulated over generations, and short-term electoral politics is difficult to deal with; in addition, , now the rich are as rich as the country, and the government is mostly cash-strapped and unable to carry out redistribution.Piketty himself admitted that modern democratic politics is firmly bound by the needs of market elites. Take the United States as an example. The great influence of the rich on mainstream politics is due to the small size of their total population. Completely disproportionate. Piketty once placed his hope that Europe could impose heavy taxes on capital, but the EU was depoliticized from the beginning and relied on technocratic management. Political elites who could shoulder the heavy responsibility of reform were nowhere to be found.

Therefore, Kelly believes that "Piketty's book presents not only a story about the structure of inequality, but also a story about the limits of modern democratic politics." “Wealth is so concentrated that most people in our society are barely aware of its existence.” Once Piketty made this clear, he actually stated: “The economics of modern democracy How incompatible is the foundation with meritocracy? "Is there something wrong with the data that

is most proud of?

"Data Problems with Capital in the Twenty-first Century" published on May 23, 2014 by Chris Giles, economic news editor of the Financial Times The 21st Century ) raised several questions about the data in Piketty’s book.

1. The problem of average data: Piketty should not simply average the data of the United Kingdom, France and Sweden to represent Europe.

2. The problem of missing data: For the entire ninety years from 1870 to 1960, there is no original data on the proportion of the top ten percent of the rich in the United States to the total social wealth.

3. U.S. data problem: Piketty chose to shift the data basis from estate tax records to the "Consumer Financial Survey", while labor economist Stephen Rose published an article in "The New Republic" In the article "Piketty and the Neo-Marxists Underestimated the American Middle Class," based on data from the U.S. Congressional Budget Office (CBO), it was found that the income of middle-income households increased by 35 percent during this period.

4. British data problem: Piketty’s long-term time series of the wealth of the top one percent of the population comes from the research of British economist Tony Atkinson. Before 2005, there was also the British national tax This is supplemented by data from Inland Revenue. After 2005, the British Internal Revenue Service was merged into Her Majesty's Revenue and Customs, and relevant British departments no longer publish such data because they feel it is unreliable.

In addition, Giles believes that there are also problems with the 2010 data. In his book, Piketty chose HM Revenue and Customs' inheritance tax records rather than data from the Office for National Statistics' Wealth and Assets Survey, which he reported to Bloomberg explained that the ONS wealth and assets survey was of “very low quality”. Giles thinks this is untrue, and points out that Piketty needs to explain why he adopted the higher-number US survey but rejected the lower-number UK survey, and why he rejected HMRC's clear advice not to Use its latest Personal Wealth Survey to estimate wealth across the UK.

Giles concluded from this: The proportion of problematic data in Piketty’s book is as high as 80%. “If someone claims to have discovered the fundamental contradiction of capitalism and then predicts that this will lead to increasing levels of wealth inequality, rise, and uses the apparent increase in wealth inequality in recent years to justify his theory, then the data is critical to the book's argument."

Piketty responded quickly. He stated that "the data issues pointed out by the Financial Times do not affect the conclusions" and published an Excel file of all the data in the book online. At the same time, Piketty told The Guardian that the Financial Times’ criticism was “intentionally misleading” and subsequently refuted Giles’s doubts point by point on the voxeu.org website.

is greater than Marx?

Since the beginning of this year, the British magazine "The Economist" has published several articles introducing and commenting on Piketty and his books.The article "People are not created equal: Revisiting an old topic about the impact of capitalism" published on January 4 called the book "Capital in the 21st Century" an examination of "what forces are preventing the fruits of capitalism from being more widely used." distribution?” The authoritative guide to this question. "Capitalism and Its Critics: Contemporary Marx" and "Greater than Marx?" published on May 3. Both articles compare Piketty with Marx, the greatest critic of capitalism, in their titles. However, in the specific content of the articles, the unique British cynicism is very obvious.

The article "Capitalism and its Critics: Contemporary Marx" said, "The book "Capital in the 21st Century" undoubtedly made the left ecstatic, the right angry, and the public's interest in this boring subject has greatly increased. However, if Pi Pi Mr. Piketty did ultimately set the tone of the debate on inequality, and the world would be poorer for it, because, to describe Piketty's nineteenth-century book of the same name, Piketty gave. The policy proposal of imposing heavy taxes on the rich caused "Capital in the 21st Century to slide to the left and lose its credibility", and satirized Piketty by saying, "He targets the rich in an attempt to drain them. The approach smacks of socialist ideology but lacks an academic flavor. Perhaps this explains why "Capital in the 21st Century" has become a best-seller, but this book is indeed a very bad blueprint for action."

"Greater than Marx?" the article said, ""Capital in the 21st Century" has Many advantages. "It is a clear and thorough analysis of the economic issues that people are most concerned about today, and it also provides a concise explanation of the growing economic inequality." The article then lists four types of criticisms against Piketty:

The first type of criticism accuses Piketty of being too immodest and even borrowing Marx's famous saying.

The second type of criticism focuses on the formula "r g" proposed by Piketty, saying that the definition of "r" is too vague. , “especially when compared with the calculus-laden chapters of many economic studies.” Some critics believe that Piketty “ignores the basic principles of economics,” which “provide that capital increases as accumulation increases. Returns should decline. The hundredth robot may not drive production as much as the first robot. Kevin Hassett of the American Enterprise Institute, a free-market think tank, believes that as wealth accumulates, returns to wealth should decline rapidly, and so should the share of income earned by capital owners (while Piketty think it will rise)".

