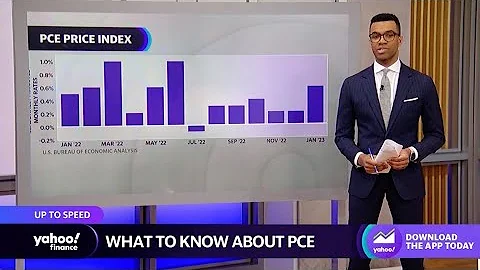

At 8:30 local time on Friday (July 30), the inflation indicator favored by the Federal Reserve, the US core PCE price index, was released, showing that key inflation indicators continue to soar.

The latest report from the U.S. Department of Commerce shows that the U.S. personal consumption expenditures (PCE) price index increased by 4.0% at an annual rate in June, in line with the expected increase of 4.0%, and the previous value increased by 3.9%; the PCE price index in June increased by 0.5% at an annual rate, which was expected to increase 0.6%, compared with an increase of 0.4% in the previous value.

data also showed that the core PCE price index in the United States increased by 3.5% at an annual rate in June, with an expected increase of 3.7%, and the previous value increased by 3.4%. It is worth noting that the U.S. core PCE price index recorded an annual rate of 3.5% in June, a new high since July 1991.

At Wednesday's FOMC resolution, regarding inflation, Powell said, "The inflation data is indeed much higher than expected, but it is not widespread inflation, but items related to cars, air tickets and hotels are rising very fast. I think it is still temporary. ."

"As long as the supply side responds and the economy adapts, we believe that inflation will fall in the short term, but I am confident that inflation will fall in the medium term, but it is difficult to say when it will fall. "

The Federal Reserve still said in its monetary policy statement, "Inflation has risen, which is mainly a reflection of some temporary factors."

This article comes from FX168

.

![Unbelievable Cosmic Phenomena Beyond Our Galaxy | Secrets Of The Universe [All Episodes] | Spark - DayDayNews](https://i.ytimg.com/vi/sHEwTKEDVM0/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLAOHCCVwEK0S3PEAiMgW9rL4mC6YQ)