The Paper reporter Chen Peizhen

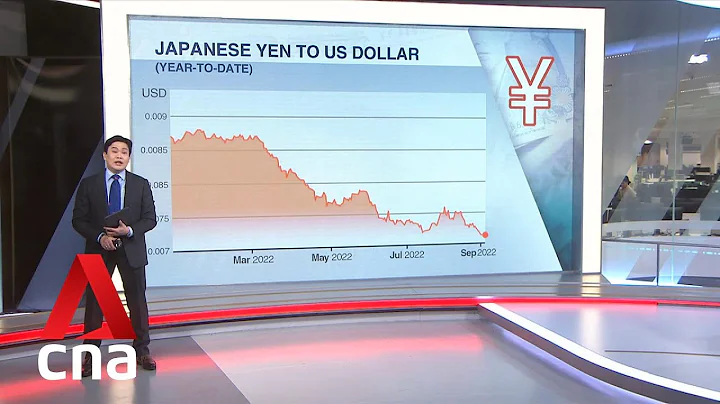

The exchange rate of the US dollar against the Japanese yen stood at 136, continuing to hit a new high since 1998. As the pace of Federal Reserve interest rate hikes continues to accelerate and the Bank of Japan has made it clear that it will curb interest rates, the interest rate spread between the US dollar and the yen has widened, and the yen has continued to depreciate.

Nihon Keizai Shimbun official website exchange rate trend chart

Regarding the depreciation of the yen, according to Japan's Kyodo News Agency, on the afternoon of Monday (June 20) local time, Japanese Prime Minister Fumio Kishida met with Bank of Japan Governor Haruhiko Kuroda The talks were held at the Prime Minister's Official Residence and views were exchanged on recent foreign exchange market trends and other issues. After the meeting, Kishida Fumio said that they mentioned that the sharp depreciation of the yen was a worrying issue during the meeting.

Kuroda Haruhiko also said that the sharp depreciation of the yen has brought various uncertainties to the business plans of Japanese companies, and he does not want this situation to continue. He said he would pay attention to the trends in the foreign exchange market and cooperate with the government to respond.

In addition, Japan's Finance Minister Shunichi Suzuki reiterated his concerns about the sharp weakening of the yen on Tuesday and said that if necessary, he would respond appropriately to currency market trends. "The government will be in close contact with the Bank of Japan and will pay attention to the foreign exchange market and its impact on the economy and prices with a greater sense of urgency. It will maintain close communication with the monetary authorities of other countries and will take appropriate measures to respond when necessary." Suzuki Junichi said.

Regarding Japan’s foreign exchange policy, the foreign exchange policy report released by the U.S. Treasury Department on June 10 showed that the Japanese government’s foreign exchange intervention is only allowed “under extreme special circumstances with appropriate prior consultation.” The yen's weakness is mainly attributed to differences in monetary policy between Japan and the United States.

In fact, as early as June 6, Haruhiko Kuroda published an article entitled "Monetary Policy Concept - Toward the Sustained and Stable Realization of the "Price Stability Target"", explaining why Japan insists on loose monetary policy .

Kuroda Haruhiko said that Japan’s economy is still recovering from the haze of the epidemic, and its income is also under downward pressure from rising commodity prices, and it does not have the conditions to tighten monetary policy at all. The priority now is to resolutely support economic activity by relentlessly maintaining strong monetary easing on the basis of current yield curve control. Unlike foreign central banks, the Bank of Japan does not face a trade-off between economic stability and price stability, so it is fully capable of continuing to stimulate aggregate demand from a monetary perspective.

Editor in charge: Zheng Jingxin Picture editor: Jiang Lidong