The third type of criticism focuses on "whether Piketty overestimates how similar the future will be to the past." Jimmy Pasokogis published in National Review The article said, "Just as an overly pessimistic view bankrupted Marx's prediction of economic growth, an overly pessimistic view will also shake Piketty's theory." At the same time, some critics questioned, "Today's predictions of economic growth will also be shaken." Wealth is mainly the result of a significant increase in labor income, and cannot be compared with the wealth of the 'idle rich' who lived off inheritances in the 19th century. The long-term relationship between the return on capital and economic growth rate pointed out by the rg formula cannot be applied to explain the wealth accumulation of Bill Gates and Jeff Bezos."

The fourth type of criticism focuses on The most divisive and controversial policy proposal is “what policy response should be adopted to increasing economic inequality”. Piketty’s proposal of “imposing a wealth tax on a global scale is widely considered politically unreasonable.” Not feasible." Kevin Hassett and Gregory Mankiw both believe that Piketty's suggestions are "motivated by ideological rather than economic considerations."

Piketty does not understand Marx?

American novelist , Marxist critic Benjamin Kunkel published a book review of more than 7,000 words in "The Pauper and the Rich Second Generation" in the "London Review of Books".He pointed out in the article that one of the reasons for the formation of "Piketty fever" is that in today's world where the marginal utility school occupies the mainstream position in economics, Piketty wants to restore the spirit of traditional political economics. There are only a few economists who hold this idea today. Since the marginal utility school brought a "marginal revolution" to economics in the 1870s, economics has seemed to have become a science. Kunkel vividly called it "a mathematical model for capitalism." alibi', but deliberately ignores the true face of capitalism." The result of such long-term development is that the highly mathematical models of modern economic theory are very different from the reality of capitalism, and the widespread unfair distribution of income and wealth in society does not receive enough attention. It is commendable that Piketty can revitalize the debate surrounding economic value with the care of political economy.

Although many people have repeatedly compared Piketty and Marx, Kunkel's views are exactly the opposite. He believes that the greatest victory of "Capital in the 21st Century" is the rich and wide-ranging data information in the book. However, "Piketty's achievements in theoretical explanation are not worthy of his impressive statistical data." The formula has only descriptive value but no explanatory value." From a Marxist perspective, Kunkel made very severe criticisms of Piketty.

In his book, Piketty treats the return on capital and the economic growth rate as two independent variables. He repeatedly emphasizes that regardless of the distribution pattern, the average "net" return on capital before redistribution always remains at 100. 4 to 5 percent; economic growth rate is mainly affected by technological development and population growth. Kunkel believes that distribution and production are two inseparable aspects of economic life. He quoted Marx's discussion in the "Glossary of a Critique of Political Economy": "If when examining production, the distribution included in it (according to : refers to the distribution of the tools of production, the distribution of members of society among types of production, and the distribution of products) aside, production is clearly an empty abstraction."

Kunkel pointed out that Piketty did not account for the inequality of the mid-20th century. He also overstated the impact of the war on capital destruction by linking the abnormal decrease with the abnormal increase in economic growth rate. Piketty also turned a blind eye to the power of labor organizations and the deterrent effect of the Soviet Union. Therefore, Piketty cannot really explain why the period from 1914 to 1974 accounted for one-third of the life span of industrial capitalism. The formula r g fails. This is a significant flaw in Piketty’s theory.

Kunkel further analyzed that Piketty’s theoretical flaws begin with his broad definition of capital. According to Piketty’s definition, after excluding the part consumed due to consumption in society’s annual income flow, the remaining part saved becomes part of the total capital stock. In other words, any wealth that is possible to obtain income belongs to capital. This definition applies equally to slave society and feudal society. The problem is that before entering capitalist society, capital accumulation and capital consumption were roughly equal. It was not until capitalism continued to expand around the world that the competition mechanism and profit maximization mechanism under the free market led to unlimited capital accumulation and expansion. Kunkel believes that Marx pointed out the real "core contradiction" of capitalism, that is, as capital accumulates, it will destroy its own accumulation (the principle of diminishing returns on capital), and also pointed out the unique mechanism of capitalism, That is, a drive to gain profits by exploiting the wages of labor. In contrast, Piketty’s rg formula cannot be regarded as the “core contradiction” of capitalism at all.

Kunkel also questioned Piketty’s proposal for a global wealth tax. Piketty once said in an interview that capitalism will exist for a long time and that taxing capital is to promote public interests while still maintaining an open and competitive economy. Kunkel said that political parties in capitalist society, regardless of whether they are left or right, tend to safeguard the interests of the ruling class, so it is absolutely impossible to pursue such a policy that harms the interests of the ruling class.Compared with political reform, Kunkel believes that social revolution caused by inequality is more likely to occur. In Kunkel's view, capitalism will usher in its end, and he even predicted that post-capitalist society would be a form of market socialism.

At the end of the article, Kunkel sarcastically said: Piketty tried to study the issues of capital and inequality, but was not familiar with Marx’s theory. He even lamented to the American media that he had read Sartre, Althusser and Bart. When he was reading Christian Dio, he found that they were not very interested in issues of capital and inequality. He had time to read these philosophers, so he might as well become familiar with Marx's works. In this case, this book would definitely be better than it is now. . ■